Claire Maumo has experience in investment banking, strategic consultancy, and journalism. She has a Bachelor’s degree in Business Management and a Master’s in finance. She has a knack for making complex concepts easy to understand. Her primary focus is on crypto, blockchain, and financial instruments. Follow her for expert insights on trading and investment.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

The explosion of trading apps in Australia has transformed the way people handle their investments. It’s now easier for Aussie traders to access the financial markets from the comfort of their homes or while on the move. This, of course, is by using internet-enabled Android and iOS mobile devices.

Given the multitude of trading apps Australia, traders find it challenging to make suitable choices for their needs. Fortunately, BrokerRaters experts did all the legwork. Through thorough market research, we were able to come up with this list of the best trading apps in Australia in 2025. Our guide will also shed more insights into mobile trading so you can be fully prepared to kickstart your mobile trading ventures.

List of the Best Trading Apps

- AvaTrade – Best Overall Trading App in Australia

- Saxo – Top Australian App for Long-Term Investments

- eToro – Beginner-Friendly Trading App in Australia

- Plus500* – Best Trading App For CFD Trading in Australia

- Pepperstone – Top Trading App For MetaTrader Users in Australia

Note: 82% of retail investor accounts lose money when trading CFDs with this provider.

Australian Trading Apps: Comparison Table

Our research process for the best trading apps in Australia was lengthy. We spent hundreds of hours testing and comparing as many apps as we could, ensuring we left no stone unturned. Some of the elements we looked into in this process include security, charges, mobile compatibility, support service, reliability, and more. With hundreds of options, we only managed to shortlist a few that met our stringent specifications.

We also visited Google Play, the App Store, and Trustpilot to analyse what other users had to say regarding the trading apps we shortlisted. We then combined our findings with our test results to come up with this unbiased list of recommendations.

Take a look at our comparison table below, which highlights the key elements of our top apps for trading.

| Trading App Australia | License & Regulation | Support Service | Software | Payment Method | Demo Account |

|---|---|---|---|---|---|

| AvaTrade | FMA, FCA, FSCA, CBI, CySEC, PFSA, ASIC, B.V.I FSC, FSA, ADGM, ISA | 24/5 | WebTrader, AvaOptions, AvaTrade App, Mac Trading, MT4, MT5, Automated Trading | Credit/debit cards, Neteller, Skrill, Wire transfer, WebMoney | Yes |

| Saxo | FCA, SCA, DFSA | 24/5 | SaxoTraderGO, SaxoTraderPRO | Bank Wire Transfer, Debit cards | Yes |

| eToro | ASIC, MAS, FCA, CySEC, FSCA, SFSA, ADGM, MFSA, FSAS, GFSC, SEC | 24/5 | eToro investing platform and app, Multi-asset platform, Social Trading, Copy Trader, Smart Portfolios | Credit/debit cards, Bank transfer, Klarna, PayPal, Skrill, Neteller | Yes |

| Plus500* 82% of retail investor accounts lose money when trading CFDs with this provider. | ASIC, MAS, FCA, FMA, CySEC | 24/7 | Plus500 CFD | Visa, MasterCard, PayPal, Skrill, Bank transfer | Yes |

| Pepperstone | ASIC, FSCA, FCA, DFSA, CySEC, CMA, SCB, BaFin | 24/7 | TradingView, MT4, MT5, cTrader, Pepperstone Trading Platform, Social trading | Visa, Mastercard, Bank transfer, Neteller, Skrill, PayPal | Yes |

Apps Short Overview

Every Australian trader has their unique needs that will boost their experience in the financial space. For this reason, do not settle for an app simply because your friends or relatives highly recommend it. Consider various elements, including fees, asset availability, charges, support service, and more. We will guide you later on how to make the best choice. But first, here are tables showing short overviews of the fee structures and asset offerings at our top trading apps in Australia.

Fees

| Trading App Australia | Minimum Deposit Requirement | Commission/ Spreads | Deposits/ Withdrawals | Inactivity Fee |

|---|---|---|---|---|

| AvaTrade | A$100 | 0.13% | Free | A$50 quarterly |

| Saxo | A$0 | Commission from A$1 | Free | None |

| eToro | A$50 | From 0% | A$5 withdrawal fee | A$10 monthly |

| Plus500* | A$100 | From 0% | Free | A$10 monthly |

| Pepperstone | A$0 | From 0.0 pips | Free | A$0 |

Note: 82% of retail investor accounts lose money when trading CFDs with this provider.

Assets

| Trading App Australia | Stocks | Forex | Crypto | Commodities | Indices | ETFs | Options |

|---|---|---|---|---|---|---|---|

| AvaTrade | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Saxo | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| eToro | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Plus500* (CFDs) | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Pepperstone | Yes | Yes | Yes | Yes | Yes | Yes | No |

Note: 82% of retail investor accounts lose money when trading CFDs with this provider.

Our Expert Opinion about Trading Apps in Australia

From our experience, the best trading apps we reference in this guide offer excellent services and features. Overall, they are all secure since we confirmed they are highly encrypted. Moreover, they have licenses and are overseen by the Australian Securities and Investment Commission (ASIC), which is Australia’s leading financial regulator.

Let’s discover more of the strengths and capabilities of our top apps for trading in the UK. Our mini reviews below are based on our test findings, so rest assured of accurate information. And although we couldn’t share every detail here, we encourage you to conduct additional research before making a final decision.

1. AvaTrade – Best Overall Trading App in Australia

While testing various trading apps for Aussie traders, AvaTrade’s AvaTradeGO app stood out in many ways. For instance, we discovered that the app is highly rated by users on Google Play, the App Store, and Trustpilot. To confirm this, we signed up for trading accounts, and our experience was seamless. All features were easily accessible, thus making us recommend it to both beginners and expert traders.

