Claire Maumo has experience in investment banking, strategic consultancy, and journalism. She has a Bachelor’s degree in Business Management and a Master’s in finance. She has a knack for making complex concepts easy to understand. Her primary focus is on crypto, blockchain, and financial instruments. Follow her for expert insights on trading and investment.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

Forex is the most liquid market in the financial space, making it an attractive hub for traders in the UK. While the market offers traders various opportunities, it carries risks that must be effectively managed. Having the best UK forex broker is one way to manage such risks, as you will have a platform overseen by the Financial Conduct Authority (FCA). Plus, the best broker hosts quality trading tools that will help you make the right decisions at the right time.

To find the best forex brokers in the UK 2025, we have created the list below. These options have been thoroughly tested and approved by our experts. If you are a beginner, we will also guide you on what forex trading is, how to start trading currencies, and market risks.

List of the Best Forex Trading Platforms

- Pepperstone – Best For MT4 Users

- IG Markets – Overall Best Platform For Forex Trading in the UK

- FxPro – Top Mobile-Friendly Platform For Forex Trading in the UK

- Plus500* – Cheapest UK Forex Trading Platform

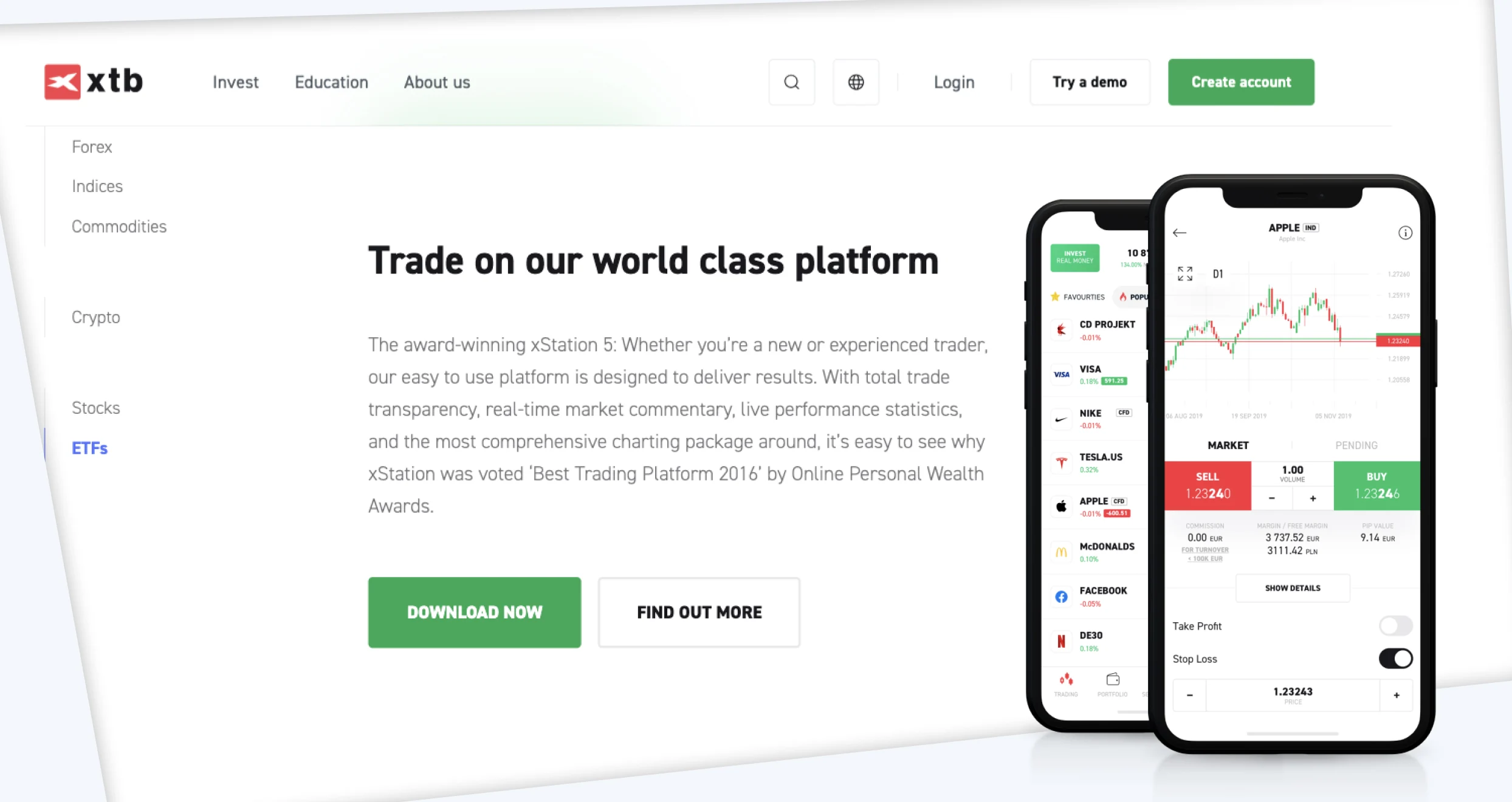

- XTB – Beginner-Friendly UK Forex Trading Platform

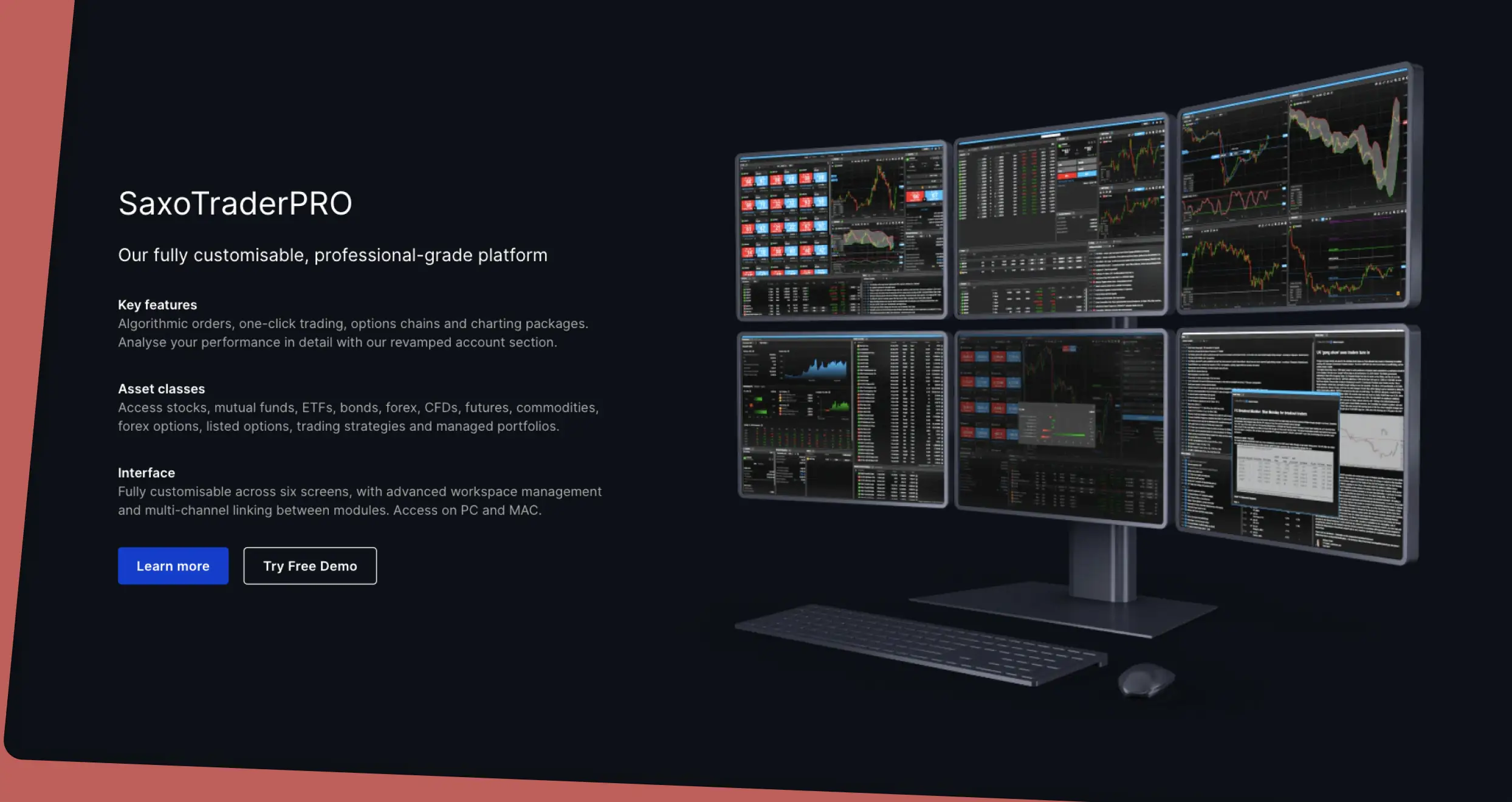

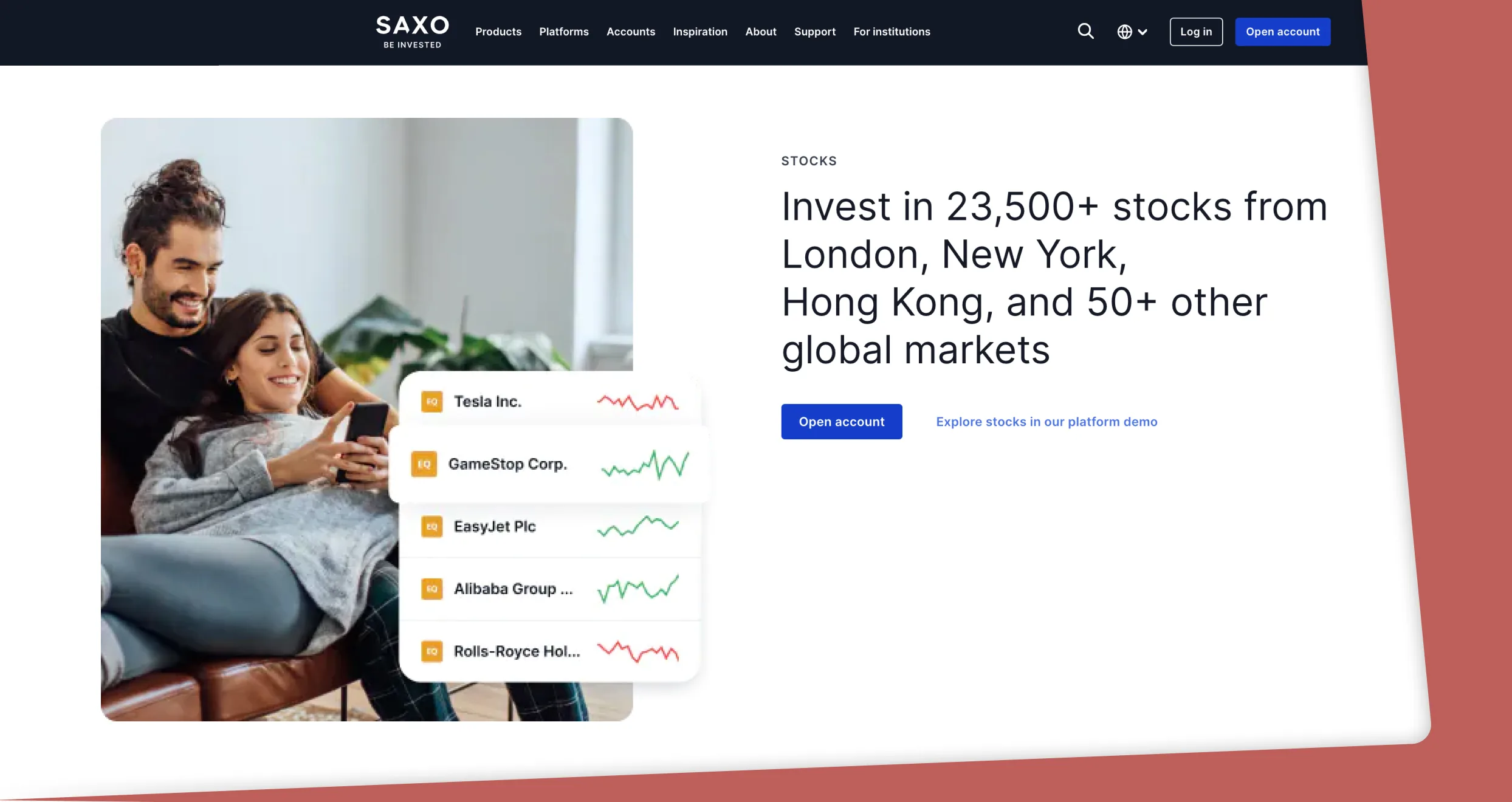

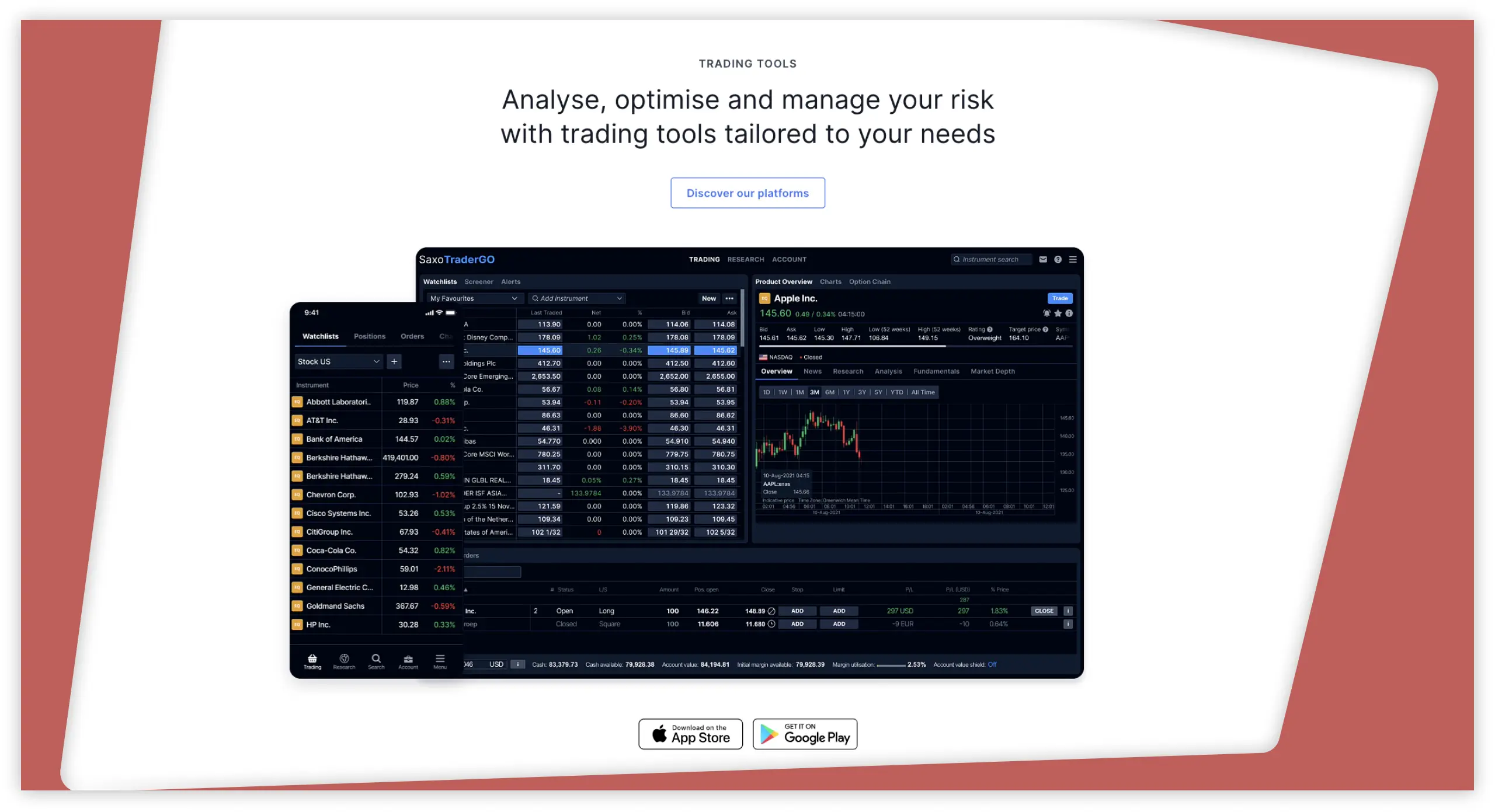

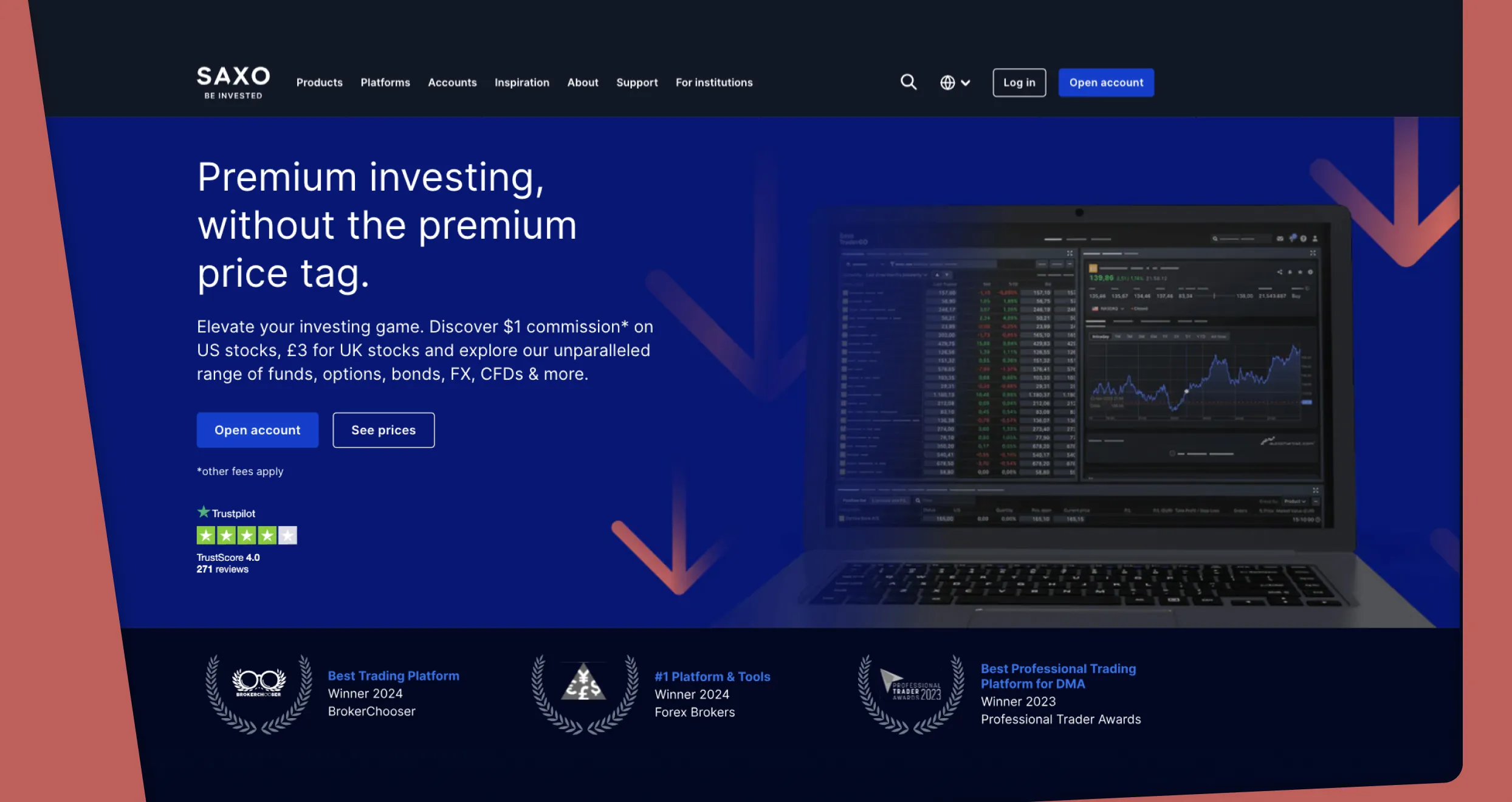

- Saxo – Best Forex Trading Platform For Professionals

