Claire Maumo has experience in investment banking, strategic consultancy, and journalism. She has a Bachelor’s degree in Business Management and a Master’s in finance. She has a knack for making complex concepts easy to understand. Her primary focus is on crypto, blockchain, and financial instruments. Follow her for expert insights on trading and investment.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

Over the years, Australia’s investment landscape has experienced a dramatic shift, departing from conventional assets like real estate to more tech-driven investment approaches. The Land Down Under has become an investment hub, with Aussies investing their money in everything from company stocks and ETFs to bonds and mutual funds.

Whichever product you’d like to invest in, you need a reliable app to capitalise on available opportunities and generate passive income or build long-term wealth. To that end, I tested dozens of investment apps and singled out the very best based on reputation, security, credibility, and other aspects. Find out all about them below.

List of the Best Investment Apps

- Saxo – Overall Best

- eToro – Best Commission-Free App

- OANDA – Best App for Earning Interest on Unused Margin

- Interactive Brokers – Best App For Professional Aussie Investors

- Coinbase – Best App for Crypto Enthusiasts

Compare Brokers Table

There’s much to consider when choosing an investment app, especially if you are, or plan to be, a career investor. Decades in the game have taught me that your app choice can make or break your investment roadmap. And while there’s no “perfect” app, you can find one that fits your investment approach like a glove by carefully weighing certain factors.

That said, my team and I dug deep into some of the most popular investment apps, leaving no stone unturned. For weeks, we reviewed different apps, examining their fees, licences, payment methods, and overall reputation. We uncovered a mountain of information and summarised everything in the table below.

| App for Investing Australia | Licence & Regulation | Minimum Deposit | Commission & Spreads | Support Service | Software | Payment Method | Demo Account | Money Insurance |

|---|---|---|---|---|---|---|---|---|

| Saxo | ASIC, DFSA, FCA, MAS, JFSA, SFC, IMA, FINMA | $0 | From 0.008 pips | 24/5 | SaxoInvestor, SaxoTraderGo, SaxoTraderPro | Bank wire transfer, credit/debit cards | Yes | Yes |

| eToro | ASIC, FAC, CySEC, MFSA, FSRA, FSMR, FSAS, FinCEN, SEC, FINRA | $50 | From 0% | 24/5 | CopyTrader, Multi-Asset Trading Platform, Investing Platform, eToro Mobile App | Credit/debit cards, eToro Money, Bank Transfer, Klarna/Sofort, e-wallets | Yes | Yes |

| OANDA | ASIC, CFTC, MAS, BVI FSC, FCA, JSA | $0 | From 0 pips | 24/5 | MT4, MT5, TradingView, OANDA Mobile, OANDA Web | Credit/debit cards, Bank wire transfer | Yes | No |

| Interactive Brokers | ASIC, SEC, FINRA, CTFC, NFA, CBA, FINMA, JFSA, MAS, IIROC, | $0 | From 0.0005 per share | 24/7 | IBKR Desktop, Trader WorkStation (TWS), IBKR GlobalTrader, IBKR Mobile, IMPACT, Client Portal, IBKR APIs | Bank wire transfer, Wise, Online BPay | Yes | Yes |

| Coinbase | AUSTRAC, FCA, FFSA, CBI, SEC, DNB, FinCEN, | $0 | From 0bps/ 5bps maker/taker fees | 24/7 | Coinbase Trading Platform, Coinbase Advanced Trading Platform | Bank account, credit/debit cards, wire transfer | No | No |

Apps Review

There’s no shortage of investment apps on Google Play and the App Store—thousands are vying for your attention. As you’d expect, sifting through dozens of them was a nightmare, but, as mentioned, we’re here to do the heavy lifting for you. From the sea of apps, we separated the game-changers from the dead weight.

This involved looking beyond the flashy user interfaces and exciting deals, focusing on the nitty-gritty elements like performance, supported assets, beginner-friendliness, etc. The mini-reviews below should give you a clear picture of what to expect from the best investing app in Australia.

