Claire Maumo has experience in investment banking, strategic consultancy, and journalism. She has a Bachelor’s degree in Business Management and a Master’s in finance. She has a knack for making complex concepts easy to understand. Her primary focus is on crypto, blockchain, and financial instruments. Follow her for expert insights on trading and investment.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

My experience trading stocks with different apps has been both exciting and heartbreaking. I’ve traded with apps plagued by issues like poor security and high fees and suffered immense consequences. I’ve also interacted with exceptional apps and enjoyed outstanding benefits, from fast order execution to world-class customer support.

My aim today is to help you avoid the headaches that come from trading with lousy providers and find the best stock trading apps in Australia. To do that, I had to test and analyze hundreds of apps. But trading is a hobby for me, and I’m glad to be of service.

Without further ado, allow me to introduce you to 5 of the best stock trading apps in Aussie.

List of the Best Stock Trading Apps

- eToro – Best for Investors

- Pepperstone – Best for Low-Cost Trading

- FP Markets – Best for Scalpers

- AvaTrade – Best for Learners

- Saxo – Best for High-End, Professional Stock Trading

Compare Apps Table

Before I tell you what the best Australian stock trading apps offer, allow me to kick off with a brief comparison table. Its primary objective is to help you get a rough idea of each app’s key features and possible limitations.

You’ll notice that I have covered several features in this guide, from licensing and regulation to demo account and money insurance. That is because I consider them as crucial building blocks. Every app that claims to be credible and trustworthy must have applaudable attributes where these factors are concerned. You should always focus on them while vetting every broker before signing up.

| Forex Trading App Australia | License & Regulation | Minimum Deposit | Commission & Spreads | Support Service | Software | Payment Method | Demo Account | Money Insurance |

|---|---|---|---|---|---|---|---|---|

| eToro | ASIC, FCA, CySEC, FSCA, SFSA, ADGM, MFSA, FSAS, GFSC, SEC | AU$50 | From 1.0 pip | 24/5 | eToro investing platform and app, Multi-asset platform, Social Trading, Copy Trader, Smart Portfolios | Credit/ debit card, Bank transfer, Klarna, PayPal, Skrill, Neteller | Yes | Yes |

| Pepperstone | ASIC, CMA, FCA, DFSA, CySEC, SCB, BaFin | AU$0 | From 0.0 pips | 24/7 | Pepperstone Trading Platform, MetaTrader 4, MetaTrader 5, TradingView,cTrader | Credit/debit cards, PayPal, Skrill, Neteller, Flutterwave | Yes | No |

| FP Markets | FCA, ASIC, MAS, FSCA, CMA, CySEC, FSA | AU$100 | From 0.0 pips | 24/7 | MT4, MT5, TradingView, cTrader, WebTrader, Mobile App, Copy Trading | Debit/credit card, Neteller, Skrill, Bank transfer, Google Pay, Apple Pay | Yes | No |

| AvaTrade | ASIC, MiFID, FSA, FSC, FSA, FFAJ | AU$100 | From 0.13% | 24/5 | MetaTrader 4, MetaTrader 5, AvaOptions, AvaTrade App, AvaSocial, DupliTrade, ZuluTrade | Credit/debit cards, E-payments, Wire transfer | Yes | No |

| Saxo | FSA, ASIC, FCA, IMA, MAS, SFC, JFSA | AU$0 | From $0.03% | 24/5 | SaxoTraderGO, SaxoTraderPRO, SaxoInvestor | Bank transfer, credit/debit cards, Quick payment | Yes | Yes |

Apps Reviews

Now, let’s dissect each trading app and explore the finer details. The mini-reviews I’ve written below focus on what each provider offers. However, since I strive to be unbiased and as informative as possible, I’ve also outlined every app’s noteworthy shortcomings, especially where indispensable factors like security and stipulated charges are involved.