Note: 82% of retail investor accounts lose money when trading CFDs with this provider.

UK Forex Brokers: Comparison Table

We share below our comparison table highlighting the key features of our top forex trading platforms UK. Note that getting to this point was not easy, and we conducted thorough market research. The process involved multiple tests, comparisons, and analysis of user testimonials. We wanted to ensure we remain unbiased so our readers can meet forex brokers that guarantee a worthwhile experience.

Feel free to analyse this comparison table and choose a suitable forex broker.

| Forex Broker | Licence | Support Service | Software | Payment Method | Demo Account | Money Insurance |

|---|---|---|---|---|---|---|

| Pepperstone | FCA, ASIC, FSCA, DFSA, CySEC, CMA, SCB, BaFin | 24/7 | TradingView, MT4, MT5, cTrader, Pepperstone Trading Platform, Social Trading | Visa, Mastercard, Bank transfer, Neteller, Skrill, PayPal | Yes | Yes (up to £85,000) |

| IG Markets | FCA, BaFin, MiFID, CySEC, FINMA, DFSA, FSCA, MAS, JFSA, ASIC, CFTC, BMA | 24/5 | Online platforms, Mobile apps, MT4, ProRealTime, L2 Dealer, US options and futures | Credit/debit cards, Bank wire transfers, Neteller, Skrill, PayPal | Yes | Yes (up to £85,000) |

| FxPro | FCA, CySEC, FSCA, SCB | 24/5 | FxPro Mobile App, MT4, MT5, cTrader, FxPro WebTrader | Credit/debit cards, Bank wire transfers, Neteller, Skrill, PayPal | Yes | Yes (up to £85,000) |

| Plus500* 82% of retail investor accounts lose money when trading CFDs with this provider. | FSCA, CySEC, FCA, ASIC, FMA, MAS | 24/7 | Plus500 Invest, Plus500 CFD | Visa, MasterCard, PayPal, Skrill, Bank transfer | Yes | Yes (up to £85,000) |