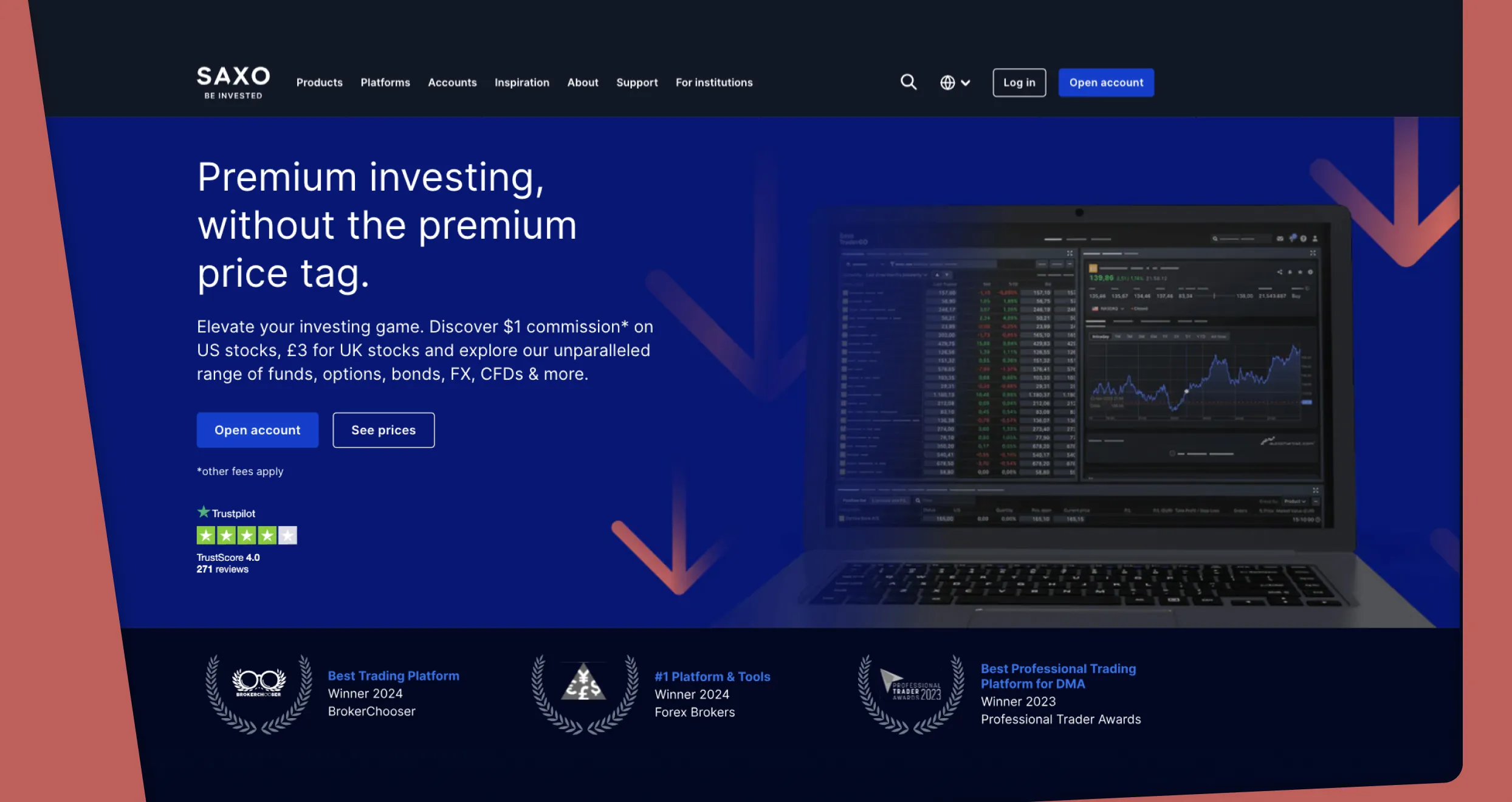

1. Saxo – Overall Best

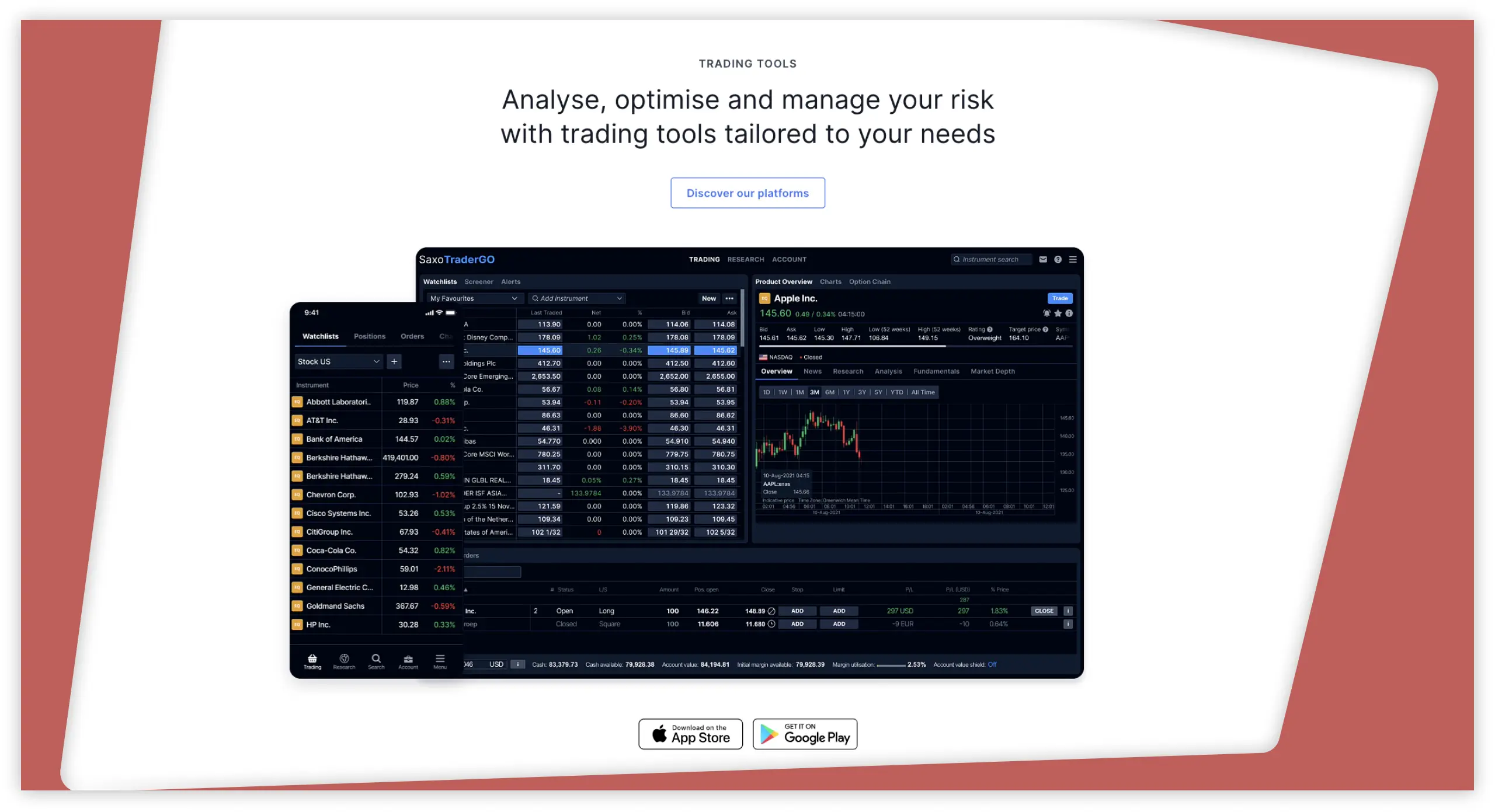

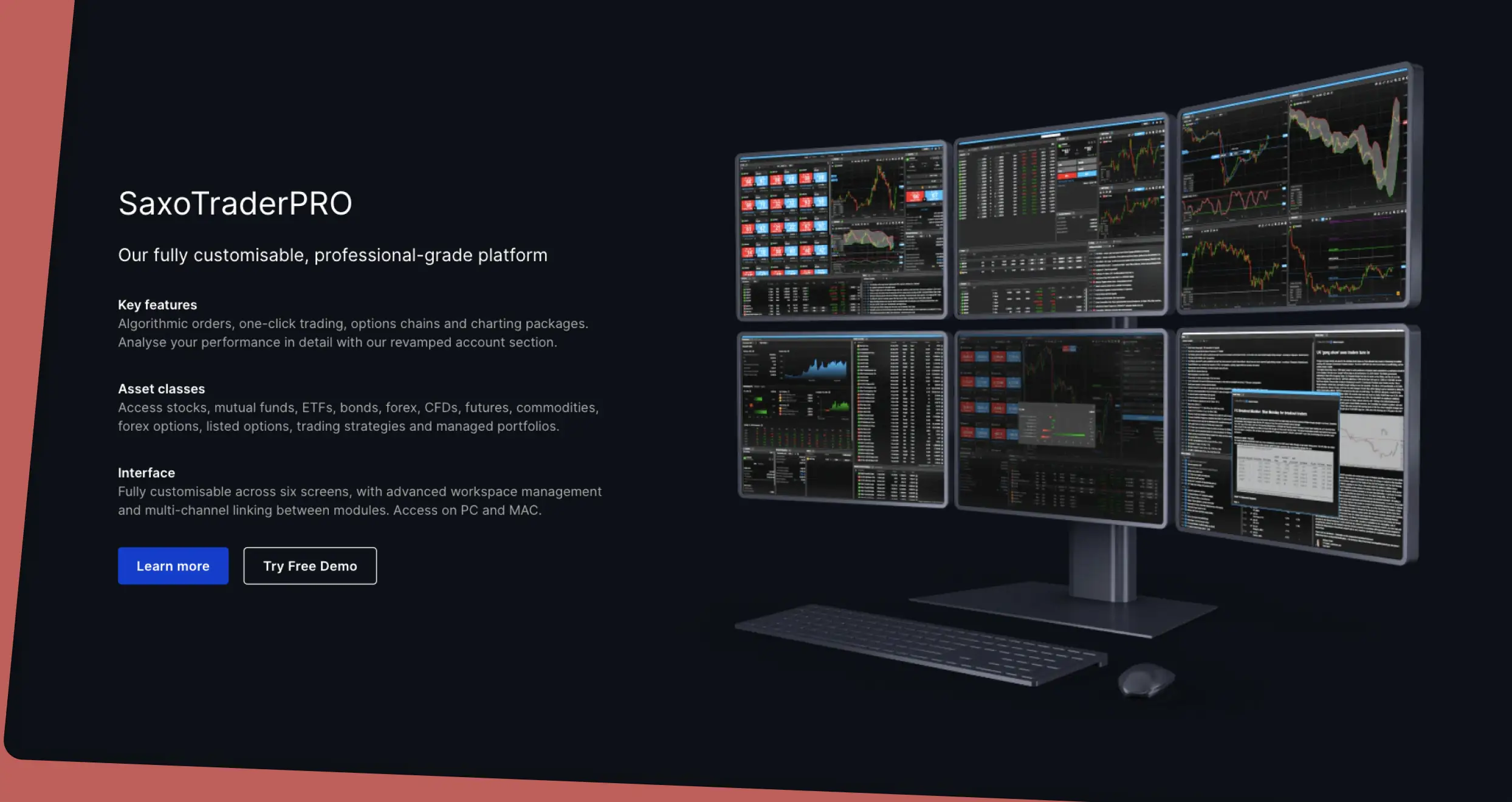

I conclusively established that Saxo is hands down the best investment app for Australian investors. With Saxo, you can invest and trade diverse assets, from stocks to CFDs. Sure, it may not share the same hype and popularity as some of its