When it comes to asset offerings, this ASIC-regulated app lists over 2,000 CFD instruments, including forex, shares, commodities, indices, cryptos, and more. We like that AvaTradeGO hosts multiple platforms that suit every trader’s preference. You can choose between the MT4, MT5, DupliTrade, AvaSocial, and AvaOptions. You can also benefit from automated trading, which is incorporated into the app’s social trading features. We find AvaTradeGO affordable, with a minimum deposit requirement of A$100 and low trading charges.

Pros

- A highly rated trading app on Google Play, the App Store, and Trustpilot

- Low minimum deposit requirement for Aussie traders

- A user-friendly and intuitive design platform

- Multiple platforms to choose from, including MT4, MT5, AvaSocial, Automated Trading, AvaSocial, and more

Cons

- Limited product offerings compared to its peers

- You can only trade AvaTrade’s securities as CFDs. No buying and taking full ownership.

Our experts investigated the AvaTrade broker’s fees and charges. We first noticed that the platform has a modest minimum deposit requirement of $100. What’s more, its users pay no additional costs while depositing funds or cashing out. That makes AvaTrade an ideal broker for both cost-conscious and newbie traders who want to test their waters with small capital before going all in.

That said, AvaTrade requires dormant account holders to pay $50 after every 3 consecutive months of inactivity. Moreover, if you let your account remain inactive for over successive months of inactivity, the broker will charge you a $100 administration fee. Not to forget, AvaTrade requires traders who hold positions overnight to cover a premium.

Here’s a breakdown of the fees you should expect to encounter while trading with this service provider:

