Claire Maumo has experience in investment banking, strategic consultancy, and journalism. She has a Bachelor’s degree in Business Management and a Master’s in finance. She has a knack for making complex concepts easy to understand. Her primary focus is on crypto, blockchain, and financial instruments. Follow her for expert insights on trading and investment.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

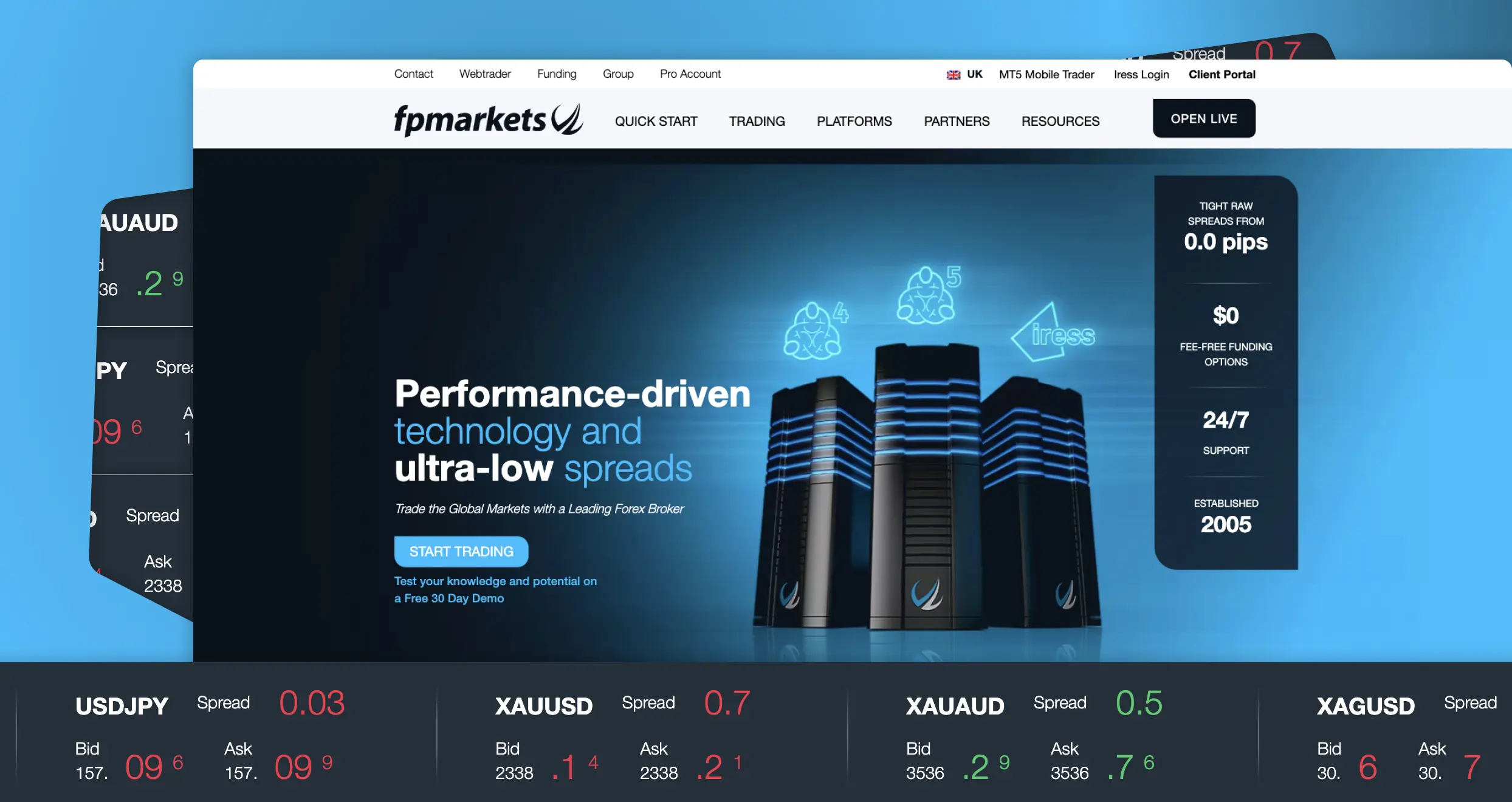

FP Markets was established in 2005 with a focus on creating a superior forex and CFD trading platform for global traders. So far, the company has achieved this dream, which is evident from the multiple awards it has earned. Moreover, many users find it reliable and secure when managing their trades. FP Markets has a fast trade execution speed, reliable support service, quality support service, and more.

We have prepared this ultimate FP Markets review to break down all the features we discovered at this brokerage firm. We are experts in the financial landscape. Therefore, we know exactly what to look for and explore before recommending any broker to our readers.

Our Opinion about FP Markets

Creating trading accounts at FP Markets was a breeze, and it took us minutes to complete the process. We did not incur any charge for setting up these accounts, and its minimum deposit requirement is also low (from $50). Plus, FP Markets offers free deposits across multiple payment methods like credit/debit cards, e-wallets, and bank transfers.