counterparts like eToro, but whatever it lacks in hype, it makes up for in substance.

For starters, the platform has a low barrier entry with a minimum deposit of 0 AUD. What’s more, the account opening process was a breeze and took me less than 5 minutes. This user-friendliness doesn’t stop after signing up. The app also has a simple, intuitive user interface that’s well laid out with bold lettering and distinct buttons. It ran smoothly, and there was no lagging or delays during my use.

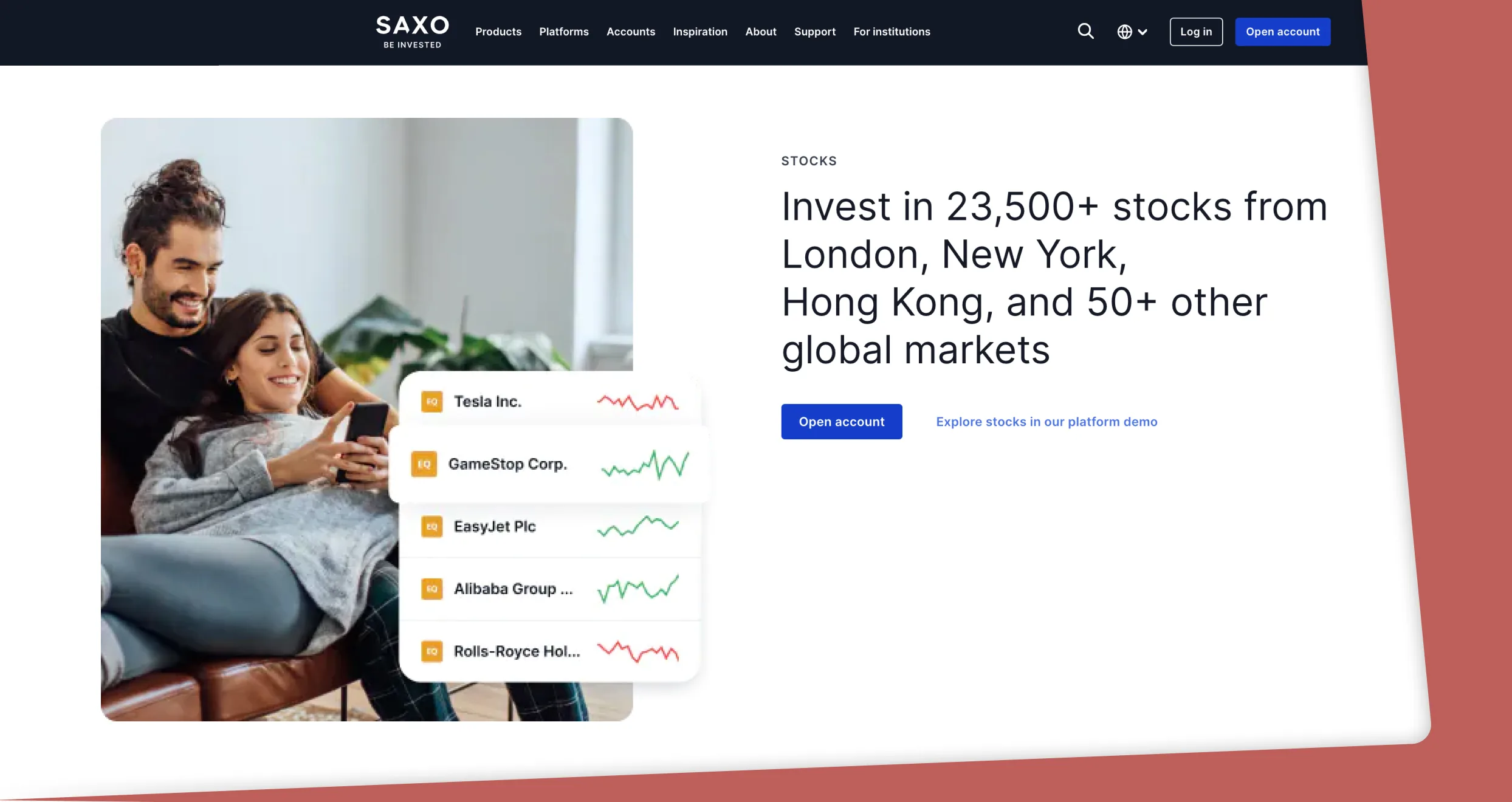

The UI aside, Saxo lets you invest in tens of thousands of securities, including more than 23,000 stocks, 5,200+ bonds, and 7,400+ ETFs. The app also features an array of technical analysis and research tools with which I had a field day.