| Fees and Charges | Amount |

|---|---|

| Spreads | From 0.9 pips |

| Administration fee | $100 |

| Inactivity fee | $50 |

| Overnight premium | Yes |

2. Saxo – Top Australian App for Long-Term Investments

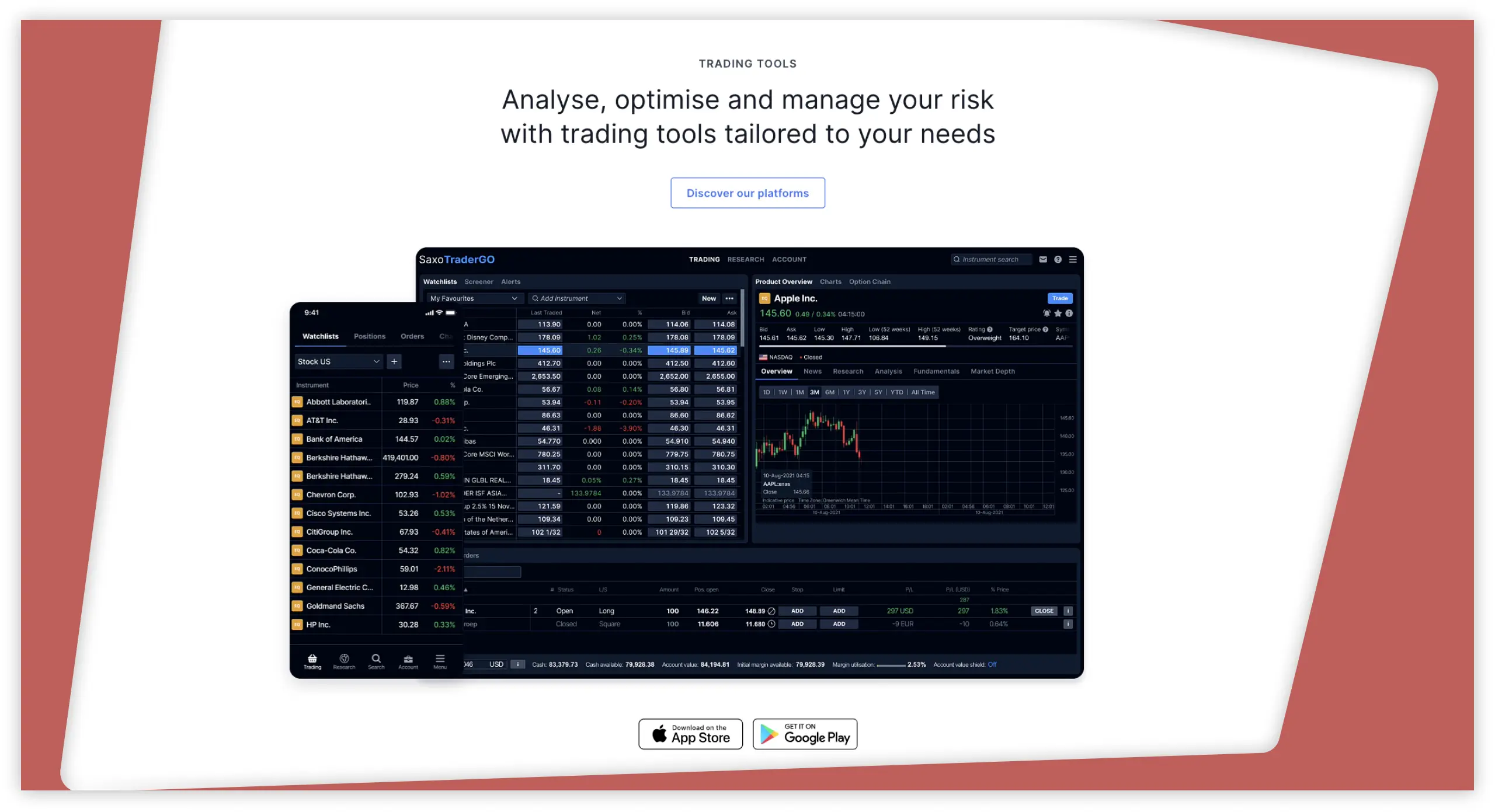

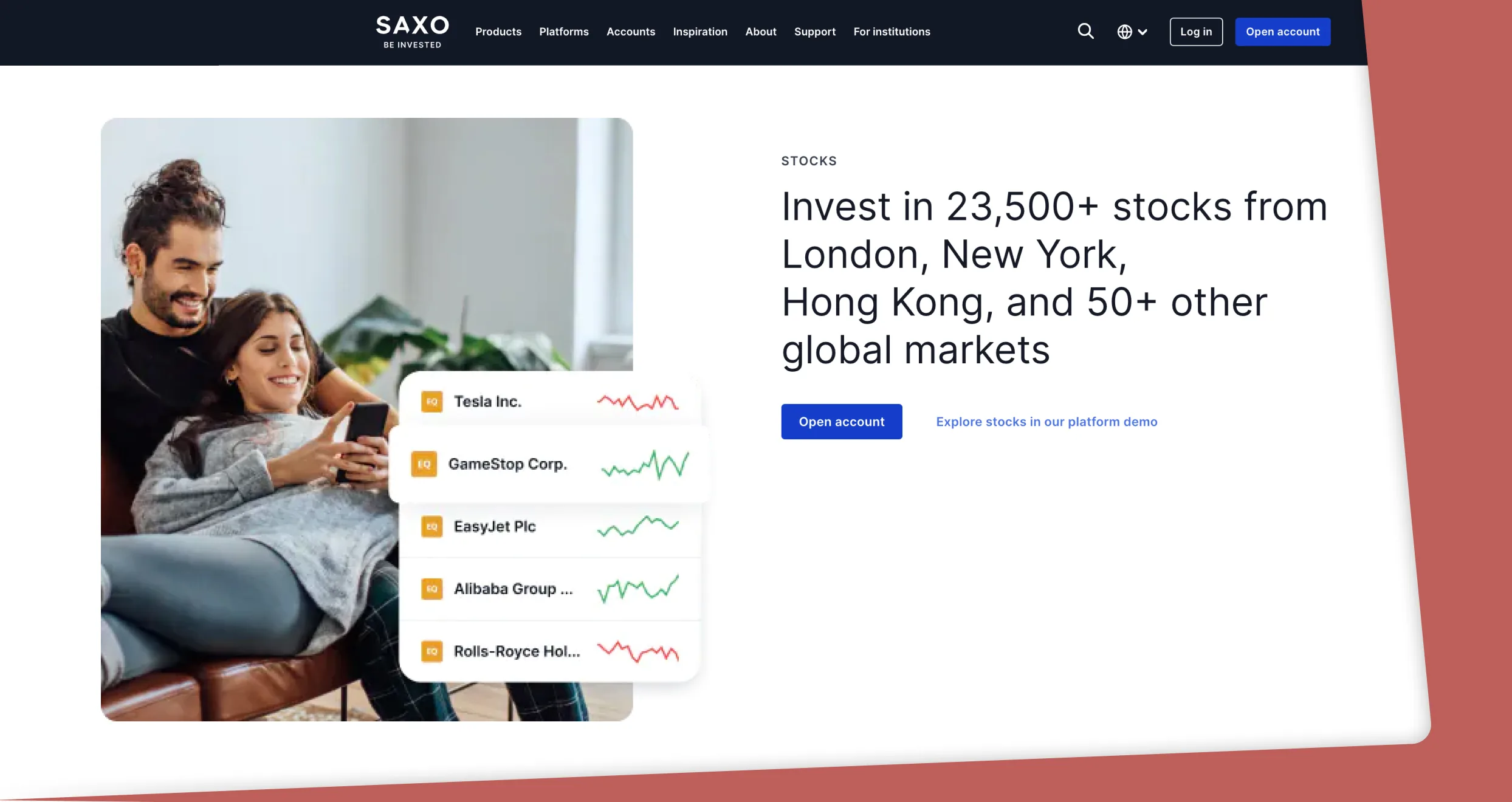

If you are looking for an app with long-term investment options, Saxo’s SaxoTraderGO app is a considerable choice. From our experience, the app is easily downloadable on Android and iOS mobile devices. It gives access to over 71,000 investment options across shares, forex, commodities, futures, bonds, ETFs, and more. We primarily like its share trading investment options, which gave us access to over 23,500 from 50+ global markets, including Hong Kong, New York, London, and more. The best part is that you can start investing in company stocks with as little as A$1 commission for American shares.

