Claire Maumo has experience in investment banking, strategic consultancy, and journalism. She has a Bachelor’s degree in Business Management and a Master’s in finance. She has a knack for making complex concepts easy to understand. Her primary focus is on crypto, blockchain, and financial instruments. Follow her for expert insights on trading and investment.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

Trading assets like stocks, forex, commodities, and more is one of the most highly profitable ventures in the UK. This is if you approach the activity with a solid plan and strategy. As a Briton, you also need the best platform that is licensed and overseen by reputable authorities for maximum safety. However, it is unfortunate that many individuals find it challenging to make suitable choices, considering the availability of hundreds of options available. The research process involved can be lengthy and overwhelming, leaving you with wrong choices.

Fortunately, we decided to do the research, so you do not have to. Through thorough market research and analysis, we came up with the list below of the best trading platforms for 2025. We also decided to educate you more on what online trading means, the risks involved, how to manoeuvre the financial market, and more. In the end, you should be in a better position to take a plunge in this dynamic landscape. This is especially if you are a beginner with zero or minimum experience.

List of the Best Trading Platforms

- Pepperstone – Beginner-Friendly Trading Platform in the UK

- eToro – Overall Best UK Trading Platform

- Plus500* – Top Platform for CFD UK Traders

- FP Markets – Best Trading Platform For Professional Traders in the UK

- Spreadex – Top Platform For UK’s Spread Bettors

- AvaTrade – An Excellent Trading Platform For Mobile Trading in the UK

Note: 82% of retail investor accounts lose money when trading CFDs with this provider.

Trading Platforms UK: Comparison Table

Coming up with the list of the best trading platforms UK above was not an easy feat. We conducted extensive market research that took hundreds of hours to complete. Our research involved comparing various platforms based on multiple factors. These include security, costs, demo accounts, support services, asset offerings, and more. Plus, we conducted many tests on them. The goal was to shortlist only those that met our specifications.

We also visited Google Play, the App Store, and Trustpilot to analyse user comments. Then, we combined our findings with the test results. We wanted to ensure we made unbiased recommendations. This research process has proven fruitful as we have received excellent feedback.

That being said, check the table below, which shows some of the features of our best UK trading platforms. By comparing them, you should be able to make informed decisions.

| Best Trading Platform | Licence | Support Service | Software | Payment | Demo Account | Money Insurance |

|---|---|---|---|---|---|---|

| Pepperstone | FCA, ASIC, FSCA, DFSA, CySEC, CMA, SCB, BaFin | 24/7 | TradingView, MT4, MT5, cTrader, Pepperstone Trading Platform, Social Trading | Visa, Mastercard, Bank transfer, Neteller, Skrill, PayPal | Yes | Yes (up to £85,000) |

| eToro | ASIC, CySEC, FCA, FSAS | 24/5 | eToro investing platform, Multi-asset platform, Copy Trader | Credit/debit cards, PayPal, Bank transfer, Neteller, Skrill, eToro Money, Online Banking | Yes | Yes (up to $250,000) |

| Plus500* 82% of retail investor accounts lose money when trading CFDs with this provider. | FCA, CySEC, ASIC, MAS, FSA | 24/7 | Plus500 Webtrader | Bank Wire Transfer, Credit/debit cards, Paypal, Skrill | Yes | Yes (up to £85,000) |

| FP Markets | FCA, FSCA, ASIC, CMA, CySEC, FSA | 24/7 | MT4, MT5, TradingView, cTrader, WebTrader, Mobile App, Copy Trading | Credit/debit cards, Neteller, Skrill, Bank transfer, Google Pay, Apple Pay | Yes | Yes (up to $500,000) |

| Spreadex | FCA, SEBI | 24/5 | iPhone App, IPAD App, ANDROID App, TradingView | Bank Wire Transfers, Credit cards | No | Yes (up to £85,000) |

| AvaTrade | CBI, CySEC, ASIC, BVIFSC, FSA, SAFCSA, ADGM, ISA | 24/5 | MT4, MT5, AvaTradeGO, AvaOptions, AvaSocial, DupliTrade, Capitalise.ai | Credit/debit cards, Wire transfer, Paypal, Skrill, NETELLER, WebMoney | Yes | Yes (up to $1,000,000) |

Platforms Short Overview

As a UK trader, always prioritise your needs when choosing a trading platform. We did some market analysis to understand traders’ views. We discovered that the majority prioritise platforms they can afford. Others also prefer those that list their preferred securities. However, those we interviewed claim that the research process can be time-consuming. In this regard, we decided to do all the legwork. Below, we share tables showing the fees and assets of our top trading platforms UK.