Pros

- Simple, easy-to-use interface with a fast sign-up process

- 71,000+ assets to trade and invest in

- Top-tier customer support service

- Caters to institutional investors and traders

- Advanced technical analysis and research tools

Cons

- No third-party platforms for trading enthusiasts

- The demo account is limited to only 20 days

2. eToro – Best Commission-Free App

It’s no secret that eToro has invested heavily in marketing, but is there actual value behind the noise? I’ll let you be the judge of that.

eToro first launched as a simple online trading platform in 2007 called RetailFX. Fast forward 18 years, and eToro has become one of the most popular investment apps in Australia. The app supports over 7,000 financial instruments. This includes stocks, ETFs, and crypto.

However, where the platform shines most is on the commissions front. As the title suggests, eToro doesn’t charge customers a commission for trading and investing. Plus, unlike other apps, eToro doesn’t sneak in hidden fees or compromise its user experience to compensate. Instead, it maintains a transparent pricing structure and provides stellar service.

This isn’t to say that investing or trading with eToro is free. Far from that, instead of a commission, eToro charges a spread. This is the amount you get when you subtract an asset’s asking price from its bid price. Spreads are built into the price; hence, they are more straightforward and transparent to charge and calculate.

Besides the low trading fees, I was really impressed by eToro’s copy trading platform, CopyTrader. With CopyTrader, novice (or even pro) traders can directly copy the investments and trades of more experienced individuals. Moreover, the platform has a vast community of investors and traders eager to share their strategies and give a helping hand. It’s a definite thumbs-up for me.

Pros

- 7,000+ financial assets

- No commissions and competitive spreads

- Best-in-class copy and social trading platform

- Highly regulated by authoritative regulatory bodies

- A vast community of investors and traders, signalling credibility

Cons

- $10 monthly inactivity fee

- Higher spreads than most of its peers

eToro has a transparent fee structure that is easy to understand and helps you plan accordingly. From our analysis, we discovered the following trading and non-trading eToro fees.

| Trading and Non-Trading Charges | Details |

|---|---|

| Account Opening | $0 |

| Management Fee | $0 |

| From $50, depending on your jurisdiction | 0.6 |

| Commission | From 0% on stocks and ETF trading |

| Spreads | From 1 pip on major currency pairs |

| Deposits and Withdrawals | $5 withdrawal |

| Inactivity | $10 monthly |

| Currency Conversion | 1.5% or 3.0%, depending on the currency or payment method |

| Overnight Funding | Varies based on global market conditions |

| Copy Trading | Free |

3. OANDA – Best App for Earning Interest on Unused Margin

OANDA is an incredible app with unmatched functionality and a stellar reputation for comprehensive and up-to-date market research. It offers a considerable array of financial products for investors and trading enthusiasts. The most notable ones include stocks, CFDs, commodities, and cryptocurrencies.

As a seasoned trader and investor, I firmly believe in the saying, ‘Don’t put all your eggs in one basket. It would be unwise to trade or invest your entire balance because you’ll lose everything should things go south. That said, OANDA offers interest of up to 7% Annual Percentage Yield (APY) for your unused margin. So, whatever amount isn’t tied up in investment and trades earns significant returns.

New users get interest rates of between 6% and 7% on the balance they don’t invest for the first 90 days. The best part is that I didn’t have to go through any extra steps to enrol in the interest rate programme. All I did was sign up for the platform, deposit cash into my account, and voila! My money started growing. Additionally, after the stipulated 90 days, my money continued accumulating, albeit at a lower rate.

That said, OANDA has plenty more to offer than just margin-boosting interests. The platform is a pioneer in the online broker industry with over 25 years in the game. The experience it has garnered over this period has allowed it to refine its offerings and deliver a robust, user-friendly experience. It has a solid reputation in the trading and investment community and is among the safest with regulation from tier-1 regulators.

Pros

- High interest on unused balances in new accounts

- Seamless user interface that’s perfect for beginners and experts

- The platform’s long history in the industry translates to unparalleled reliability

- Low minimum deposit requirement

- Supports popular third-party trading platforms like MT4, MT5, and TradingVie

Cons

- Learning Center thin on content

- Dormant accounts are subject to inactivity fees

OANDA broker has a clear fee structure with no hidden charges. This makes it easier for you to know how much you will be paying once you make a commitment. Some of the fees to incur at OANDA include the following:

| Trading and Non-Trading Charges | Details |

|---|---|

| Account Opening | $0 |

| Management Fee | $0 |

| Minimum Deposit Requirement | From $0, depending on your jurisdiction |

| Commission | From 0% on US-listed shares |

| Spreads | From 0.6 points |

| Deposits and Withdrawals | Free deposits. Withdrawal fees apply based on the payment method used |