| XTB | CIRO, FCA, CNMV, KNF | 24/5 | xStation 5, xStation Mobile | Credit/debit cards, e-wallets, bank transfers | Yes | Yes (up to £85,000) |

| Saxo | FSA, FCA, MAS, SEBI | 24/5 | SaxoTraderGO, SaxoTraderPRO, SaxoTraderGO | Bank Wire Transfer, Debit cards | Yes | Yes (up to £85,000) |

Brokers Short Overview

There are various elements to look into when choosing a UK forex broker. Among them are fees and asset offerings, which help you plan accordingly. We understand that comparing these features among hundreds of forex brokers can be daunting. Therefore, we did the work ourselves and share below our findings.

Fees

| Forex Broker | Minimum Deposit Requirement | Commission/ Spreads | Deposits/ Withdrawals | Inactivity Fee |

|---|---|---|---|---|

| Pepperstone | £0 | From 0.0 pips | Free | None |

| IG Markets | £0 | From 0.6 points | Free | None |

| FxPro | £100 | From 0.0 pips | Free | £10 one-off account maintenance fee after 6 months |

| Plus500* | £100 | From 0.0 pips | Free | £10 monthly after 3 months |

| XTB | £0 | From 0.8 pips | Free | £10 monthly after 12 months |

| Saxo | £0 | From 0.6 pips | Free | None |

Note: 82% of retail investor accounts lose money when trading CFDs with this provider.

Assets

| Forex Broker | Stocks | Forex | Cryptos | Commodities | Indices | ETFs | Options |

|---|---|---|---|---|---|---|---|

| Pepperstone | Yes | Yes | Yes | Yes | Yes | Yes | No |

| IG Markets | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| FxPro | Yes | Yes | Yes | Yes | Yes | No | No |

| Plus500* (CFDs) | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| XTB | Yes | Yes | Yes | Yes | Yes | Yes | No |

| Saxo | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Note: 82% of retail investor accounts lose money when trading CFDs with this provider.