1. eToro – Best for Investors

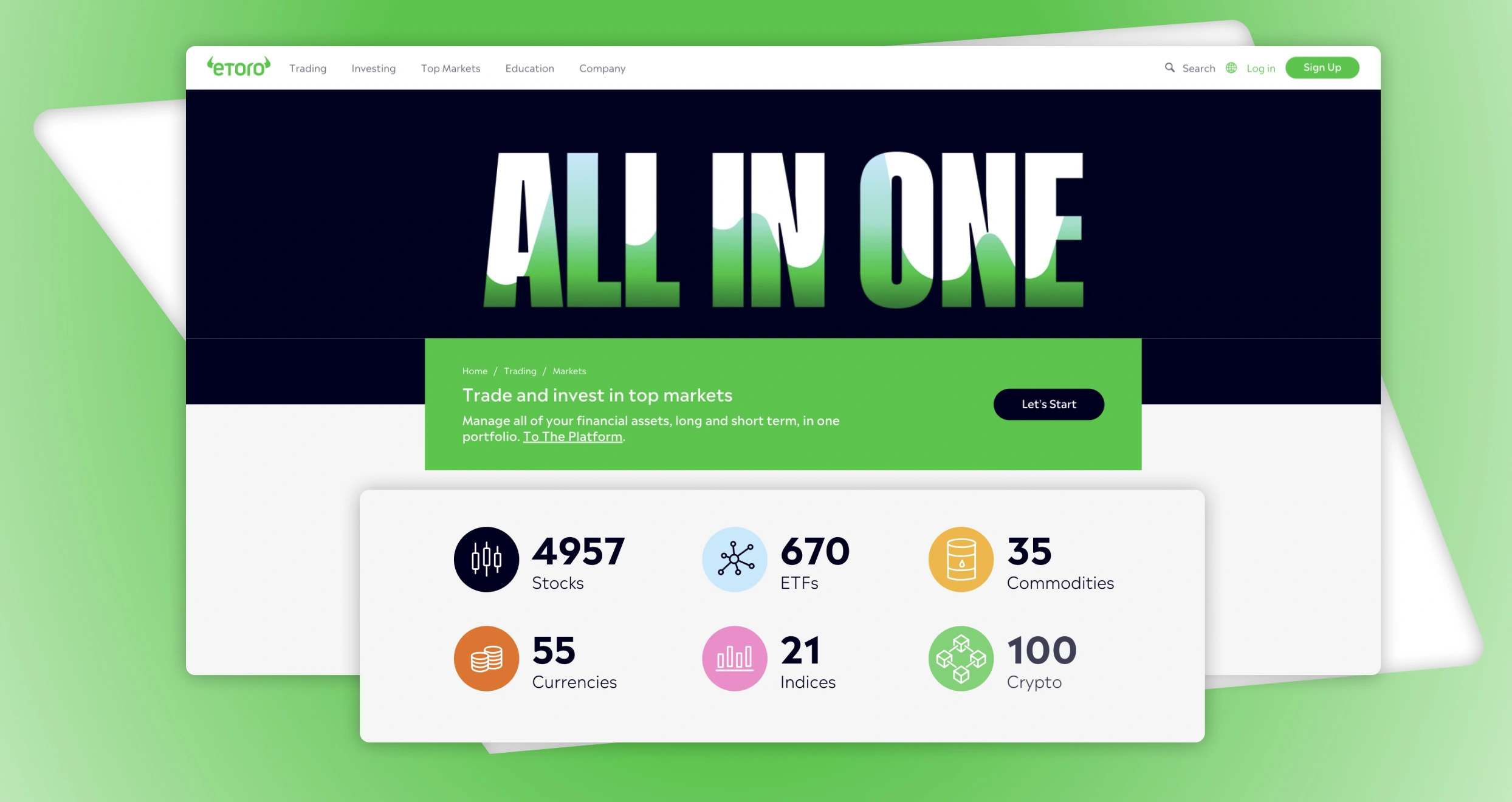

If you are a stock trader who likes investing in the best financial products, I recommend signing up with eToro today. This service provider, which boasts over 35 million customers, is home to a vast variety of investment products.

With the eToro app, you can invest in over 6,000 stocks from 20 exchanges. You just need at least AU$10, and your dividends will be automatically sent to your account at the right time. Note that, depending on where you are located, you may have to pay a AU$1 or AU$2 commission fee every time you open or close a stock position. You can invest in stocks from popular corporations like Microsoft, Tesla, and Amazon.

You can also buy popular digital currencies, from Bitcoin, Cardano, and Tron to Ethereum, Solana, and Polygon. The best part is that eToro has a proprietary crypto wallet, so you don’t need to involve a third party. Furthermore, as an eToro client, you can invest in ETFs and other financial assets.

If you are interested in investing but don’t have sufficient knowledge, the eToro Academy will sort you out. Through this platform, you’ll learn everything that’s essential to an investor, from the meaning of common investment terms to the fundamentals of risk management.