| Inactivity | $10 after 12 months |

| Overnight Funding | Varies based on global market conditions |

| Currency Conversion Fee | Calculated by applying a 0.5% mark-up or mark-down |

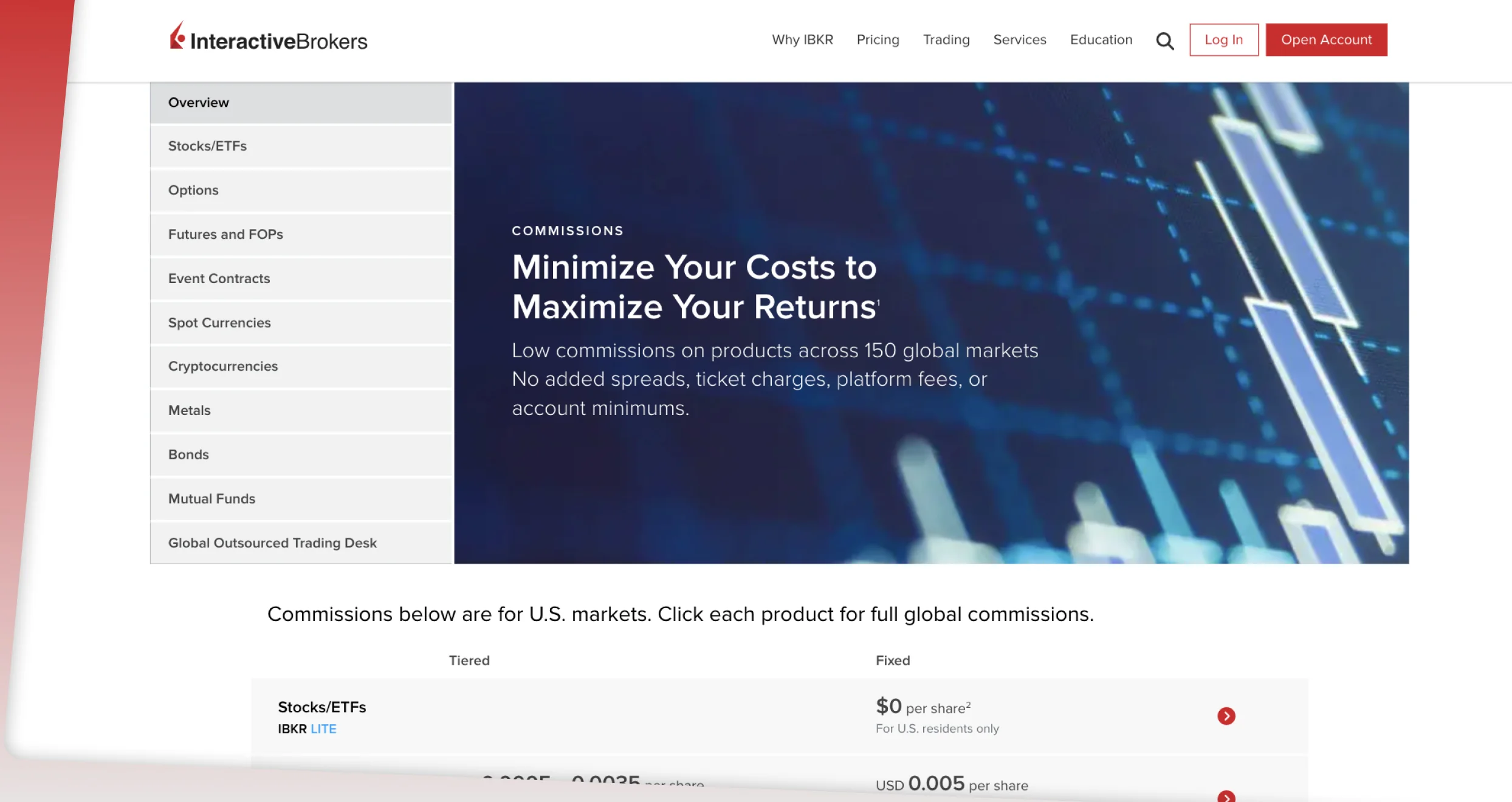

4. Interactive Brokers – Best App for Multi-Asset Traders

I pride myself on having a diverse portfolio with multiple assets. If you also belong in this camp, then Interactive Brokers (IBKR) is just what the doctor ordered. Interactive Brokers boasts well over 4 decades of experience in the business. It’s a standout investment platform that supports a wide variety of financial instruments like stocks, CFDs, futures, options, and FOPs, among others.

Today’s vast investment landscape and technological advancements mean investors can invest in multiple assets. With Interactive Brokers, you can trade and invest in more than 150 markets globally and trade over 48,000 mutual funds, 30,000+ corporate bonds, and 28 currencies. Given the wide variety, it’s only logical for IBKR to have an app that can hold its weight.

The IBKR app doesn’t disappoint. I was astounded by how many features the Trader Workstation app had and how IBKR managed to fit so many of them without making the app laggy or cluttered. However, I found it too complex for rookie investors. The good news is that beginners can always opt for the IBKR GlobalTrader app, which is more straightforward and excellent for helping newbies find their footing. Both apps ran smoothly on Android and iOS devices.