Our Expert Opinion about Forex Brokers in the UK

As mentioned earlier, we conducted multiple tests and comparisons on hundreds of brokers in the UK. We left no stone unturned to ensure we recommend every broker to the right trader. If you have identified potential brokers to partner with from our list, we share their mini-reviews below. Read them carefully to clear any doubts you may have. You can also test them via their demo accounts before making a final choice.

1. Pepperstone – Best For MT4 Users

After testing and analysing hundreds of UK forex brokers, we primarily recommend Pepperstone for MT4 users. We have an opportunity to trade over 90 currency pairs across majors, minors, crosses, and exotics in highly competitive conditions, including low spreads and deep liquidity. Plus, Pepperstone lists an additional 2,400 instruments for portfolio diversification. Sadly, the broker doesn’t allow buying and taking ownership of the featured securities. You only get to trade them as CFDs and spread betting. There is no minimum deposit requirement, and all deposits are free of charge.

MT4 UK forex traders are guaranteed an amazing experience at this broker’s MT4 platform. Some of the features we discovered are social and automated trading, customisable charting, mobile trading, over 28 indicators, and more. And if you want to try trading currencies on other platforms, Pepperstone has other options to choose from. They include MT5, cTrader, and TradingView, all with unique features. Other elements that caught our attention and are worth mentioning are numerous learning resources, a virtually funded demo account, and a reliable support service.