Pros

- Offers investment products like stocks and cryptocurrencies

- Low-budget investors can start with AU$10

- Free deposits

- Friendly spreads and commissions

- Free academy with quality materials

- Available on IOS and Android

Cons

- Spreads are higher than on other platforms

- AU$5 fee withdrawal fee for moving funds from an investment to an external account

eToro has a transparent fee structure that is easy to understand and helps you plan accordingly. From our analysis, we discovered the following trading and non-trading eToro fees.

| Trading and Non-Trading Charges | Details |

|---|---|

| Account Opening | $0 |

| Management Fee | $0 |

| From $50, depending on your jurisdiction | 0.6 |

| Commission | From 0% on stocks and ETF trading |

| Spreads | From 1 pip on major currency pairs |

| Deposits and Withdrawals | $5 withdrawal |

| Inactivity | $10 monthly |

| Currency Conversion | 1.5% or 3.0%, depending on the currency or payment method |

| Overnight Funding | Varies based on global market conditions |

| Copy Trading | Free |

2. Pepperstone – Best for Low-Cost Trading

I’ve traded with many apps over the years, but I always choose Pepperstone when I want low spreads and commissions. Try this CFD trading app today. You can trade numerous stock CFDs on this platform, including Australian, UK, and German share CFDs, and enjoy low commissions starting from 0.07%.

While trading stock CFDs with Pepperstone, you can diversify your portfolio with numerous assets and keep costs to a bare minimum. For starters, you can diversify with 90+ currency pairs, whose spreads start at an impressive 0.0 pips. That includes major pairs like AUD/USD, EUR/USD, and GBP/USD. Other assets you’ll have access to include CFDs on cryptocurrencies, commodities, and indices.

Trading with Pepperstone is as seamless and hassle-free as it can get. This service provider has no minimum deposit requirement, so it’s up to you to decide how much you want to put in your account. And don’t worry about covering transaction fees. You won’t have to pay a single dime when depositing or withdrawing money from your Pepperstone account.

If you are a seasoned trader and would like to switch from your current provider to Pepperstone, I recommend checking out the Pro account option. It comes with numerous boons you won’t get with a standard account, from a dedicated relationship manager to higher leverage and premium referral rewards.

Pros

- No minimum deposit

- Free deposits and withdrawals

- Low commissions for stock traders

- Spreads start from 0.0 pips

- Hosts MT4, MT5, and other platforms

- Available on Android and IOS

Cons

- Limited asset range

- Low leverage for retail traders

We find Pepperstone broker to be one of the brokers with transparent fee structures. There are no hidden charges, so what you see displayed on its platform is what you will incur. This makes it easier for you to budget without worrying about overspending.

Let’s discover below some of the trading and non-trading charges at Pepperstone.

| Trading and Non-Trading Charges | Details |

|---|---|

| Account Opening | $0 |

| Management Fee | $0 |

| Minimum Deposit Requirement | From $0, depending on your jurisdiction |

| Commission | From $0.02 on US-listed shares |

| Spreads | From 0.0 pips on its Razor Account |

| Deposits and Withdrawals | Free |

| Inactivity | None |

| Overnight Funding | Varies based on global market conditions |

| Copy Trading | Free |

Note that Pepperstone charges both spreads and commissions. While spreads are charged on all accounts, commissions are only imposed on the Razor Account.

3. FP Markets – Best for Scalpers

I consider FP Markets the best app for scalpers for good reasons. This provider has razor-sharp commissions of up to 0.06%. If you are a scalper, FP market’s friendly commissions will save you from accumulating high costs and losing a significant chunk of your profits and capital every day. Moreover, this provider puts you in the best position to leverage every opportunity by providing fast execution speeds.