Pros

- 30,000+ bonds, 43,000+ mutual funds, and other securities

- No minimum deposit requirement

- Quick customer support

- A sea of educational materials

- No inactivity fee

Cons

- A tad complicated for noobs

- No third-party software for trading enthusiasts

After conducting thorough research and extensive assesments, we can confidently categorize Interactive Brokers as one of the most affordable service providers out here. As we’ve already mentioned, this company has no minimum deposit requirement. Plus, it allows traders to fund their accounts with payment methods like ACH and wire transfer at no additional cost. We also highly recommend IBKR because, unlike other brokers, it doesn’t require traders to pay inactivity fees for dormant accounts.

Here’s an overview of the Interactive Brokers fees and charges our team unearthed during our evaluation and exploration:

| Type | Fee |

|---|---|

| Account opening and maintenance | $0 |

| Deposit | $0 |

| Withdrawal | Yes |

| Inactivity | $0 |

| Overnight charges | Yes |

| Currency conversion | 0,5% |

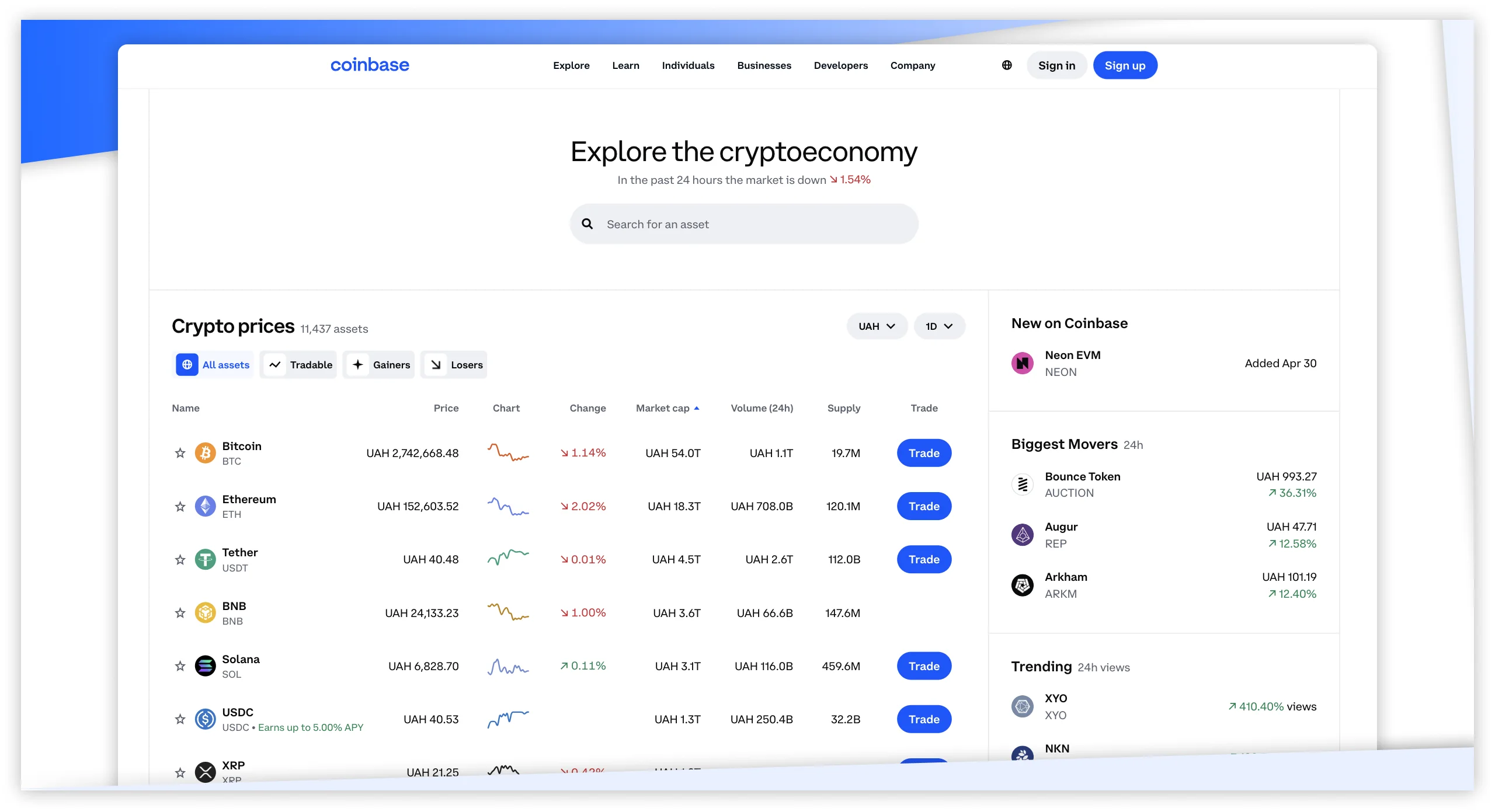

5. Coinbase – Best App for Crypto Enthusiasts

If there’s one thing I know about Aussie investors, they love crypto. That’s why around 1 in 4 Australians held at least one cryptocurrency. Coinbase holds its own in the global crypto community as a leading cryptocurrency exchange. It’s undoubtedly my go-to option, and here’s why.