Pros

- Lists over 90 currency pairs

- Low forex spreads, starting from 0.0 pips on major currency pairs

- A user-friendly and customisable platform on both desktop and mobile devices

- No inactivity fees

Cons

- The featured assets can only be traded as CFDs or spread betting. No buying and taking ownership

- The MT4 platform at Pepperstone doesn’t feature advanced take-profit/stop-loss levels

We find Pepperstone broker to be one of the brokers with transparent fee structures. There are no hidden charges, so what you see displayed on its platform is what you will incur. This makes it easier for you to budget without worrying about overspending.

Let’s discover below some of the trading and non-trading charges at Pepperstone.

| Trading and Non-Trading Charges | Details |

|---|---|

| Account Opening | $0 |

| Management Fee | $0 |

| Minimum Deposit Requirement | From $0, depending on your jurisdiction |

| Commission | From $0.02 on US-listed shares |

| Spreads | From 0.0 pips on its Razor Account |

| Deposits and Withdrawals | Free |

| Inactivity | None |

| Overnight Funding | Varies based on global market conditions |

| Copy Trading | Free |

Note that Pepperstone charges both spreads and commissions. While spreads are charged on all accounts, commissions are only imposed on the Razor Account.

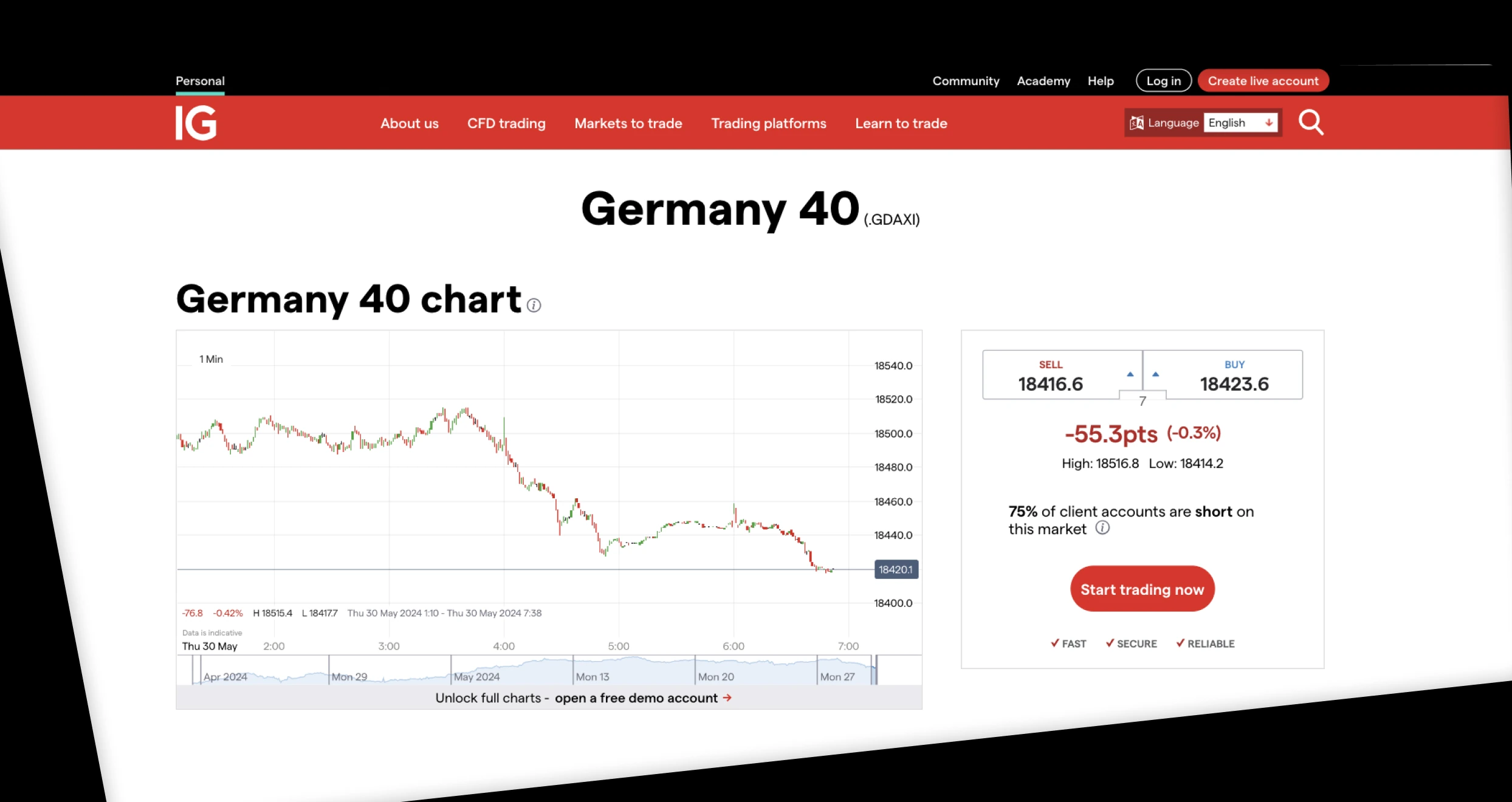

2. IG Markets – Overall Best Platform For Forex Trading in the UK

We tested IG Markets and found it a suitable forex broker for any UK trader. This best forex broker UK has a user-friendly interface that has customisable features. Plus, the broker has a fast trade execution speed, allowing you to open multiple positions during the day. We also like IG Markets’ vast learning resources, which have been helpful in advancing users’ skills.

Forex trading at IG Markets exposes you to more than 80 currency pairs, including major, emerging, minor, and exotic. There are no commissions incurred in forex, but spreads which start from 0.6 points. The best part is that the broker supports leverage trading, with a limit of up to 1:30 for retail traders. And when it comes to trading tools, expect to explore endless options at IG Markets’ Web, ProRealTime, L-2 Dealer, and MT4 platforms.

Pros

- Hosts a demo account with £10,000 virtual funds for beginners to get started with

- There is the MT4 platform, which is one of the most sought-after platforms by forex traders

- No minimum deposit requirement for UK clients

- Additional 17,000+ securities for portfolio diversification

- Spread betting is also supported, which comes with tax-free returns

Cons

- High forex trading fees compared to its peers

- It has plenty of advanced tools that can confide beginner traders

Both low-budget and high-budget individuals can trade on IG Markets since this broker has no minimum deposit requirement. You can top up your account with whatever is within your budget limitations after signing up with this terrific service provider. Note that IG Markets charges spreads and commissions that vary from one asset to another. For instance, the spreads for currency pairs like AUD/USD and EUR/USD start at 0.6 points. On the other hand, the charges for shares start at 0.08% commission per side. You can also trade spot gold and other commodities, whose spreads start at 0.3 points.

