Claire Maumo has experience in investment banking, strategic consultancy, and journalism. She has a Bachelor’s degree in Business Management and a Master’s in finance. She has a knack for making complex concepts easy to understand. Her primary focus is on crypto, blockchain, and financial instruments. Follow her for expert insights on trading and investment.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

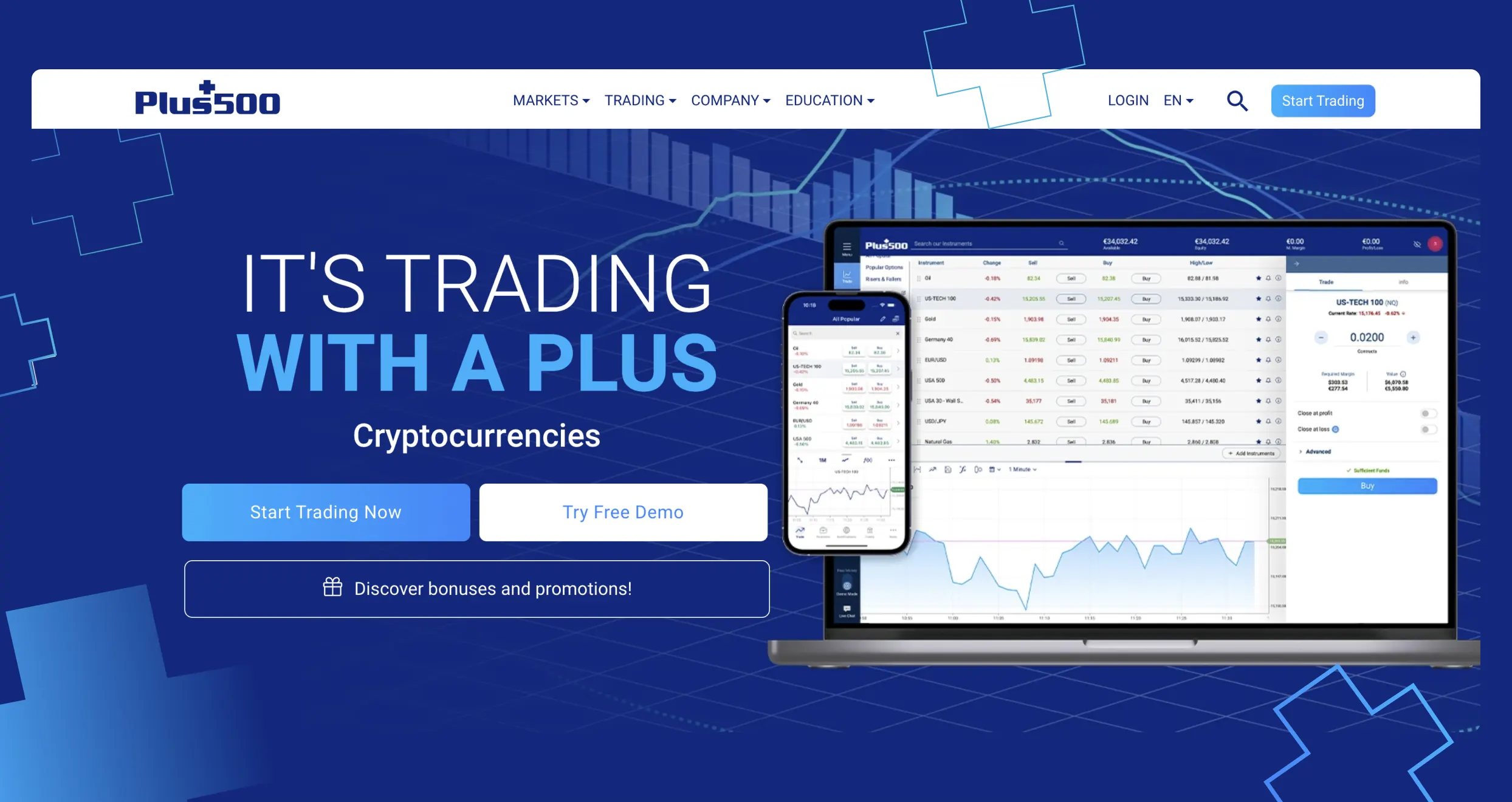

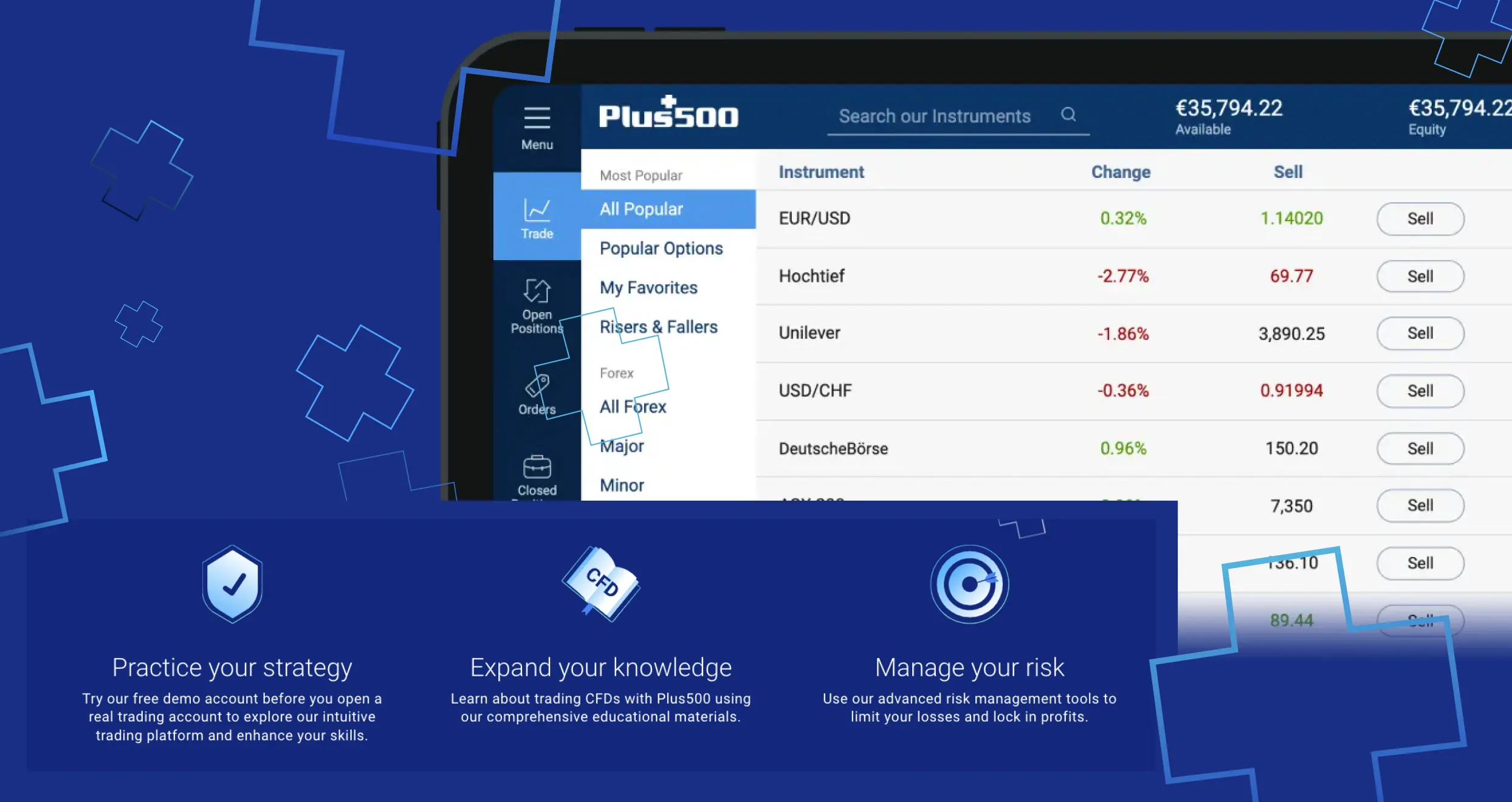

Established in 2008, Plus500 prides itself on being a world-renowned broker connecting over 26 million clients to the financial space. So far, it accepts clients from 50+ global countries and has a total trading volume of $800+ billion. It is among the most highly recommended brokerage firms. Many users find it efficient for managing trades on both desktop and mobile devices.

To confirm this broker’s reliability and credibility, we decided to test it and analyze its features. We share our unbiased Plus500 review below based on our findings. Our goal is to clear some traders’ doubts and answer questions like “is Plus500 good for beginners and expert traders?”

Our Opinion about Plus500

We signed up for trading accounts at Plus500 and tested its performance. While some elements stood out, we discovered a few pitfalls. We believe that having an understanding of the strengths and weaknesses of Plus500 will give you a clear insight into what to expect upon committing.

For instance, we liked that Plus500 offers user-friendly and fully customizable trading platforms. Moreover, it seamlessly executes trades on desktop and mobile devices. However, there are no third-party platforms like MT4/5, which, in our opinion, limits some of the most advanced traders.