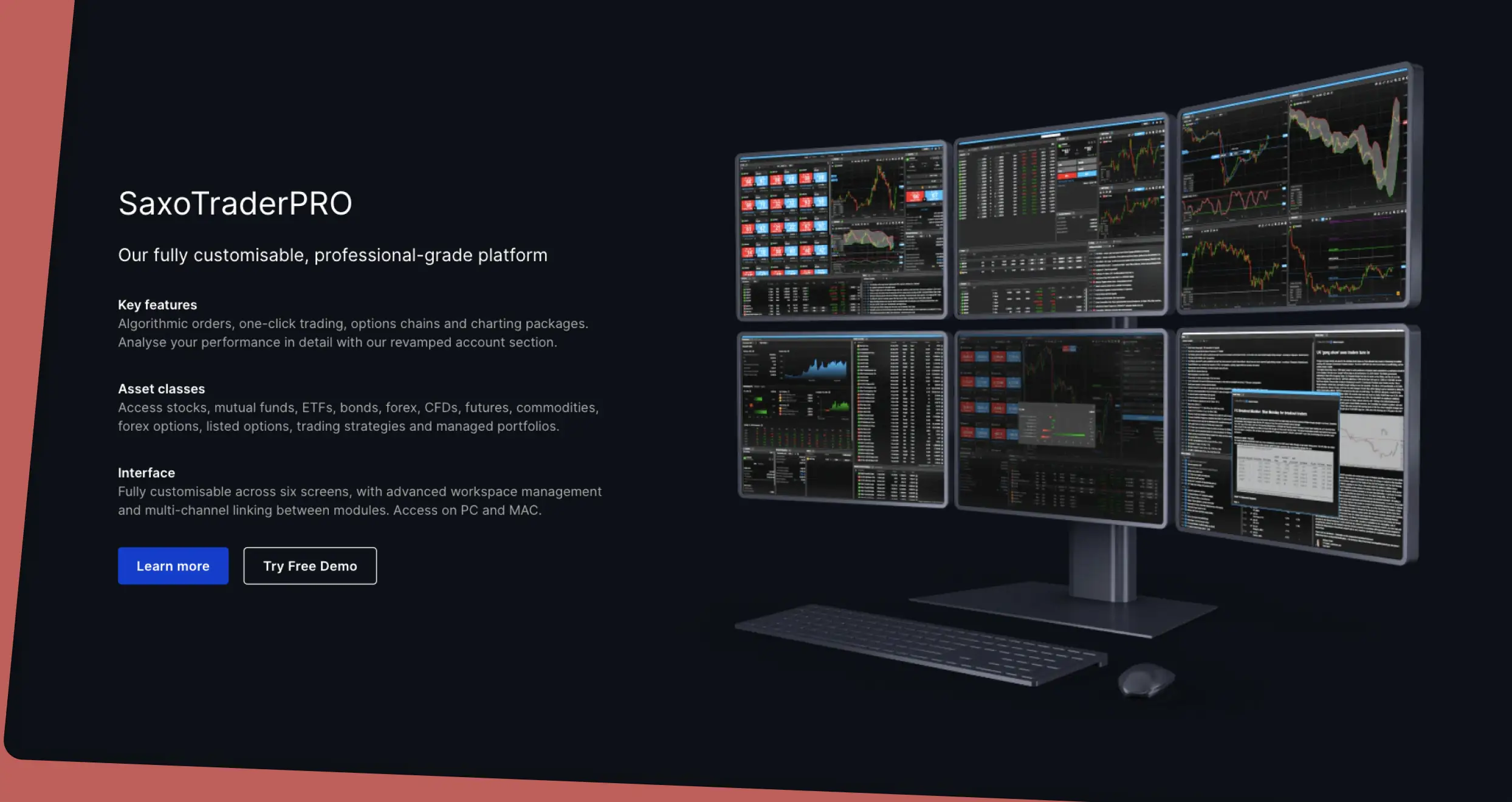

Although the SaxoTraderGO app doesn’t feature third-party platforms like MT5 or cTrader, we like its powerful SaxoTraderPro and SaxoInvestor options. These platforms are loaded with advanced resources for market analysis and skills development. Moreover, the app is backed up by a professional support service team and a comprehensive FAQ section to ensure you are ready to make your first investments. Overall, the SaxoTraderGO app has no minimum deposit requirement, and all transactions are free.

Pros

- Low minimum deposit requirement

- Over 23,500 stocks to explore

- Hosts a SaxoTraderPro platform with advanced resources for professional traders

- Has a reliable and responsive 24/5 support team via phone, email, and live chat