We’ve highlighted some of the fees and charges that our experts discovered while exploring and evaluating IG Markets.

| Fees and Charges | Details |

|---|---|

| Account opening charge | $0 |

| Spreads and commissions | Starting from 0.1 points/ 0.08% commission per side |

| Overnight funding | Yes |

| Guarantee stop premiums | Yes |

| Direct Market Access | Variable commission |

| Live price data fees | Variable monthly fee |

| Currency conversion fee | 0.8% |

| Account inactivity fee | $0 |

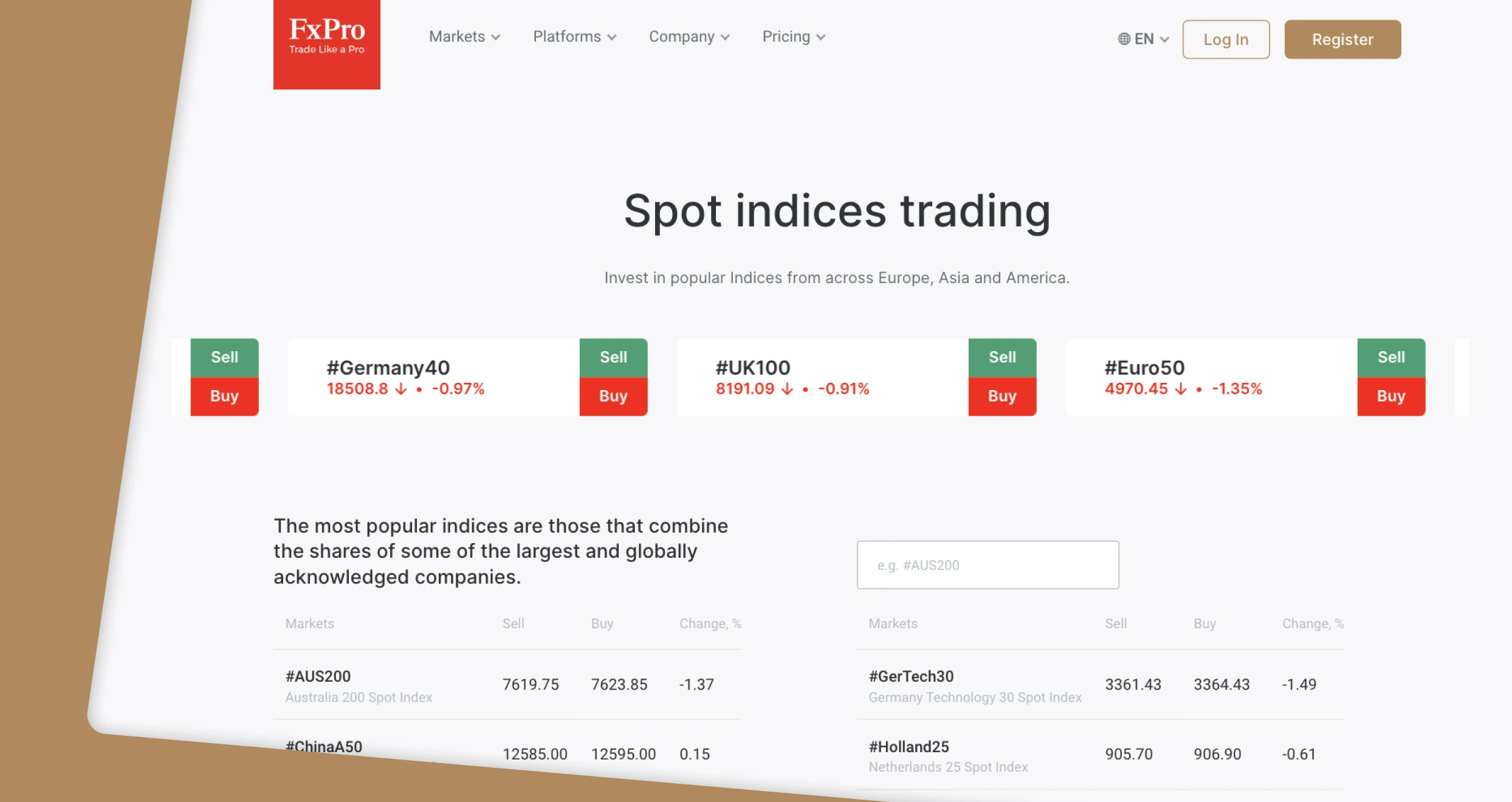

3. FxPro – Top Mobile-Friendly Platform For Forex Trading in the UK

While our listed best forex brokers UK are mobile-friendly, FxPro tops the list. Besides being among the most highly rated by users, the broker’s app is user-friendly on both desktop and mobile devices. Through the app, we were able to easily access numerous trading tools on third-party platforms. These include cTrader, MT4, and MT5. We also like its ability to host multiple trading accounts so every trader can choose an option aligning with their trading preference.

Forex traders will access over 70 currency pairs at FxPro, including major, minor, and exotic. Besides advanced resources for professional traders, beginners will enjoy its learning materials on the “Knowledge Hub” platform. Plus, there is a demo account with which you can explore the currency market free of charge. For traders looking for diversified options, FxPro has your back. Additional 2100+ assets across 6 classes are at your disposal. These include indices, metals, energy, futures, shares, and cryptocurrencies.

Pros

- A user-friendly mobile app for Android and iOS devices

- Low minimum deposit requirement of £100 for UK clients

- Hosts quality trading tools on its FxPro web, cTrader, MT4, and MT5 platforms

- Lists over 70 currency pairs

Cons

- Offers only CFD trading

- No EA trading on its FxPro proprietorship platform

Admittedly, FxPro isn’t the cheapest broker today. The company requires first-time users to make a $100 initial deposit to use a standard account, which is reasonable but can’t be termed as the lowest threshold. Also, Raw+ account holders must make an initial deposit of $500 or more. Additionally, anyone interested in the company’s Elite account offering must be ready to meet the $30k minimum deposit mandate. Please review and understand FxPro minimum deposit requirements before registering a live account.

When it comes to spreads and commissions, FxPro has juicy offerings. Everyone who opts for Raw+ or Elite gets the opportunity to enjoy sharp spreads starting from 0 pips. The numbers are higher for Standard Account owners, with the lowest spreads starting from 1.2 pips.

We have some good news for those worried about transaction fees inflating costs. FxPro doesn’t charge additional deposit or withdrawal fees. However, you may have to cover charges inflicted by financial institutions, depending on your preferred funding method.