Fees

| Best Trading Platform | Fees | Minimum Deposit Requirement | Transaction | Inactivity |

|---|---|---|---|---|

| Pepperstone | From 0.0 pips | £0 | Free | None |

| eToro | From 2 pips | £100 | £5 withdrawal | £10 monthly |

| Plus500* | From 0.0 pips | £100 | Free | £10 monthly |

| FP Markets | From 0.0 pips | £100 | Free | None |

| Spreadex | From 0.6 pips | £0 | Free | None |

| AvaTrade | 0.03 pips | £100 | Free | £50 quarterly |

Note: 82% of retail investor accounts lose money when trading CFDs with this provider.

Assets

| Best Trading Platform | Forex | Stocks | Commodities | ETFs | Options |

|---|---|---|---|---|---|

| Pepperstone | Yes | Yes | Yes | Yes | No |

| eToro | Yes | Yes | Yes | Yes | No |

| Plus500* (CFDs) | Yes | Yes | Yes | Yes | Yes |

| FP Markets | Yes | Yes | Yes | Yes | Yes |

| Spreadex | Yes | Yes | Yes | Yes | Yes |

| AvaTrade | Yes | Yes | Yes | Yes | Yes |

Note: 82% of retail investor accounts lose money when trading CFDs with this provider.

Our Expert Opinion about Trading Platforms in the UK

Below are our mini-reviews of the best trading platforms UK based on our experience. We hope they put you in a better position to make suitable choices.

1. Pepperstone – Beginner-Friendly Trading Platform in the UK

We also tested Pepperstone and primarily recommend it to new UK traders. We find it user-friendly with a modern design interface. This is an element that guarantees an exciting experience. Moreover, Pepperstone is one of the platforms hosting quality learning materials. Furthermore, there is a supportive team to help users manage any issues or challenges. Beginners can get started on its virtually funded demo account. The account is compatible with desktop and mobile devices.

We discovered over 1200 assets at Pepperstone, which you can trade as CFDs and spread betting. Plus, Pepperstone features social trading on its MT4, MT5, cTrader, and TradingView platforms. Social trading can help newbies adjust in the financial space. We also like its low spreads from 0.0 pips and no minimum deposit requirement. This makes it easier for newbies to start trading with small funds. This, of course, is as they gradually increase the amount.

Pros

- No minimum deposit requirement

- Low spreads from 0.0 pips

- Quality learning materials and a demo account for newbies

- Social and copy trading on multiple platforms

Cons

- Limited asset offerings compared to its peers

- You can only trade the assets as CFDs and spread betting

We find Pepperstone broker to be one of the brokers with transparent fee structures. There are no hidden charges, so what you see displayed on its platform is what you will incur. This makes it easier for you to budget without worrying about overspending.

Let’s discover below some of the trading and non-trading charges at Pepperstone.

| Trading and Non-Trading Charges | Details |

|---|---|

| Account Opening | $0 |

| Management Fee | $0 |

| Minimum Deposit Requirement | From $0, depending on your jurisdiction |

| Commission | From $0.02 on US-listed shares |

| Spreads | From 0.0 pips on its Razor Account |

| Deposits and Withdrawals | Free |

| Inactivity | None |

| Overnight Funding | Varies based on global market conditions |

| Copy Trading | Free |

Note that Pepperstone charges both spreads and commissions. While spreads are charged on all accounts, commissions are only imposed on the Razor Account.