Cons

- Stock investment commission is higher compared to its peers

- No third-party platforms like MT4, MT5, and more

3. eToro – Beginner-Friendly Trading App in Australia

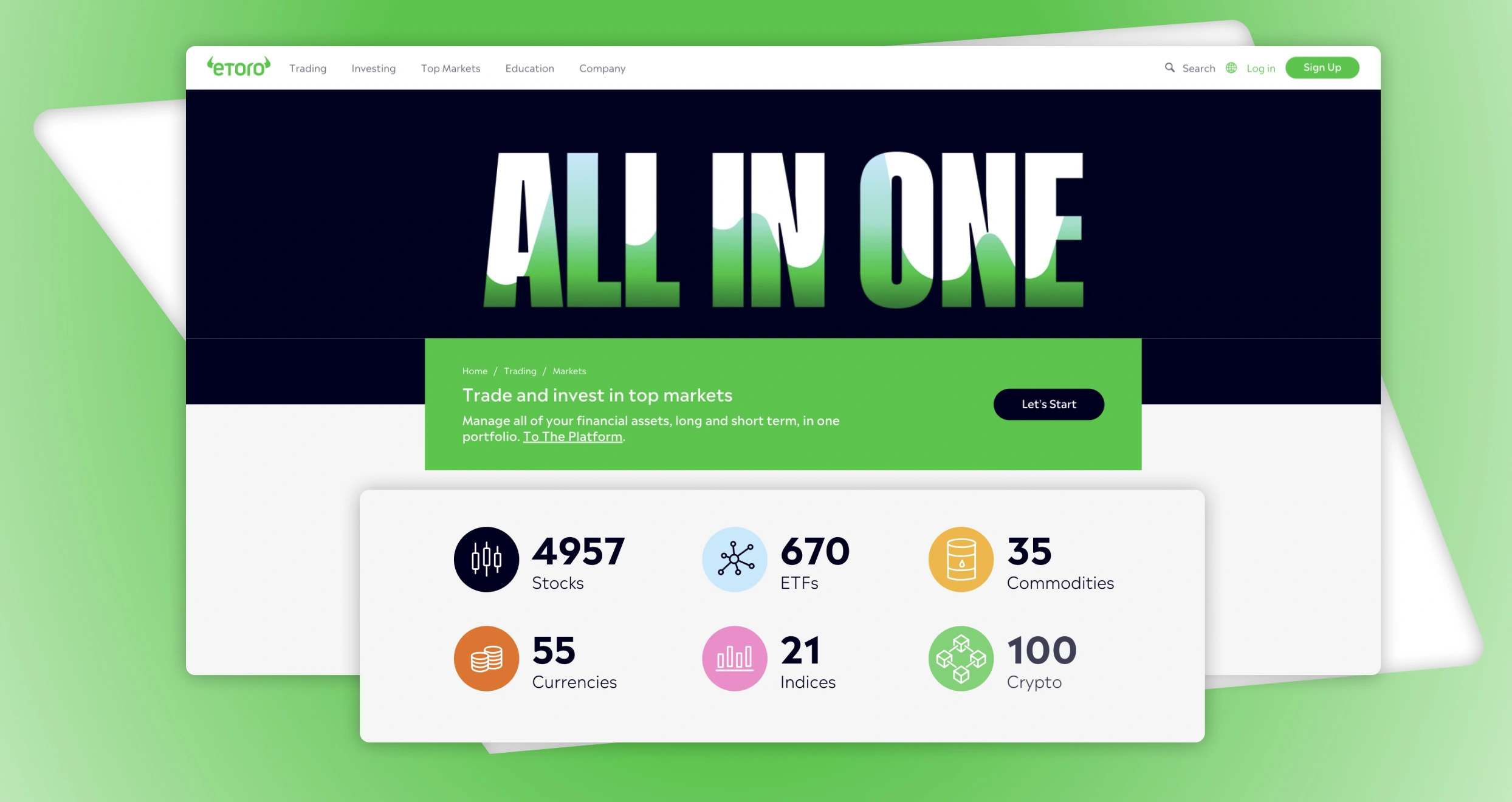

eToro has always been one of our favourite trading apps, and it is no surprise that it made it to this list of recommendations. We signed up for trading accounts on this app and must confess that the procedures were seamless. Its user-friendly and customisable trading platform made it easier for us to navigate the featured assets and seamlessly manage our activities. The app is perfect for beginners who don’t want to waste valuable time figuring out how complex systems work.

We also consider eToro the best trading app for Australian newbies because it has vast educational resources. While evaluating this service, we checked out its academy and were impressed. You will benefit from a plethora of articles, guides, courses, webinars, recorded videos, and more. The best part is that you can search for a specific material using the incorporated search button. Additionally, eToro features social trading, which can be beneficial to any newbie. Through social interactions with other traders and copying potentially profitable positions from experts, eToro allows you to maximise your profitability even with limited experience. You can get started with as little as A$50 and explore 6,000+ assets.

Pros

- Intuitive user interface tailored to make navigation easy for beginners

- Offers a free academy platform with top-quality courses and other materials

- Low minimum deposit requirements for Australians

- Gives users access to 6,000+ tradable and investment products

- Beginners can leverage the power of copy and social trading

Cons

- A$5 fee for every withdrawal request

- No third-party platforms like MT4/5

eToro has a transparent fee structure that is easy to understand and helps you plan accordingly. From our analysis, we discovered the following trading and non-trading eToro fees.

| Trading and Non-Trading Charges | Details |

|---|---|

| Account Opening | $0 |

| Management Fee | $0 |

| From $50, depending on your jurisdiction | 0.6 |

| Commission | From 0% on stocks and ETF trading |

| Spreads | From 1 pip on major currency pairs |

| Deposits and Withdrawals | $5 withdrawal |

| Inactivity | $10 monthly |

| Currency Conversion | 1.5% or 3.0%, depending on the currency or payment method |