Here’s an overview of the FxPro broker fees and charges:

| Fees and Charges | Amount |

|---|---|

| Minimum deposit | $100 |

| Spreads | From 0 pips |

| Transaction fees | $0 |

| Currency conversion fee | Yes |

4. Plus500 – Cheapest UK Forex Trading Platform

Getting into forex trading requires a strategic approach, one of which is investing with a small capital. With Plus500, you are guaranteed cost-effective forex trading services. During our experience, we signed up for forex trading accounts free of charge and deposited only £100 as the minimum deposit requirement. The best part is that forex trading is commission-free, and all you incur is low spreads from 0.0 pips on major currency pairs. Overall, Plus500 hosts 60+ currency pairs. The leverage limit for forex retail traders goes up to 1:30 and 1:300 for professionals.

Although this forex broker does not host advanced third-party platforms like the MT4, professional traders will enjoy quality and unique tools on its “Professional Trading” platform. Plus500 operates seamlessly on Android and iOS devices, which is evident from the excellent user testimonials. Beginner forex traders can start trading forex on its virtually funded demo account while enjoying quality learning materials.

Note: 82% of retail investor accounts lose money when trading CFDs with this provider.

Pros

- Lists over 60 currency pairs

- Forex trading is commission-free and attracts low spreads

- Low minimum deposit requirement for UK clients

- High leverage limit for professional traders

Cons

- All the securities listed can only be traded as CFDs

- Has a £10 monthly inactivity fee that starts applying after only three months should you fail to log into your trading account

Many traders prioritize brokers they can afford. Since fees vary with a broker, we decided to go through Plus500’s fee structure. Here are some of the trading and non-trading charges to expect when you commit to this broker.

| Trading and Non-Trading Charges | Details |

|---|---|

| Account Opening | $0 |

| Minimum Deposit Requirement | $100 |

| Commission | $0 |

| Spreads | From 0.0 pips on major currency pairs |

| Deposits and Withdrawals | $0 |

| Inactivity | $10 monthly |

| Currency Conversion | Up to 0.7% |

| Overnight Funding | Varies based on trade size |

5. XTB – Beginner-Friendly UK Forex Trading Platform

Forex trading at XTB will make it easier for any beginner to adjust to the currency market. We like its user-friendly and modern design interface. Beginners will find the platform exciting and continue exploring the available features. Plus, we discovered plenty of learning materials and a virtually funded demo account for newbies to get started. And when you are ready to explore live trading, XTB has no minimum deposit requirement. This, in our opinion, is perfect for those who are sceptical of risking huge capital.

70+ currency pairs are listed on the XTB platform. Beginners will also enjoy commission-free trades with low spreads of 0.8 pips on major currency pairs. Moreover, XTB features minor swap values that allow you to keep your open position for longer. And since there is micro lots trading, you can open positions with investment volumes from 0.01 lot. Other 5,800+ securities featured for portfolio diversification include shares, ETFs, indices, commodities, and more.

Pros

- A user-friendly and intuitive design forex trading platform

- No minimum deposit requirement

- Low forex spreads from 0.8 pips

- 70+ currency pairs available

Cons

- No third-party platform like the MT4

- You will incur a £10 monthly inactivity fee after 12 months if you do not keep your account active

We love XTB because it is one of the most affordable brokers out here. How so? For starters, there are no XTB minimum deposit requirements. Moreover, the broker’s users don’t have to pay additional fees while funding their accounts or cashing out. Most importantly, XTB doesn’t require traders to cover account opening, maintenance, or inactivity fees. In the table below, we’ve highlighted the fees, commissions, and costs you should take note of before committing to XTB.

| Fees and Charges | Amount |

|---|---|

| Account opening and maintenance | $0 |

| Minimum deposit | $0 |

| Deposit fee | $0 |

| Withdrawal fee | $0 for withdrawals above $50; $30 for withdrawals below $50 |

| Investing commission | From 0% |

| Spreads | From 0.3 pips |

| Currency conversion fee | 0.5% |

| Inactivity fee | $0 |

6. Saxo – Best Forex Trading Platform For Professionals

Saxo is one of the forex brokers hosting quality resources that any professional trader will find useful. We noticed that it mainly focuses on supplying advanced traders with investment resources on its SaxotraderPRO and SaxoInvestor platforms. Simply put, you will not need a third-party platform with Saxo, as it has proven reliable with its unique features. The broker has no minimum deposit requirement, and all transactions are free of charge. On top of that, it has a SaxoTraderGO platform for mobile trading.

Forex trading at Saxo exposes you to more than 185 currency pairs. There are also 71,000+ additional securities for portfolio diversification. These include shares, commodities, cryptos, ETFs, mutual funds, options, and more. The forex pairs are spread across major, minor, exotic, spot, and cryptos, with spreads from only 0.6 pips. For those looking to advance their skills, you can rely on this broker’s vast learning materials and a £100,000 virtually funded demo account.

Pros

- No minimum deposit requirement

- Lists over 185 currency pairs and an additional 71,000 instruments for portfolio diversification

- Low forex spreads from 0.6 pips

- List advanced market analysis tools

Cons

- The demo account is only valid for 20 after activation

- No featured third-party platforms

Forex Trading in the UK

Forex trading in the UK is legal, and any trader above 18 years is free to explore the market. The activity is overseen by the Financial Conduct Authority (FCA), whose main object is ensuring forex brokers adhere to its stringent financial standards. The FCA strives to maintain the integrity of the UK’s financial landscape while providing a fair trading environment for consumers.

UK traders can explore various global currencies via brokerage firms like the ones we recommend above. All you have to do is confirm their regulatory status to avoid falling victim to scammers. Plus, ensure you conduct thorough market research and choose a currency pair you believe has an increased profitability. Remember, forex trading can be lucrative, but losses are inevitable.

When it comes to tax rules, His Majesty’s Revenue and Customs (HMRC) is responsible for collecting capital gains tax on profits earned from forex trading. Having this in mind is crucial in planning and budgeting for your activities.

What is Forex Trading?

Forex trading is the act of buying and selling various global currencies, hoping to benefit from their price difference. Also known as foreign exchange or currency trading, it is a legal activity in the UK. You can trade the currencies as CFDs or spread betting using a brokerage firm.

There are various reasons a trader can engage in forex/currency trading. First, they want to hedge against international currency and interest rate risk. This is topical at the moment, as many world economies grapple with inflation and other concerns which governments have attempted to control by raising interest rates.

You can also use forex trading to speculate on the impact of political events and natural disasters. These factors impact a country’s currency, thus leading to potential profits or losses. On top of that, companies and individuals can also use forex to hedge against currency risks. This is especially if they arise from transactions carried out by global subsidiaries.