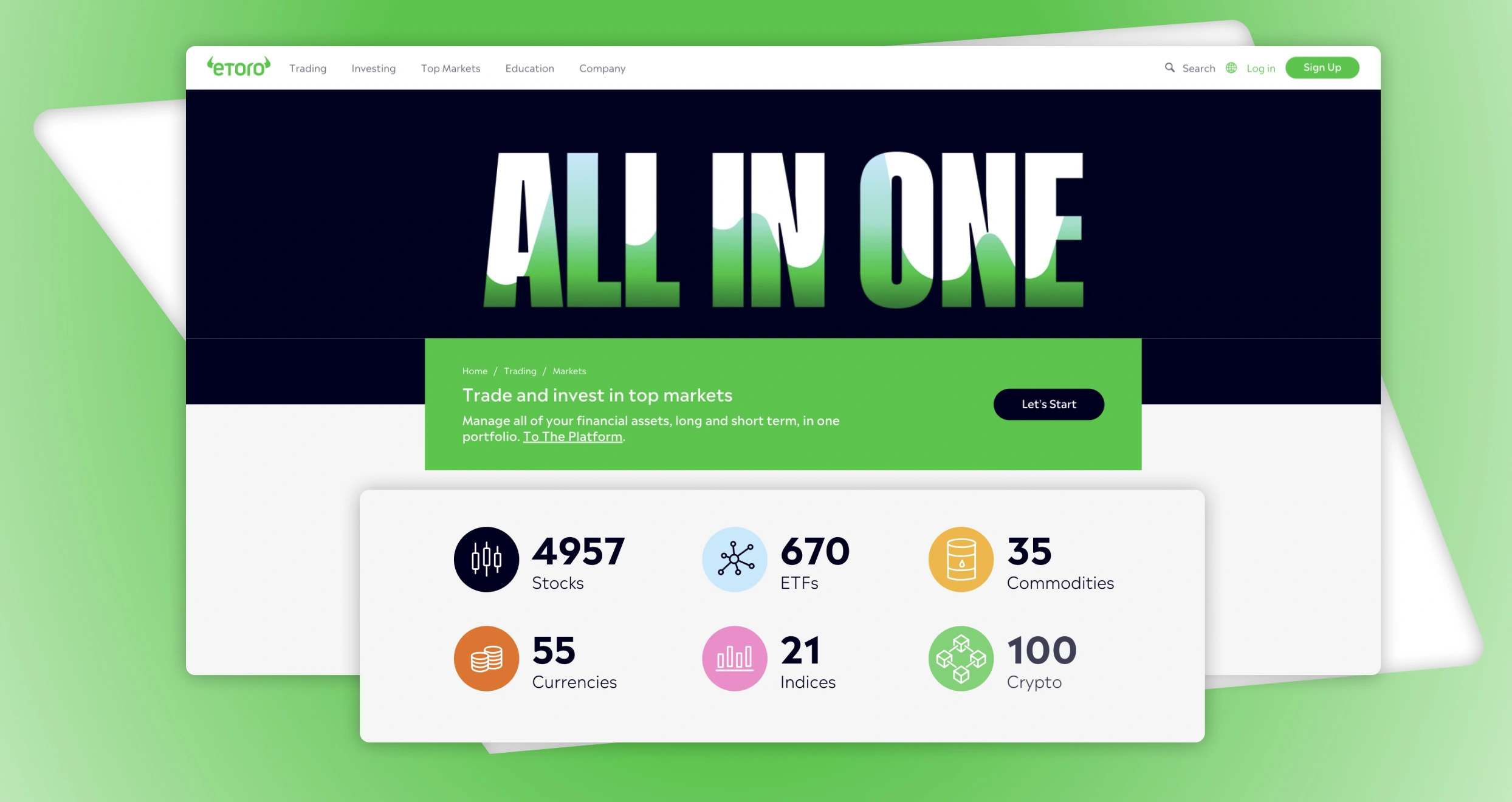

2. eToro – Overall Best UK Trading Platform

We tested many of the best UK trading platforms, and eToro stood out for various reasons. First, we find it to be user-friendly and customisable both on its desktop and mobile devices. Plus, eToro has a streamlined account opening procedure that takes minutes to complete. We also like its support for vast learning materials and a £100,000 virtually funded demo account. This makes it easier for newbies to learn how to trade. Plus, they will easily gauge their skill levels before diving into live trading. The broker has a low minimum deposit requirement of £100 for UK clients, and all deposits are free.