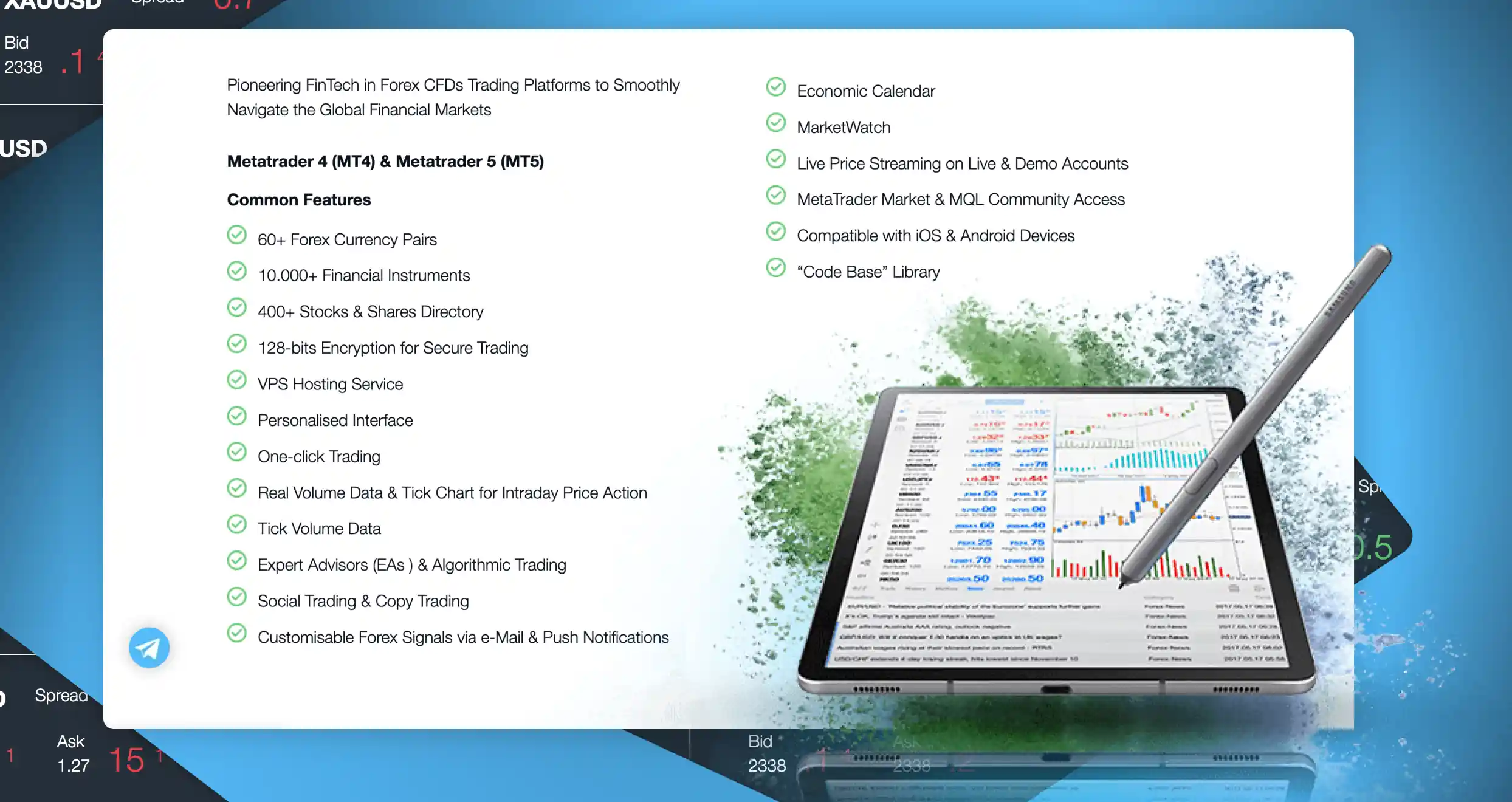

Trading on FP Markets is an enjoyable experience since this broker has an extensive pool of assets. As a stock enthusiast, you can trade CFDs on over 10,000 Australian/international shares here. Note that this impressive range of share CFDs is only available on Iress. Other platforms like MT5 have fewer tradable assets.

Speaking of platforms, I find FP Markets’ offering nothing short of impressive. With the FP Markets app, you can leverage the exceptional features associated with powerful platforms like cTrader, TradingView, and MT4/5.

If you prefer withdrawing your proceeds at the end of each day or trading session, you won’t have to worry about high fees when trading with FP Markets. This broker offers free transactions and quick customer support assistance whenever you have transaction delays or any other issues.

Pros

- Low commissions and spreads

- Fast execution speeds

- CFDs on over 10,000 stocks and shares

- Users can diversify with forex pairs, commodities, and metals

- 24/7 support

- Free deposits and withdrawals

- Available on Android and IOS

Cons

- Iress has a high minimum deposit

- Non-Iress users have access to limited stock CFDs

We reviewed the applicable FP Markets fees, and like that the broker has a transparent structure. This allows users to efficiently plan for their activities without worrying about incurring additional costs. There are no hidden charges and no price manipulation with this broker.

| Trading and Non-Trading Charges | Details |

|---|---|

| Account Opening | $0 |

| Management Fee | $0 |

| Minimum Deposit Requirement | From $50, depending on your jurisdiction |

| Commission | From 0% |

| Spreads | From 0.0 pips on major currency pairs |

| Deposits and Withdrawals | Free deposits. Withdrawal fees apply based on the payment method used |

| Inactivity | $0 |

| Overnight Funding | Varies based on global market conditions |

| Copy Trading | Free |

4. AvaTrade – Best for Learners

For you, a stock trader, to make informed decisions and enjoy reasonable returns, you must be knowledgeable. You must be familiar with every key concept, from how the stock market works to the basics of proper risk management. If your knowledge is wanting, sign up with AvaTrade, the best stock trading app Australia for beginners.