How does Forex Trading Work?

Forex trading occurs on over-the-counter (OTC) markets and is overseen by banks and financial institutions. OTC trading means that there is no physical currency exchange of the underlying currency. The currency market operates round the clock during weekdays, allowing you to maximise on any arising opportunities.

You can either “go long” in forex trade, whereby you predict a currency’s value increasing over time. For traders who believe a currency’s value will decrease over time, they can “go short”. The goal is to repurchase the currency in an attempt to earn profits.

Currencies are represented using three-letter ticker symbols. For instance, the Great Britain pound is represented by the symbol GBP, whereas the US dollar is represented by the USD symbol. It is crucial to understand these symbols since currencies are always traded as currency pairs. It means that when purchasing a currency, essentially, you are selling another. Currency pairs also come in various categories, including major, minor, exotic, and more. They are categorised based on their popularity and how actively they are traded globally.

How to Choose the Best Forex Trading Platform

Engaging in forex trading requires the best broker. You want to have your own peace of mind and solely focus on managing your activities. To achieve this, various elements must be looked into to identify a broker that aligns with your requirements. Therefore, we share tips below to help you make informed choices. This, of course, is if you decide to overlook our recommendations above and conduct your own research.

One of the risks of trading forex online is bumping into scammers looking to take off with your hard-earned money. To avoid such a problem, confirm whether a forex broker is licensed and overseen by the FCA. Visit its official website and confirm this element at the bottom of its homepage. You can also confirm this status via the FCA official website.

Forex trading platforms UK offer various accounts to suit different types of traders. Whether you prefer the standard, mini, micro, raw, or pro account, ensure it is provided by your forex broker. The account must match your trading style and risk tolerance. It should also have favourable leverage limits and minimum deposit requirements.

The best forex trading platform UK should be affordable and align with your budget. You see, some brokers charge low but have inadequate resources for your trading style. Others may also charge high fees but guarantee comprehensive resources that will leave you enjoying your experience. Therefore, create a balance when considering a forex broker. Confirm all applicable charges.

The best trading platform is your gateway to the financial market. Therefore, ensure it is user-friendly and reliable. Plus, it must feature a trading app so you can easily switch to mobile trading anytime you are on the move. You will notice some brokers featuring third-party platforms like cTrader and MT4 while others remain with their proprietary options with unique features. Select what works best for you, and confirm the availability of demo accounts.

A good customer support is essential, especially if you are a new forex trader. You need proper guidance and assistance anytime you find yourself in a predicament. Your broker’s support service should align with your trading schedule, whether it operates 24/7 or five days a week. Also, confirm the channels of contact to ensure you effectively communicate when the time comes.

Forex brokers UK support various payment methods for deposits and withdrawals. A good broker should accept payments using various options so you can easily transact with what’s more convenient for you. Some of the payment methods at the brokers we recommend above include credit/debit cards, e-wallets, and bank transfers.

While looking into the elements above will help you identify the best UK forex broker, research a broker’s reputation within the trading community. By reading previous and current user reviews, it will be easier to understand its service and product offerings from a user perspective. Remember, no broker is perfect. So the best will have positive reviews outweighing the negatives.

Forex Trading Risks for UK Traders

Forex trading carries risks that, if not effectively managed, can leave you with losses. Before you start exploring the financial market, it is essential to be familiar with these risks. This way, it will be easier for you to develop a proper approach that will maximise your potential.

- Liquidity risks

The currency market is the most liquid in the financial space. It has the highest daily trading volume, which attracts numerous traders. However, while many currencies are highly liquid, others aren’t. This can be challenging for you to enter and exit a position whenever you identify an opportunity, thus leaving you with losses. It is best to conduct thorough research, especially when trading less liquid currencies.

- Volatility risks

The financial space is volatile since various market conditions affect currencies’ value. Sudden price movements can affect an already-opened position, leaving you with losses. You should consider applying risk management controls like stop-loss orders to mitigate massive losses in such events.

- Leverage risks

In forex trading, you can apply leverage, whereby you open a larger trade size with a small initial investment. While it can bring huge profits, losses are inevitable. Small price movements may negatively affect your trading, making your broker to request a margin call. Should you fail to meet the requirement, your broker will automatically close the position, thus leaving you with massive losses.

- Interest rate risks

Interest rates can affect a currency’s value. For instance, if the UK’s interest rates rise, the GBP value will strengthen due to an influx of investment in the region. Conversely, should the interest rates fall, the value of GBP will also weaken, and investors will begin withdrawing their investments. With this in mind, it is crucial to stay abreast of various currency values to make the best decisions.

- Emotional risks

Trading forex using an internet-enabled device can be addictive. You may find yourself opening a position even when you didn’t plan to. Trading based on emotions like excitement, greed, and fear can be risky and leave you with losses. It is crucial to remain disciplined and have a cash management plan. Only trade forex whenever you identify a potentially profitable opportunity.

Take a look at our additional article discussing Stock Brokers in the UK.

Pros & Cons of Forex Trading

Like any other venture or activity, forex trading has favourable and unfavourable traits for traders. You should weigh the advantages and disadvantages to decide whether it is worth putting your money into.

| Pros | Cons |

|---|---|

| The currency market is easily accessible 24/5, allowing traders to maximise on arising opportunities. | Sudden price movements in this volatile market can leave you with losses. |

| The activity gives you access to leverage trading. You can maximise returns by opening larger positions with small capital. | Forex trading brings less returns compared to investing in assets like stocks. |

| Forex is a highly liquid market, which increases the potential for high returns. | Leverage trading is like a double-edged sword. While it can bring profits, you are also prone to massive losses. |

| Forex trading attracts low fees. The activity’s cost is determined by bid-ask spreads, which are attractive even to low-budget traders. | |

| The volatility in the currency market can benefit your trades and bring about profits. |

Conclusion

If you believe that forex trading is the right venture for you, we hope this guide has given you a proper head start on your investment. Continue learning more about forex trading and seek professional advice before you start trading. Plus, have the best broker in your corner that meets your trading needs. The above recommendations have proven reliable. They are not only FCA-regulated but host numerous currency pairs from which to choose.

That being said, approach forex trading cautiously. Start with a small capital while building your confidence. Also, apply risk management controls since the market can be unpredictable and you do not want to incur massive losses. Most importantly, remain disciplined and track your progress to avoid repeating the same mistakes.

IG Markets and Pepperstone look like solid options for both beginners and experienced traders.

Thanks for the comprehensive review, but I have to ask - how can we be sure about the safety of these platforms? I've been burned before with offshore brokers that looked legitimate at first.