When it comes to asset offerings, we explored over 5,000 options. These include forex stocks, commodities, ETFs, indices, and more. Unfortunately, we find this platform’s trading charges to be a bit high compared to its peers. We also incurred £5 when making withdrawals. In our opinion, this fee can affect low-budget traders. The good news is that eToro supports social and copy trading, making it a compelling options trading platform for those looking to diversify their strategies. You will interact with other traders and mirror potentially profitable trades.

Pros

- Low minimum deposit requirement

- A user-friendly and intuitive design trading platform

- Commission-free stock trading

- Reliable and responsive 24/5 support service

- Hosts an award-winning social and copy trading platform

Cons

- Withdrawal fees apply

- No third-party platforms like the MT4 and MT5

eToro has a transparent fee structure that is easy to understand and helps you plan accordingly. From our analysis, we discovered the following trading and non-trading eToro fees.

| Trading and Non-Trading Charges | Details |

|---|---|

| Account Opening | $0 |

| Management Fee | $0 |

| From $50, depending on your jurisdiction | 0.6 |

| Commission | From 0% on stocks and ETF trading |

| Spreads | From 1 pip on major currency pairs |

| Deposits and Withdrawals | $5 withdrawal |

| Inactivity | $10 monthly |

| Currency Conversion | 1.5% or 3.0%, depending on the currency or payment method |

| Overnight Funding | Varies based on global market conditions |

| Copy Trading | Free |

3. Plus500 – Top Platform for CFD UK Traders

Your CFD trading experience will never be the same with Plus500. We find this platform the best primarily due to its commission-free CFD trades. We only incurred low spreads, which were also low from 0.0 pips. Moreover, this platform is user-friendly and customisable. Plus, its app is among the most highly rated by CFD users on Google Play, the App Store, and Trustpilot. Beginners can get started on this platform’s £50,000 virtually funded demo account. This is while learning the financial market using its many learning materials.

Besides having a reliable 24/7 support service, Plus500 hosts advanced resources. You will find them listed on its “Plus500 Professional” platform. The leverage limit goes up to 1:30 for retail traders and 1:300 for professionals. Moreover, you get to trade CFDs on over 2,800 assets. These include forex, shares, commodities, ETFs, indices, and more. Note that live trading requires a minimum deposit of £100, which you get to make free of charge.

Also, as a leading UK forex broker, Plus500 provides traders with the tools and resources needed to succeed in a competitive market.

Pros

- Commission-free CFD trades

- Has a virtually funded demo account and quality learning materials for newbies

- £100 minimum deposit requirement, which we believe is low

- High leverage limits and an advanced platform for professional traders

- Low spreads from 0.0 pips

Cons

- Only forex and CFD instruments supported

- Limited asset offerings compared to its peers

Many traders prioritize brokers they can afford. Since fees vary with a broker, we decided to go through Plus500’s fee structure. Here are some of the trading and non-trading charges to expect when you commit to this broker.

| Trading and Non-Trading Charges | Details |

|---|---|

| Account Opening | $0 |

| Minimum Deposit Requirement | $100 |

| Commission | $0 |

| Spreads | From 0.0 pips on major currency pairs |

| Deposits and Withdrawals | $0 |

| Inactivity | $10 monthly |

| Currency Conversion | Up to 0.7% |

| Overnight Funding | Varies based on trade size |

4. FP Markets – Best Trading Platform For Professional Traders in the UK

Professional UK traders will definitely enjoy their experience at FP Markets. As expert traders ourselves, we didn’t get enough of this platform. We explored quality tools for market analysis on FP Markets’ third-party platforms. These include cTrader, TradingView, MT4, and MT5. We experienced fast execution speed and an advanced client portal to track trading. We also benefited from superior VPS solutions for EAs, auto-trading, and more. Plus, FP Markets hosts numerous learning materials. You can utilise them to advance your skills.