Besides the many amazing features that made the broker FP Markets stand out, we discovered a few drawbacks. For instance, while it features thousands of assets, you only trade them as CFDs. Additionally, we noticed that some withdrawal options are not free.

Pros

- Low minimum deposit requirement for most regions

- Free deposits across multiple payment methods

- Hosts numerous learning and market analysis tools

- Multiple trading platforms to choose from, including WebTrader, cTrader, TradingView, MT4, and MT5

- Offers social and copy trading

- Over 10,000 securities to explore on multiple trading accounts, including Standard, Raw, and Iress

- A reliable and responsive support service via phone, email, and live chat

- Low forex and CFD trading charges

Cons

- The featured securities are available to trade as CFDs

- Withdrawal fee from 1% apply

- Its Iress trading account has a high minimum deposit requirement of $1,000

Fees

We reviewed the applicable FP Markets fees, and like that the broker has a transparent structure. This allows users to efficiently plan for their activities without worrying about incurring additional costs. There are no hidden charges and no price manipulation with this broker.

| Trading and Non-Trading Charges | Details |

|---|---|

| Account Opening | $0 |

| Management Fee | $0 |

| Minimum Deposit Requirement | From $50, depending on your jurisdiction |

| Commission | From 0% |

| Spreads | From 0.0 pips on major currency pairs |

| Deposits and Withdrawals | Free deposits. Withdrawal fees apply based on the payment method used |

| Inactivity | $0 |

| Overnight Funding | Varies based on global market conditions |

| Copy Trading | Free |

Available Assets

There are more than 10,000 CFD instruments at FP Markets across various asset classes. These include forex, shares, commodities, cryptos, and more. The best element about exploring these securities is that you have access to multiple platforms to choose from. Whether you prefer the MT4, MT5, cTrader, or TradingView, FP Markets has it all for you. You are guaranteed quality resources to maximize your potential.

When it comes to leverage applications, FP Markets has favorable limits for all types of traders. Retail traders can get up to 30:1, while professionals get 500:1. Moreover, we discovered multiple account types to suit every trader’s needs.

Here is a breakdown of the number of assets you will trade at FP Markets Standard, Raw, and Iress accounts.

| Asset Class | Number Offered |

|---|---|

| Forex | 70+ currency pairs |

| Shares | 10000+ |

| Indices | 19+ |

| Commodities | 12+ |

| Cryptocurrencies | 12+ |

| ETFs | 46+ |

| Bonds | 2+ |

| Futures | 7+ |

Disclaimer: CFD trading is risky, especially with the application of leverage attached. While many traders earn good profits from it, it can leave you with massive losses should a trade work out against you. Therefore, start by understanding CFD trading and all the risks involved before venturing into such securities. Remember, over 76% of retail traders lose money in CFD trading.

Security

We discovered that FP Markets has employed robust security measures to ensure its clients have the best trading environment. The broker is highly encrypted on both its desktop and mobile trading platforms. While there is no two-factor authentication login procedure, you can still secure your account with a passcode or biometrics ID.

Additionally, FP Markets operates under the oversight of multiple global authorities. This guarantees a safe environment as your funds are segregated in tier-one bank accounts only accessible to you. Moreover, you are guaranteed a conducive environment free from imposters and money laundering activities. You will also be protected under its investor protection program. However, the protection amount varies based on your jurisdiction. Note that some regions are not protected under this program.

That being said, here are the top global financial authorities overseeing FP Markets activities.

| Financial Regulator | Legal Entity |

|---|---|

| Financial Services Authority (Seychelles) | First Prudential Markets Limited |

| Financial Services Commission (Mauritius) | FP Markets Ltd |

| Financial Sector Conduct Authority (South Africa) | FP Markets (Pty) Ltd |

| Financial Services Authority (St. Vincent and the Grenadines) | FP Markets LLC |

| Cyprus Securities and Exchange Commission (CySEC) | First Prudential Markets Ltd |

| Australian Securities and Investments Commission (ASIC) | First Prudential Markets Pty Ltd |

Conclusion

Our FP Markets review above shares a glimpse of what it offers once you commit to it. Before you do, we encourage you to visit FP Markets’ website and test it using its virtually funded demo account. With unique features like automated and social trading, we believe you will definitely enjoy your experience.

However, note that success in trading still requires a strategic approach. Continuous learning must also be employed so you can stay abreast with any new market developments. Most importantly, apply risk management controls to avoid incurring massive losses. Fortunately, FP Markets offers all the resources you need to trade securely and efficiently. You simply need to figure out whether it aligns with your trading requirements.

Would you recommend this provider?

Fees

Account opening

Customer service

Deposits & Withdrawals

Would you recommend this provider?

Fees

Account opening

Customer service

Deposits & Withdrawals

I’ve been using FP Markets for a while, and overall, it’s a solid broker with tight spreads and fast execution.

Would you recommend this provider?

Fees

Account opening

Customer service

Deposits & Withdrawals