Where learning is concerned, I’ve yet to meet a provider better than AvaTrade. It has one of the best online academies for traders: AvaAcademy. This academy is free, which is quite surprising considering the range and quality of the resources it offers. Visit it today, and select the “Stock Market Trading Courses” option to start your journey. Don’t stop at stock-related courses; you should also learn about other instruments since you will need them for diversification and risk management purposes.

Consume as much knowledge as you can from Ava Academy. After exhausting the available materials, don’t dive into trading immediately. First, gauge the extent of your understanding with the available quizzes. If it proves sufficient, open a demo account and start practicing. Practice non-stop until you generate consistent virtual profits and are confident in your ability to make the right decisions.

Pros

- Free academy with hundreds of educational materials

- Easy-to-use app with a friendly interface

- Free demo account with AU$10,000

- Quality support service

- Available on Android and IOS

Cons

- High inactivity fees compared to its peers

- Your account may be subject to a AU$100 annual administration fee

Our experts investigated the AvaTrade broker’s fees and charges. We first noticed that the platform has a modest minimum deposit requirement of $100. What’s more, its users pay no additional costs while depositing funds or cashing out. That makes AvaTrade an ideal broker for both cost-conscious and newbie traders who want to test their waters with small capital before going all in.

That said, AvaTrade requires dormant account holders to pay $50 after every 3 consecutive months of inactivity. Moreover, if you let your account remain inactive for over successive months of inactivity, the broker will charge you a $100 administration fee. Not to forget, AvaTrade requires traders who hold positions overnight to cover a premium.

Here’s a breakdown of the fees you should expect to encounter while trading with this service provider:

| Fees and Charges | Amount |

|---|---|

| Spreads | From 0.9 pips |

| Administration fee | $100 |

| Inactivity fee | $50 |

| Overnight premium | Yes |

5. Saxo – Best for High-End, Professional Stock Trading

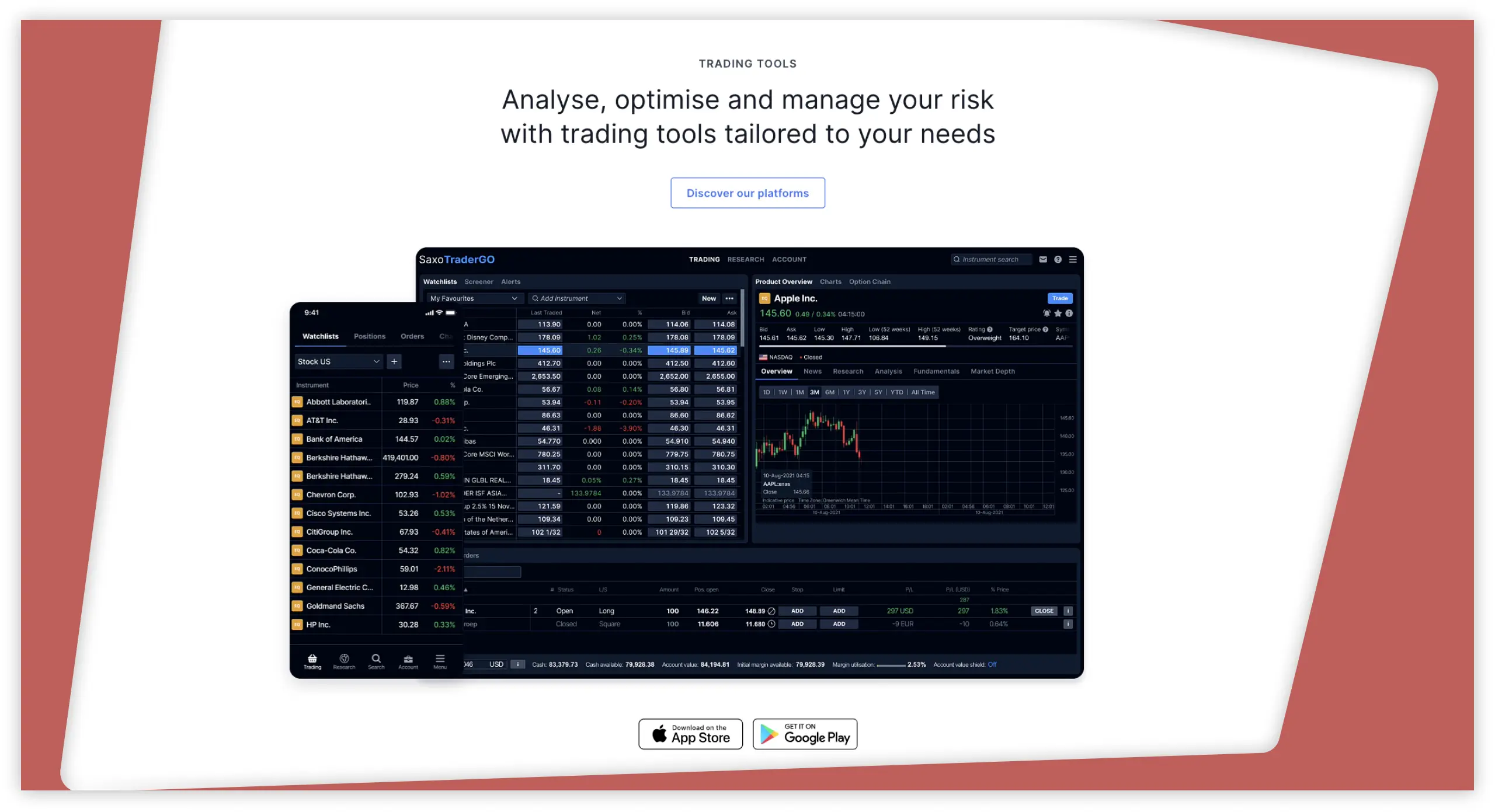

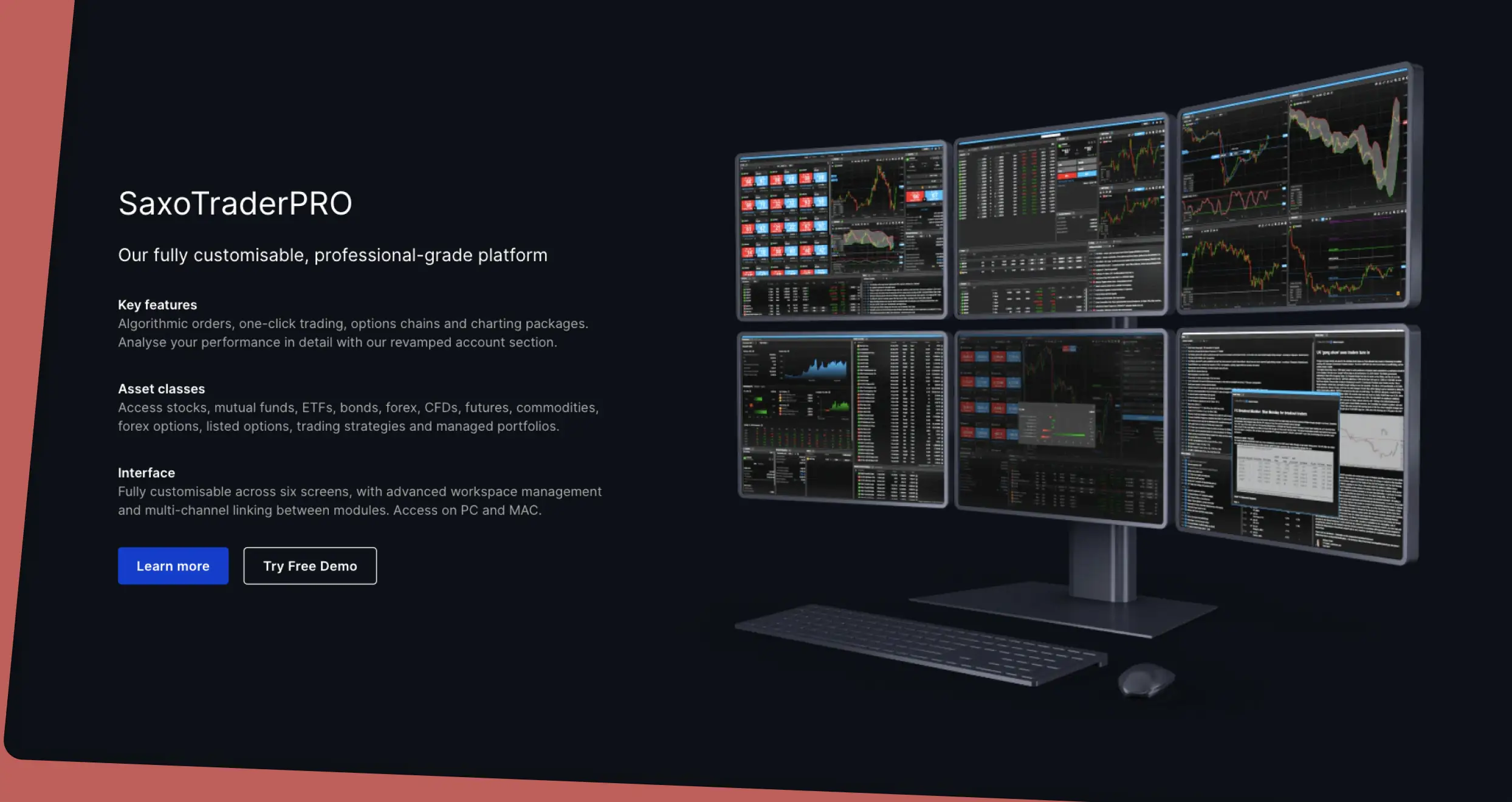

SaxoTraderPRO is one of the most powerful proprietary trading platforms today, making Saxo an excellent choice for professionals. This fully customizable platform is explicitly designed for high-net-worth professionals. It has many high-performance tools, from an advanced trade ticket engineered for optimum speed and productivity to a Depth Trader that allows you to place and manage real-time traders in relation to the Level 2 order book.

You can download and access SaxoTraderPRO from your Windows or MacOS PC. This platform allows users to set up to 6 screens, so your experience will be seamless and hassle-free. But note that you can’t access it from a mobile phone, which is no surprise since a powerful platform like this demands significant processing power. If you want to trade on your phone, SaxoTraderGO is the right platform to use.