Getting started at this platform’s live trading account requires at least £100. And although it only offers CFD trading, the assets available are over 10,000. These include forex, shares, commodities, cryptos, indices, and more. Also, FP Markets is a great platform for trading ETFs. When it comes to support service, FP Markets hosts a team of professionals available 24/7. You can reach out to them via phone, email, and live chat. They are very responsive and offer relevant solutions that will streamline your activities.

Pros

- Low minimum deposit requirement of £100

- Low spreads from 0.0 pips

- Fast trade execution speed on its desktop and mobile devices

- Features an Iress DMA platform for share trading

- Reliable and responsive 24/7 support service

Cons

- The available securities are available to trade as CFDs only

- The minimum balance for the Iress account type is £1000

We reviewed the applicable FP Markets fees, and like that the broker has a transparent structure. This allows users to efficiently plan for their activities without worrying about incurring additional costs. There are no hidden charges and no price manipulation with this broker.

| Trading and Non-Trading Charges | Details |

|---|---|

| Account Opening | $0 |

| Management Fee | $0 |

| Minimum Deposit Requirement | From $50, depending on your jurisdiction |

| Commission | From 0% |

| Spreads | From 0.0 pips on major currency pairs |

| Deposits and Withdrawals | Free deposits. Withdrawal fees apply based on the payment method used |