| Overnight Funding | Varies based on global market conditions |

| Copy Trading | Free |

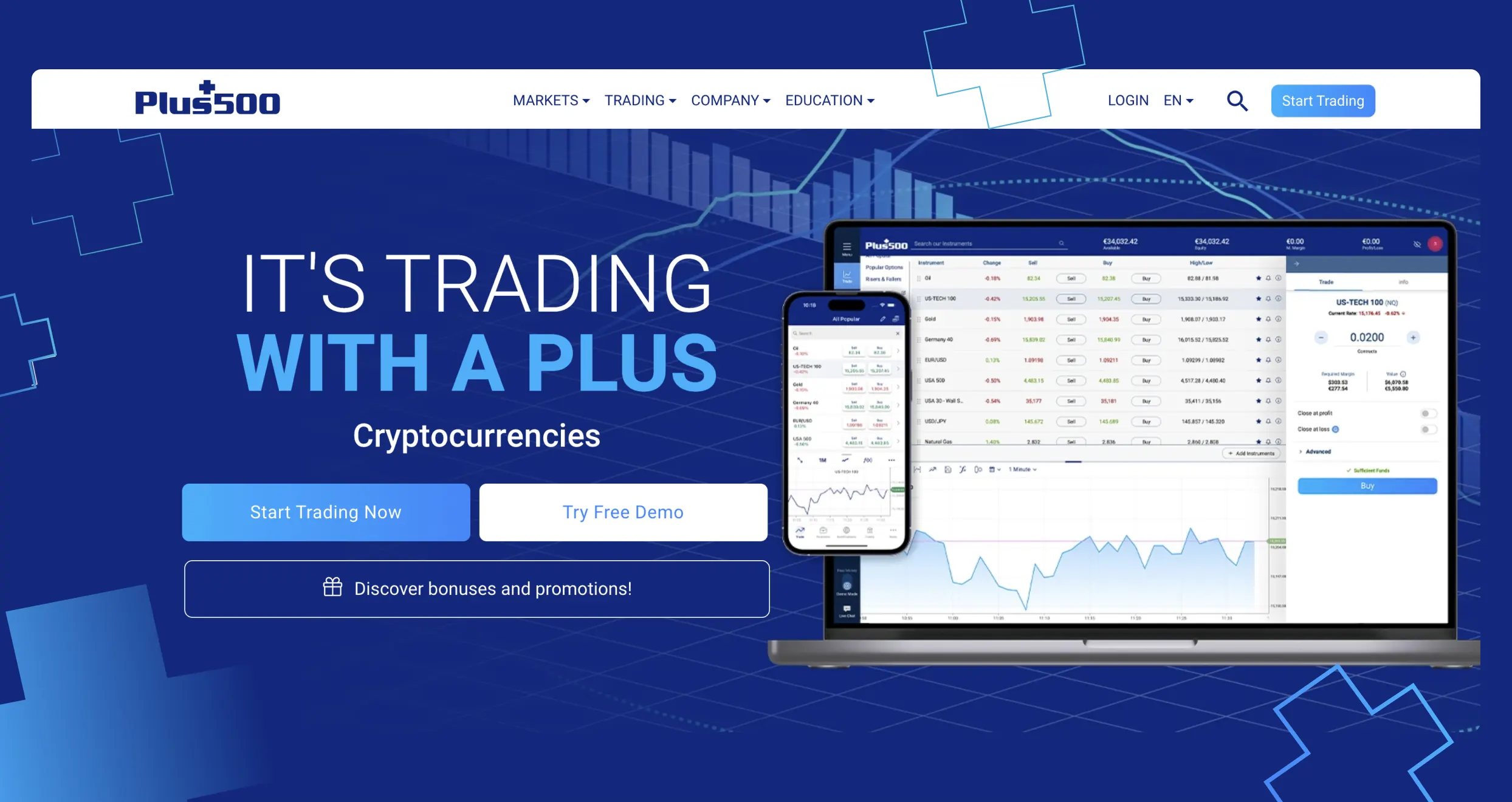

4. Plus500 – Best Trading App For CFD Trading in Australia

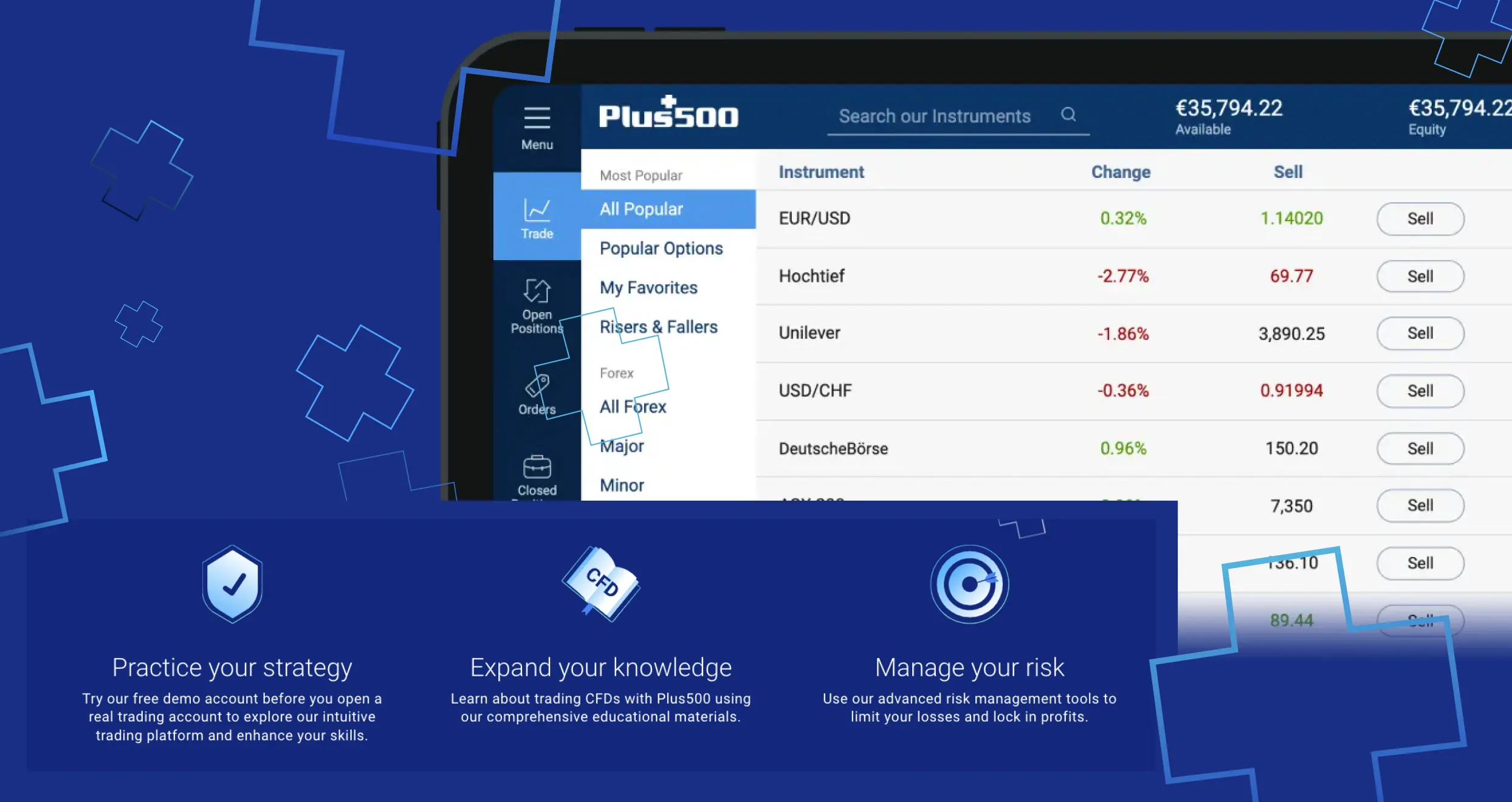

While hundreds of trading apps Australia feature CFD trading, Plus500 stands out as the best in this category. This is primarily because of its commitment to offering low trading services for CFD trades. From our analysis, the app features over 2,800 CFD assets, including shares, forex, commodities, ETFs, and more. All these are available commission-free and you only incur low spreads from 0.0 pips. Moreover, Plus500 is among users’ most highly rated trading apps, making it suitable for new and expert CFD traders.