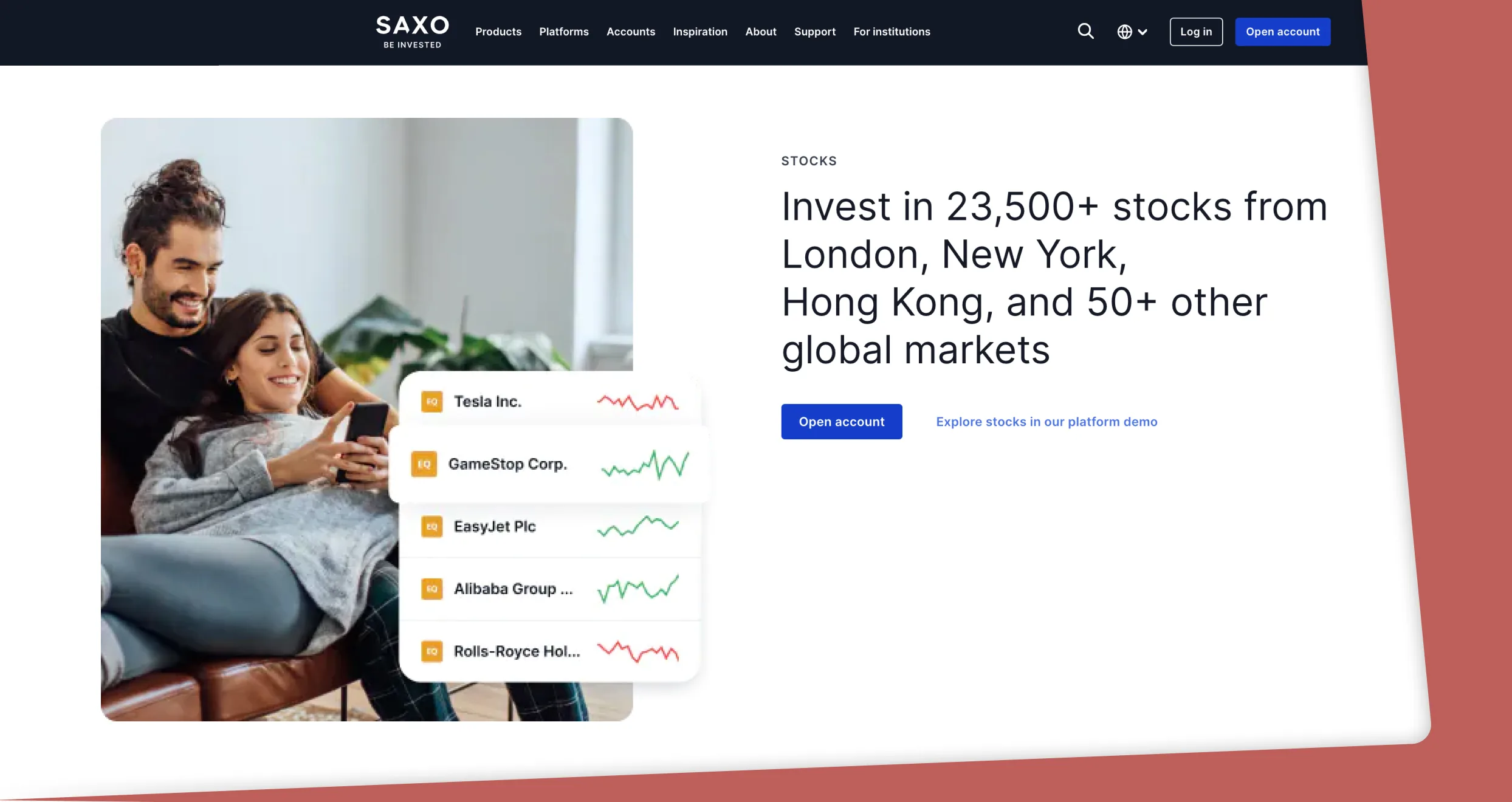

Sign up with Saxo today and get access to thousands of CFDs on stocks, indices, forex, and many other assets. That’s not all; you can also invest in over 23,000 stocks, 5,200+, and thousands of ETFs and crypto ETFs through SaxoInvestor. The best part is that you can access all of Saxo’s platforms with a single account.

Pros

- High-end trading platforms

- Ultra-competitive spreads and commissions

- Thousands of tradable instruments

- Tens of thousands of investment products

- Lower costs for high-value traders

- Excellent customer support

Cons

- Mobile users can’t access SaxoTraderPRO

- Low-net-worth traders incur higher costs

How to Start with a Stock Trading App

At this point, I’m sure you’ve identified at least one app that suits your needs. If you’ve done that, do the following:

Your chosen app comes from a specific broker. Visit the broker’s official site. Here, you’ll find a link for downloading the app. Before getting the app, check the stipulated requirements, including the required OS version. Alternatively, you can go to your phone’s official store, i.e., the App Store or Google Play, and search for the app. Apps from unofficial, third-party sources can come with malware, so avoid them entirely.

Open the app and register or sign up. Most apps I’ve used ask new signees to provide their email or phone number and set a strong password at this point. If asked to do that, ensure the email or phone number you share is active. A code/link will be sent to whatever channel you choose, and you must use it to activate your account. Also, secure your account with a strong, unguessable password.

Once you complete the basic registration steps, your provider will ask for more intimate information, from your legal name to your physical address. Here’s my advice: don’t share incorrect or fishy information. That is because your provider will ask you to submit documents that will be used to counter check and verify your identity and location.

Give your provider time to verify your account. If the company guarantees instant verification, the process will be complete in a couple of minutes. If not, you may have to wait for a few hours or days. You will receive a text message or email notifying you of successful verification. You can now deposit money into your brand-new account with one of the supported funding methods.

Choose your favorite instrument to start trading. Before risking your money, analyze current market sentiments, news, and trends. Also, use tools like stop-loss and take-profit orders to manage risk and maximize profits. I can’t overemphasize the importance of portfolio diversification. Don’t put your money in one basket because you will take heavy financial hits if things go south.

How We Test

At BrokerRaters, trading is our business, and our primary objective is to guide you to the best service providers. Choose the best app for stock trading Australia from our list, knowing we put each provider through rigorous testing before making recommendations. While doing so, we checked multiple crucial functions, including regulatory status, performance, and security.

We’ve played our part. Now, it’s time for you to play yours. While using any of the apps we’ve recommended here, prioritize responsible trading. In a nutshell, stick to a strict trading budget and maintain self-discipline. You should also set time for your education and strive for continuous self-improvement.

Bottom Line

Trading with the right app should be a top priority. You shouldn’t commit to inferior providers because your experience will be undermined by countless critical issues, from app crashes and glitches to hidden fees and slow customer support. Finding the best stock market apps Australia has to offer should be relatively easy now that I’ve introduced the top 5.

Before I sign off, let me point this out in clear terms: stock trading is risky. You should only try this venture if you have money that you can afford to lose. Also, your trading account is a prime target for hackers. Use every means at your disposal to protect it, including 2FA and biometric verification.

Great list! It’s super helpful. I especially like the focus on learning resources like AvaTrade's academy. Definitely going to check out eToro and Pepperstone.