| Inactivity | $0 |

| Overnight Funding | Varies based on global market conditions |

| Copy Trading | Free |

5. Spreadex – Top Platform For UK’s Spread Bettors

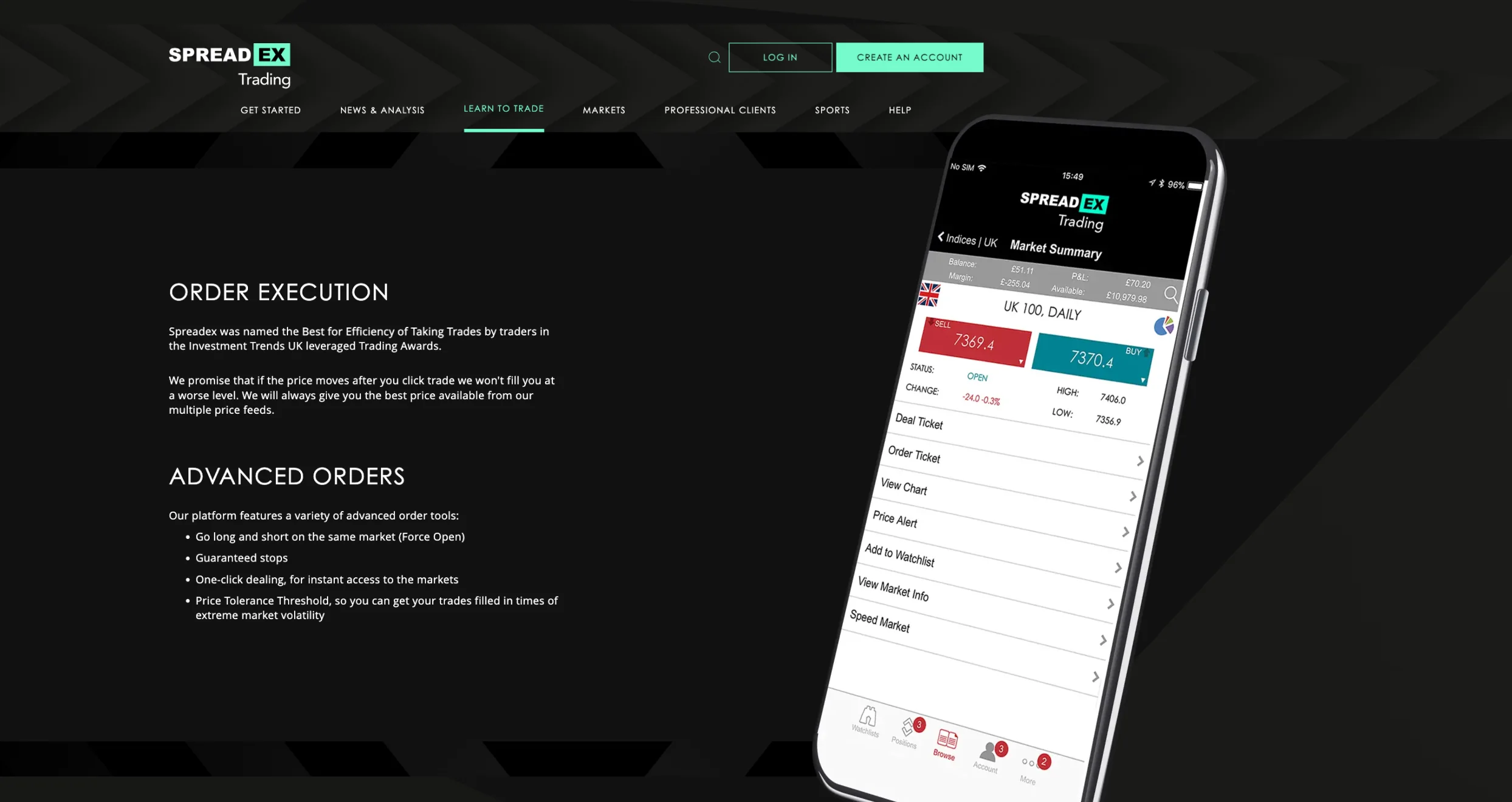

Spreadex is an excellent choice for spread bettors in the UK. This is primarily due to its cutting-edge spread betting services. Based on our experience and analysis, this platform is easy to use and customisable. Plus, it has a fast trade execution speed. This allows users to open multiple positions as they are guaranteed reliability. We accessed over 10,000 global markets across various classes. Some of them are stocks, forex, indices, commodities, cryptos, ETFs, and more. The best part is that Spreadex has no minimum deposit requirement, making it a standout among UK spread betting brokers. Spreads are also low, from 0.6 points on major currency pairs.

Besides its proprietary platform, Spreadex hosts the TradingView platform with advanced tools. For instance, TradingView features social trading. You will also find interactive chart types, drawing tools, and pre-built technical indicators. This allows you to efficiently analyse the financial market. Plus, you will efficiently develop solid strategies that will maximise your potential.

Pros

- Low trading fees with spreads from 0.6 points on major currency pairs

- Quality market analysis tools

- Features a Spreadex Pro platform tailored for professional traders

- Free deposits and withdrawals

- No minimum deposit requirement

Cons

- No demo account

- No MetaTrader platforms

Our experts evaluated Spreadex’s fees and have good reasons to consider it one of the most affordable brokers today. Several aspects caught our eyes from the get-go. For starters, the platform has zero minimum deposit requirement, free transactions, and no inactivity fees. We’ve summarized Spreadex’s fees in the table below.

| Description | Commission/Fee |

|---|---|

| Minimum deposit | $0 |

| Deposit fee | $0 |

| Withdrawal fee | $0 |

| Inactivity fee | $0 |

| Overnight fee | Yes |

6. AvaTrade – An Excellent Trading Platform For Mobile Trading in the UK

AvaTrade is a considerable choice when it comes to trading apps in the UK. From our analysis, the broker’s app is among the most highly rated by users. You can confirm this on Google Play, the App Store, and Trustpilot. The high ratings are primarily due to its user-friendly and customisable interface. Many users also find its support service reliable. It is an element that can contribute to streamlining your trading activities. The platform lists over 1250 CFD assets. These include forex, shares, commodities, cryptos, ETFs, and more.

We noticed that AvaTrade has a low minimum deposit requirement of £100. All transactions are free of charge using credit cards, e-wallets, and bank transfers. We also enjoyed low trading charges and quality resources. All these and more are on its MT4, MT5, AvaSocial, DupliTrade, and ZuluTrade platforms. Automated trading is also featured. It allows users to manage their activities with minimal effort. For beginners, AvaTrade hosts adequate learning materials and a virtually funded demo account.