Pros

- Has a cutting-edge, easy-to-use trading platform

- It is a secure brokerage firm that is licensed and regulated by top-tier global authorities

- Plus500 has a low minimum deposit requirement of $100

- Its trading app is accessible on Google Play and the App Store

- It hosts a “Trading Academy” platform hosting quality skills advancement resources

- You can trade on its Plus500 CFD, Plus500 Future, or Plus500 Invest platform

- CFD trading is commission-free with low spreads from 0.0 pips

- No hidden charges

Cons

- There are no featured third-party platforms like the MT4, cTrader, or the MT5

- You will incur a $10 inactivity fee should your account remain dormant for over three months

- Plus500 Invest and Plus500 Futures are limited to specific regions

Note: 82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Fees

Many traders prioritize brokers they can afford. Since fees vary with a broker, we decided to go through Plus500’s fee structure. Here are some of the trading and non-trading charges to expect when you commit to this broker.

| Trading and Non-Trading Charges | Details |

|---|---|

| Account Opening | $0 |

| Minimum Deposit Requirement | $100 |

| Commission | $0 |

| Spreads | From 0.0 pips on major currency pairs |

| Deposits and Withdrawals | $0 |

| Inactivity | $10 monthly |

| Currency Conversion | Up to 0.7% |

| Overnight Funding | Varies based on trade size |

Available Assets

From our analysis, we discovered that the Plus500 trading platform lists over 2,800 assets. These assets are spread across various classes, including forex, shares, indices, commodities, cryptos, options, and ETFs. For most regions, Plus500 supports CFD trading across the featured assets. Real stock trading is available on the Plus500 Invest platform, while futures trading is only available for US citizens on the Plus500 Futures platform.

Let’s break down the number of Plus500 product selections.

| Asset Class | Number Offered |

|---|---|

| Forex | 60+ currency pairs |

| Shares | 1900+ |

| Indices | 29+ global stock indices |

| Commodities | 24+ |

| Cryptocurrencies | 19+ |

| ETFs | 96+ |

Note that options trading at Plus500 is offered on a few stock CFDs and stock index CFDs. Thematic indices like the Cannabis Index are also available for traders.

Disclaimer: CFD trading is complex and highly risky, considering the application of leverage attached. We have witnessed over 76% of retail traders lose their money in CFD trading. It may not be a suitable activity for you. Therefore, ensure you understand how CFD trading works and the risks involved.

Security

Plus500 is a legitimate brokerage firm that has witnessed tremendous growth throughout the years. Its shares are listed on the UK’s London Stock Exchange and is licensed by world-class financial regulators. It’s unfortunate that Plus500 doesn’t have a banking license, but who knows what the future holds?

Having multiple licenses and being regulated by tier-one authorities means that this broker has users’ interests at heart. By using it, you are guaranteed your fund’s safety as they are secured in segregated accounts. Moreover, you have a conducive environment free from imposters and money laundering activities.

That being said, below are some of the financial regulators overseeing the activities of Plus500 on a global scale.

| Financial Regulator | Legal Entity |

|---|---|

| Cyprus Securities and Exchange Commission (CySEC) | Plus500CY Ltd |

| Financial Conduct Authority (FCA) | Plus500UK Ltd |

| Monetary Authority of Singapore (MAS) | Plus500SG Pte Ltd |

| Australian Securities and Investments Commission (ASIC) | Plus500AU Pty Ltd |

| South Africa’s Financial Sector Conduct Authority (FSCA) | Plus500AU Pty Ltd |

| Israel Securities Authority (ISA) | Plus500IL Ltd |

| Dubai Financial Services Authority (DFSA) | Plus500AE Ltd |

| Seychelles Financial Services Authority (FSA). | Plus500SEY Ltd |

Note that Plus500 highlights the authorities overseeing it in specific regions at the bottom of its homepage. It operates several subsidiaries and offers investor protection to traders. This depends on the region or entity you are signing up with. For instance, UK traders signing up for accounts via Plus500UK Ltd will get £85,000 in investor protection.

Users are also eligible for negative balance protection at Plus500. This means that you will be protected should the balance in your account go into a negative territory.

Conclusion

From our experience trading at Plus500, we recommend it to all types of traders. We like that it has a streamlined account opening procedure and a dedicated trading platform for iOS and Android mobile devices. Overall, Plus500 is worth trading with, but remember, it might not suit all traders’ requirements. That being said, we hope our ultimate Plus500 review above will help you make informed decisions. You can take advantage of its $40,000 virtually funded demo account to test its performance and offerings. The Plus500 demo account will also help you gauge your skill level without risking your hard-earned money.

Fees

Account opening

Customer service

Deposits & Withdrawals

Would you recommend this provider?

Fees

Account opening

Customer service

Deposits & Withdrawals

Would you recommend this provider?

Fees

Account opening

Customer service

Deposits & Withdrawals

Would you recommend this provider?