We like that Plus500 has a user-friendly and customisable trading platform. This will keep you glued to CFD trading long-term without worrying about finding another provider with advanced resources. For beginners, the app has a virtually funded demo account to get started with. Its comprehensive learning materials are also impressive. Moreover, it has multiple outstanding features, from stop-loss and take-profit orders to powerful technical indicators and charting tools for advanced traders. You can start live trading with as little as A$100.

Overall, Plus500 is one of the top CFD trading apps available, offering an exceptional balance of functionality and accessibility for all traders.

Note: 82% of retail investor accounts lose money when trading CFDs with this provider.

Pros

- Users can trade CFDs on over 2,800 financial assets

- Low spreads and commissions free trades

- Cost-free deposits and withdrawals

- Professional support is available 24/7

- Top-notch educational tools, including articles, guides, videos, and more

Cons

- No third-party platforms like the MT4/5

- Its A$10 monthly inactivity fee kicks in after only three months

Many traders prioritize brokers they can afford. Since fees vary with a broker, we decided to go through Plus500’s fee structure. Here are some of the trading and non-trading charges to expect when you commit to this broker.

| Trading and Non-Trading Charges | Details |

|---|---|

| Account Opening | $0 |

| Minimum Deposit Requirement | $100 |

| Commission | $0 |

| Spreads | From 0.0 pips on major currency pairs |

| Deposits and Withdrawals | $0 |

| Inactivity | $10 monthly |

| Currency Conversion | Up to 0.7% |

| Overnight Funding | Varies based on trade size |

5. Pepperstone – Top Trading App For MetaTrader Users in Australia

If you love exploring the financial market using the MetaTrader platforms, Pepperstone is your best option. We were primarily impressed by its zero minimum deposit requirement, which makes it easier for any trader, whether new or low-budget, to get started. Moreover, this app is user-friendly and customisable — an element that will keep you trading with it long-term. It offers beginners an opportunity to test it via its virtually funded demo account before making a commitment.

We traded more than 1200 CFD instruments at Pepperstone across diverse asset classes. Although the asset offerings may seem limited compared to its peers, this app shines when it comes to market analysis resources. The availability of the MT4 and MT5 platforms allows users to tailor their trading styles with advanced customisation. Other advanced platforms at Pepperstone include TradingView and cTrader, which also have browser versions that enable you to alternate devices. With these apps, you will enjoy EA/automated trading, customisable charting and indicators, social/copy trading, and much more.

Pros

- No minimum deposit requirement

- No inactivity fee

- Sharp spreads starting from 0.0 pips

- Features multiple trading platforms with advanced resources

- Expert support is available 24/7

Cons

- Fewer financial instruments compared to other top providers

- Limited learning materials for beginners

We find Pepperstone broker to be one of the brokers with transparent fee structures. There are no hidden charges, so what you see displayed on its platform is what you will incur. This makes it easier for you to budget without worrying about overspending.

Let’s discover below some of the trading and non-trading charges at Pepperstone.

| Trading and Non-Trading Charges | Details |

|---|---|

| Account Opening | $0 |

| Management Fee | $0 |

| Minimum Deposit Requirement | From $0, depending on your jurisdiction |

| Commission | From $0.02 on US-listed shares |

| Spreads | From 0.0 pips on its Razor Account |

| Deposits and Withdrawals | Free |

| Inactivity | None |

| Overnight Funding | Varies based on global market conditions |

| Copy Trading | Free |

Note that Pepperstone charges both spreads and commissions. While spreads are charged on all accounts, commissions are only imposed on the Razor Account.

Mobile Trading in Australia

Mobile trading in Australia has become a game changer since many Aussies can now manage their activities using smartphones or tablets. With the flexibility of managing trades from anywhere, mobile trading is here to stay. Gone are the days when traders had to be glued for hours to a desktop at home or in the office.

Many brokers understand the importance of mobile trading, and in turn, they have developed their own iOS and Android trading apps to accommodate all types of traders. Note that trading apps in Australia work just like web trading platforms. You can use them to open positions, conduct market analysis, receive alerts and notifications, and more. All you have to do is choose a suitable option like the ones we recommend above for a worthwhile experience.

Mobile trading in Australia is overseen by ASIC. This means that any provider you commit to for your activities must be licensed and regulated by this authority. Failure to confirm this element may lead you to fraudsters’ hands, who are looking for innocent traders to scam.

Remember, you must download and install a mobile app on your smartphone or tablet to enjoy mobile trading. Plus, ensure your device is connected to a stable internet as the financial market asset prices tend to frequently change. You do not want to miss out on potentially profitable opportunities due to slow internet speed. Most importantly, have a backup option by connecting your trading account on your desktop. It will be easier to continue trading, especially if you cannot access your mobile device.

Mobile Trading vs Desktop

With the onset of mobile trading in Australia, many traders are at a crossroads in terms of whether to stick to mobile or desktop trading. Unfortunately, there is no specific answer on the best option since both desktop and mobile devices give you access to the financial markets. This, of course, is if they are connected to a stable internet.