Pros

- Low minimum deposit requirement for UK clients

- A user-friendly and intuitive design trading app/platform

- Features social and copy trading, which can be useful for newbies

- Adequate research and educational materials

Cons

- Limited asset offerings compared to its peers

- It has a quarterly inactivity fee of £50, which kicks in barely after three months of account’s dormancy

Our experts investigated the AvaTrade broker’s fees and charges. We first noticed that the platform has a modest minimum deposit requirement of $100. What’s more, its users pay no additional costs while depositing funds or cashing out. That makes AvaTrade an ideal broker for both cost-conscious and newbie traders who want to test their waters with small capital before going all in.

That said, AvaTrade requires dormant account holders to pay $50 after every 3 consecutive months of inactivity. Moreover, if you let your account remain inactive for over successive months of inactivity, the broker will charge you a $100 administration fee. Not to forget, AvaTrade requires traders who hold positions overnight to cover a premium.

Here’s a breakdown of the fees you should expect to encounter while trading with this service provider:

| Fees and Charges | Amount |

|---|---|

| Spreads | From 0.9 pips |

| Administration fee | $100 |

| Inactivity fee | $50 |

| Overnight premium | Yes |

Online Trading in the UK

Online trading in the UK is legal, and any individual above 18 years can participate in the activity. You will be able to enter into a legally binding agreement to open an account. While trading has proven lucrative, losses are inevitable. That is why it is crucial to conduct extensive market analysis before opening a position.

The Financial Conduct Authority (FCA) is responsible for overseeing the UK’s online trading. It has rules that every broker must abide by. The goal is to ensure the online trading space remains secure. This is primarily from imposters and anti-money laundering activities. Simply put, the FCA maintains the integrity of the UK financial market. It does so using its robust regulatory framework.

The online trading space in the UK is open 24/7. This allows traders to explore tradable assets anytime they identify potentially profitable opportunities. Various securities are offered, including forex, shares, commodities, cryptocurrencies, ETFs, and more. Spread betting is also legal in the UK—an activity that allows you to explore various assets tax-free. Any other profits you will incur through trading must be taxed and reported to the HMRC.

What is a Trading Platform?

A trading platform is an online application. It allows traders to explore various financial instruments. This is by using their internet-powered desktop or mobile devices. The best trading platforms UK are offered by brokerage firms. They easily give you access to assets like forex, shares, commodities, cryptos, and more.

The best element about trading using a platform is exposure to numerous opportunities. For instance, UK traders can spread bet and earn tax-free profits. You can also practise automated and social trading. Plus, trading platforms give users access to quality market analysis tools. However, understand that the market carries risks. If not managed effectively, it can leave you with losses. Start by understanding these risks and selecting a highly reputable and regulated platform. This is if you want to maximise experience and potential.

How to Choose the Best Trading Platform in the UK

If you are new to trading in the UK, choosing the best platform is crucial. Below, we share some tips to ensure you make the right choice.

The best trading platform UK should be highly encrypted and regulated by the FCA. You see, there are many scammers in the region. Overlooking this element will expose you to such unscrupulous individuals. Our recommended trading platforms above are FCA-regulated. They will secure your funds in segregated accounts. You will also enjoy the best trading conditions.

Checking a platform’s trading and non-trading charges is crucial. This is because the best online trading platform UK fees vary. You want to choose the one you can afford, or aligns with your budget. That being said, confirm the minimum deposit requirements. Plus, check the commission/spreads, inactivity fees, overnight charges, and more.

The best trading platform UK should be user-friendly and customisable. Most importantly, it should have a fast trade execution speed. Many traders may overlook these elements. However, they help streamline your activities and guarantee an exciting experience. Moreover, confirm the availability of learning and research resources. Ensure they meet your skill level. Also, settle with a platform hosting a demo account and trading app.

Whether you are looking to trade forex, commodities, cryptos, or more. In this case, the trading platform UK you select must host the instruments. This will help you plan for your activities while enjoying your experience. Plus, consider one with multiple asset class offerings for efficient portfolio diversification.

A platform with a reliable and responsive support service is worth committing to. You see, all traders experience challenges that require professional help. A platform with quality support ensures you solve any issues quickly. This is without affecting your open positions. Remember, not all platforms’ support services are available 24/7. Others operate five days a week. You simply need to ensure their availability aligns with your trading schedule. They must also be reachable via convenient channels like live chat, email, and phone.