First, Coinbase supports well over 200 tradable assets. This encompasses popular cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) to lesser-known names such as LivePeer (LPT), Tensor (TNSR), and the like. Besides the broad crypto selection, the app supports local payment methods like PayID, making funding your account fast and easy. I was able to link my PayID with the Coinbase app in just a few taps of my phone’s screen.

Coinbase also gets points for its bank-like user interface. The simple layout, bold lettering, and spaced-out tiles allow fluid navigation. I’m also a huge fan of the app’s innovative financial services. For instance, apart from trading crypto, I could also stake my coins and earn USDC rewards. Beginners can also earn altcoin rewards for completing educational tasks.

You can up the ante by becoming a Coinbase One member. This membership gives you direct access to the platform’s decentralised exchange, where you can buy and sell NFTs and borrow crypto-backed loans.

Pros

- Wide selection of crypto assets to trade in

- Competitive staking reward

- Supports crypto loans

- Powerful tools, including TradingView-powered charts

- Stellar, 24/7 customer service

Cons

- Higher trading fees for low-volume investors

- No demo account

Coinbase doesn’t have a fixed minimum deposit requirement, which should be terrific news to people working with a limited budget. Moreover, the exchange covers transaction charges on behalf of its clients, so you don’t have to worry about additional costs while topping up your Coinbase account. To make everything better, the company allows its users to send crypto to other Coinbase users free of charge.

That said, our experts discovered numerous fees and charges while researching and evaluating Coinbase. For starters, the company charges a 0.1%C Lighting Network fee as well as variable exchange fees that depend on numerous factors, including market conditions, order size, and the involved payment method. Coinbase users who require asset recovery services are also subject to network and recovery fees.

Let’s review some of the fees and charges that you might encounter while trading with Coinbase:

| Fees and Charges | Details |

|---|---|

| Minimum deposit | None |

| Fiat deposit fees | $10 (wire), €0.15 (SEPA) |

| Fiat withdrawal fees | $25 (wire), £1 (SEPA) |

| Crypto transfer fee | None |

| Exchange fees | From 5bps/0bps taker/maker fees |

| Lightning Network fee | 0.1% |

| Staking commission | From 25% |

How to Start With an Investment App

So, you’re looking to get started with an app. It seems simple enough, but it’s always a good idea to get some pointers to start on the right foot. Here’s how you can get started with an investment app in Australia.

First thing first, you’ll want to ensure you have a mobile device that’s compatible with the best investment apps in Australia. If you own an Android device, target at least Android 14 and above. For iOS devices, the threshold is iOS 17. If your current device is incompatible with most of these apps, then maybe it’s time for an upgrade.

Next, choose a suitable app from the ones we listed above. You need an app that aligns with your investment strategies and financial goals. For instance, if you want a diverse portfolio, download Interactive Brokers and download Coinbase if crypto is more your cup of tea.

I’d advise dabbling with a couple of apps before settling on the best ones. Download a couple of them and compare their features. Pay particular attention to performance, fees, and supported assets. After this trial run, pick the one that works best for you.

Once you download the app, open it, and it’ll prompt you to open an account. The app will require you to share personal details; nothing out of the ordinary, just information like your name, e-mail address, and phone number.

After giving this information, you’ll need to verify your account with a unique code sent to your phone number or email. Once you complete verification, you’ll officially have an account with the platform.

Different apps have different payment methods, as shown above. As such, be sure you pick an app that supports your preferred payment method. Next, link your bank account, e-wallet, or card to the app and deposit your investment amount. Check your chosen funding method’s fees and processing time to avoid nasty surprises.

Take advantage of the app’s learning resources to build your knowledge on trading and investing. I recommend starting with a demo account until you get a firm grasp on investing. Also, start with low investment amounts until you’re confident enough to go big. Don’t forget to invest in assets you are familiar with.

How We Test

At BrokerRaters, we take a comprehensive approach to testing out different apps and reviewing their functionality. We adopt our standardised testing methodology to evaluate costs, security, pricing, customer service, and the all-around user experience. Our team of experienced experts spends days and sometimes weeks exploring every feature and function of these investment platforms to give you an accurate and unbiased review.

Investing in assets like stocks, bonds, and ETFs carries a considerable degree of risk, regardless of the investment app. It’s important to conduct extensive research before investing in any investment platform. Also, adopt responsible trading practices that will help you cut down losses and profit from your investments.

Bottom Line

I’m all too familiar with the exasperation of finding a proper investment app in Australia. Luckily, you don’t need to risk your hard-earned money with a trial-and-error approach; just turn to my list of the best investing apps in Australia and take your pick.

Still, it’s worth noting that although a good investing app is crucial to profitability, it’s not the only factor. Conduct extensive research and stay updated on the current market news to boost your investment decisions. It’s also a good idea to connect and share ideas with other investors on popular forums and communities.