Simply put, choosing between mobile and desktop trading depends on your personal preference and circumstances. For instance, if you are into day trading or scalping, which involves opening multiple positions during the day and participating in technical analysis. In this case, you may opt for desktop trading due to its wide dashboard that allows you to comfortably manage multiple tabs. You will only apply mobile trading whenever you step away from your trading station and are on the move.

For beginners or part-time traders who do not spend hours trading, mobile trading can be their best option. If you are managing another full-time job, mobile trading will allow you to learn the financial markets and open positions during breaks or while commuting home from work. You can still manage desktop trading over the weekends or whenever you need a break from your phone or tablet.

That being said, while mobile trading has simplified how Australian traders manage their activities, desktop trading is not going anywhere anytime soon. Desktop devices have larger screens, thus enabling traders to manage multiple tabs and streamline their activities. This doesn’t mean desktop trading can maximise your potential more than mobile trading. Regardless of your preference, knowledge regarding the asset you want to trade is power. Most importantly, conduct thorough market research for solid strategies before opening a position.

How to Choose the Best Trading App in AU

Choosing the best trading app Australia is something that you must take seriously. Whether you are a new Australian trader or have been in the industry for a longer period, having a top app for trading offers an exciting experience. You will also maximise your potential for success in various markets.

That being said, here are the top elements to prioritise to ensure you make a suitable selection.

As a trader, you need to ask yourself if the trading app you choose is provided by a safe broker. This means that you should confirm whether the Australian Securities and Investment Commission (ASIC) regulates it. Not only do such apps guarantee the security of your funds, but investing with them is legal in Australia. Remember, the region is also dominated by fraudsters. Therefore, ensure you do not fall victim to them by overlooking this element.

It is also essential that you review the selection of trading instruments in an app for trading in Australia. Make sure that the app you are choosing hosts the assets you plan to trade, including forex, share, commodities, cryptos, and more. The more assets an app has, the better for your future investment opportunities and portfolio diversification.

The best trading app Australia should have a user-friendly, customisable, and modern-design platform. Plus, it should have a fast trade execution speed, especially if you are looking to enter frequent short term positions. The last thing you expect is to have a lagging platform that may affect your activities.

Additionally, you need extensive support when it comes to research and skills development. Therefore, confirm the availability of research and learning resources. For beginners, consider the availability of a demo account for testing the app’s performance and gauging your skill level before making a commitment.

Trading apps Australia require you to put in some money in the hope of returns. While this may work as you anticipate, understand that losses are inevitable. Therefore, we advise you to always budget for your activities and stick to it. Confirm all the charges to expect once you commit, including hidden fees/costs. The good news is that our recommended Australian trading apps above do not have hidden charges.

Many investors overlook this element when choosing a trading app in Australia. What they fail to understand is that customer service is a go-to platform whenever they encounter any issues during their investment period. Our recommended apps above have dedicated support services but vary when it comes to availability. Therefore, choose an with a support service that matches your investment schedule and can be contacted via convenient channels like live chat, email, or phone.

You should prove that a trading app is secure and reliable by analysing user testimonials on google Play, the App Store, and Trustpilot. From the reviews, you will understand which app is suitable for trading various assets. It is also easy to identify the one that is compatible with your mobile device, whether Android or iOS.

Mobile Trading Risks

Mobile trading gives you 24 hour access to the financial market. You can conduct your research, learn, and open positions anytime you see fit. However, using a mobile device to trade is like giving someone stuck in desert water. They probably are going to drink it.

For instance, it’s hard to control cash management with mobile trading. By accessing the market 24/7 and keeping track of an asset’s price, you will likely open multiple positions than you would have with a desktop device. If you were influenced by emotions, chances are that you will incur multiple losses, thus leaving you frustrated with nothing in your nest egg.

Another mobile trading risk is security. Mobile devices are more prone to malware attacks and software glitches. Should this happen, you may lose your personal data or incur losses if your open position is affected due to failure of keeping track.

When it comes to conducting market analysis, mobile devices limit full access with their smaller screen size. It will be challenging to view and utilise analytics tools, charts, and more, leading to less informed decisions. And with its touch interface, you may find yourself in trouble if you accidentally click the wrong input.

Pros & Cons of Mobile Trading

Mobile trading has encouraged many traders to explore the financial markets and try their luck on various investments. While it carries many benefits, it also falls short in a few areas, as shared in our table below.

| Pros | Cons |

|---|---|

| Ability to trade from anywhere using a smartphone or tablet. | Smaller screens and low processing power compared to desktop devices. |

| It offers streamlined transactions as orders can be executed quickly and effortlessly. | Mobile trading confines traders to a single screen, unlike desktop, which allows users to manage multiple screens. |

| Access to live data 24/7, allowing you to make the best decisions. | |

| You can track your activities anytime, making it easier for you to benefit from frequent but short-term opportunities. | |

| Instant trade execution through a few taps on your screen. |

Conclusion

Our ultimate guide recommends the best trading apps in Australia for both newbies and expert traders alike. These apps have all been tested and approved on by our expert researchers to save you the stress of conducting time-consuming and overwhelming research. With mobile trading skyrocketing in Australia and other global regions, you do not want to miss out on the benefits that come with mobile trading. Therefore, make a suitable choice, have a trading plan, be open to learning from any losses, and apply risk management controls to maximise your potential in the financial landscape. For beginners, start with a small capital and take advantage of the apps’ demo accounts before taking a plunge into live trading.

Personally, I like AvaTrade the most because it offers a variety of platforms like MT4, MT5, and AvaSocial, which work well for me