Consider analysing other users’ comments and ratings before making a choice. Honest reviews are on Google Play, the App Store, and Trustpilot. This allows you to understand a platform’s strengths and weaknesses. As a result, you will make the best choice aligning with your requirements and risk tolerance.

Risks to Trade with Trading Platform

Trading in the UK has become prevalent. Many individuals are looking for efficient ways to start exploring this market. Before engaging in online trading, understand that risks are involved. This is especially when using trading platforms. Some of the most common risks include:

- Market volatility

The financial space carries numerous assets, most of which are highly volatile. Such asset prices constantly change and within a short timeframe. Without solid strategies, sudden market movement may negatively affect your trade. It is crucial to conduct extensive research on highly volatile assets. Plus, only make a move when you see a potentially profitable opportunity. However, market volatility can also work in your favour and bring about good profits.

- Liquidity risks

There are also assets that are highly liquid while others aren’t. Less liquid assets make it challenging to trade whenever you identify an opportunity. This can sometimes lead to losses. Note that liquid assets are those that can easily be exchanged for cash. Their value is less likely to increase over time. Their demand in the financial space is high.

- Leverage risks

Trading platforms in the UK expose you to leverage. Leverage allows you to manage larger positions with a small capital. While it can bring about good profits, losses are inevitable. You may find yourself with massive losses that could affect your trading activities. Therefore, only apply leverage when confident in your skills. Plus, risk amounts you are comfortable losing in case a trade doesn’t work out in your favour.

- Cash management risks

Internet-powered best online trading platform UK exposes you to the financial market 24/7. With this advantage, you can open many positions during the day, hoping to earn profits. However, sometimes things do not go as expected, and you may find yourself on the losing side. You may also open a position due to excitement from managing profitable trades. This may lead you to make irrational decisions and open positions based on emotions. As a trader, have a cash management plan. Only open a position when you identify a potentially profitable opportunity. We have witnessed many individuals lose money on emotional trading.

- Security risks

The financial space is dominated by both legitimate and fraudulent individuals. Wrong choices, such as overlooking a platform’s regulatory status, may land you in the wrong hands. As a result, you can lose your money. Plus, there have been cases of cyber attacks, leading to the loss of personal data. Technical glitches can also affect your open position. You may end up missing out on potentially profitable opportunities and incur losses.

Pros & Cons of Trading with a Platform

Trading platforms in the UK have many benefits as well as a few cons, as listed below.

| Pros | Cons |

|---|---|

| Trading platforms are accessible 24/7, allowing you to open a position anytime you identify a potentially profitable opportunity. | Internet connectivity issues or technical glitches may affect your open positions on a trading platform. |

| They expose traders to numerous assets and trading resources, making it easier for them to navigate this dynamic space. | Since they are easily accessible, trading can become addictive. This may lead you to open positions based on emotions, even without solid strategies and opportunities. |

| Online trading platforms are more cost-effective than on-site ones, attracting all types of traders. | You will be exposed to leverage trading, which can maximise returns as well as magnify losses. |

| An FCA-regulated platform guarantees maximum safety to your funds and offers the best trading conditions for an exciting experience. | |

| Online trading platforms offer flexibility since you can manage your activities using desktop and mobile devices. |

Conclusion

Having the best UK trading platforms is a crucial decision every trader must make. To ensure you find a suitable option, follow our guidelines above. Then, test the platform’s performance via its demo account to avoid risking real money. And when you are ready to kickstart your ventures via a live trading account, do not go all in. Start with a small capital and apply risk management controls like stop-loss orders. Some platforms like the ones we recommend also have quality trading resources. Therefore, take advantage of them and practise continuous learning. Thorough research is also crucial in identifying the best entry and exit points.

This is a solid breakdown - really helpful for someone like me who's still exploring options. I'm particularly interested in platforms that offer strong learning resources and demo accounts to practice. Pepperstone and AvaTrade seem appealing in that regard. Still figuring out which platform would suit me best, but this guide definitely gave me some good starting points.