Claire Maumo has experience in investment banking, strategic consultancy, and journalism. She has a Bachelor’s degree in Business Management and a Master’s in finance. She has a knack for making complex concepts easy to understand. Her primary focus is on crypto, blockchain, and financial instruments. Follow her for expert insights on trading and investment.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

Cryptocurrency trading and investment is gaining global traction, especially with online businesses embracing it for payments and purchases. In Australia, individuals are investing in this asset, hoping to earn profits in the future when the prices increase. If you are looking to join this bandwagon, ensure you make the best decisions that will not only maximise your experience but also secure your assets. One way to do so is to identify a reliable crypto wallet that will secure your tokens from unauthorised access.

Today, we will explore the best crypto wallets in Australia 2025. These wallets have been tested and approved by our experts, and all you have to do is choose what suits your investment needs. Our comprehensive guide will also enlighten you more about crypto trading so you can be fully prepared to kickstart this venture.

List of the Best Crypto Wallets

- eToro Money – Overall Best Crypto Wallet in Australia

- Kraken – Top Crypto Wallet For Australian Mobile Traders

- Coinbase – Best Multi-Currency Crypto Wallet in Australia

- Exodus – Beginner-Friendly Crypto Wallet in Australia

- Crypto.com – Best Wallet For NFTs in Australia

Australian Crypto Wallets: Comparison Table

There are many cryptocurrency wallets in Australia, and choosing the best can be challenging. To help our readers streamline this research process, we participate in it ourselves and make the best recommendations. We collect as many wallets as possible and test them. We also compare them based on various elements, including security, supported cryptos, charges, support service, and more.

Since we strive to remain unbiased, we combine our test results with user testimonials. We collect and sample the comments and ratings from Google Play, the App Store, and Trustpilot.

Below, we share our comparison table highlighting some of the top features of our best crypto wallets in Australia to help you make informed choices.

| Crypto Wallet Australia | Wallet Type | Support Service | Price | Supported Coins | Digital Wallet |

|---|---|---|---|---|---|

| eToro Money | Custodial | 24/5 | Free | 50+ | Yes |

| Kraken | Non-custodial Wallet | 24/7 | Free | 2000+ | Yes |

| Coinbase | Non-custodial wallet | 24/7 | Free | 1000+ | Yes |

| Exodus | Self-custody wallet | 24/7 | Free | 350+ | Yes |

| Crypto.com | Non-custodial wallet | 24/7 | Free | 1000+ | Yes |

Wallets Short Overview

Choosing a wallet you can afford and supporting adequate cryptocurrencies requires a thorough crypto wallets review and analysis. Since many investors prioritise these two elements when seeking a crypto wallet, we decided to prepare the tables below to streamline your research process. The tables show brief overviews of the fee structures and tokens offered by our best crypto wallets in Australia.

Fees

| Crypto Wallet Australia | Fees | Minimum Deposit Requirement |

|---|---|---|

| eToro Money | 2% coin transfer fee | None |

| Kraken | AU$0 | 0.0001 BTC |

| Coinbase | 0.50% conversion fee | None |

| Exodus | AU$0 | None |

| Crypto.com | AU$0 | None |

Assets

| Crypto Wallet Australia | Bitcoin | Ethereum | Litecoin | Ripple | Tether | Solana |

|---|---|---|---|---|---|---|

| eToro Money | Yes | Yes | Yes | Yes | Yes | Yes |

| Kraken | Yes | Yes | Yes | Yes | Yes | Yes |

| Coinbase | Yes | Yes | Yes | Yes | Yes | Yes |

| Exodus | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto.com | Yes | Yes | Yes | Yes | Yes | Yes |

Our Expert Opinion about Crypto Wallets

From our tests, we settled on the following cryptocurrency wallets as the best in Australia. This means that choosing from this list will not only guarantee a secure investment but also maximise your potential. The wallets host adequate resources that you may need to efficiently manage your crypto investments.

That being said, here are our mini-reviews on digital wallets based on our hands-on experience. By comparing them, you will identify what suits your crypto investment preference.

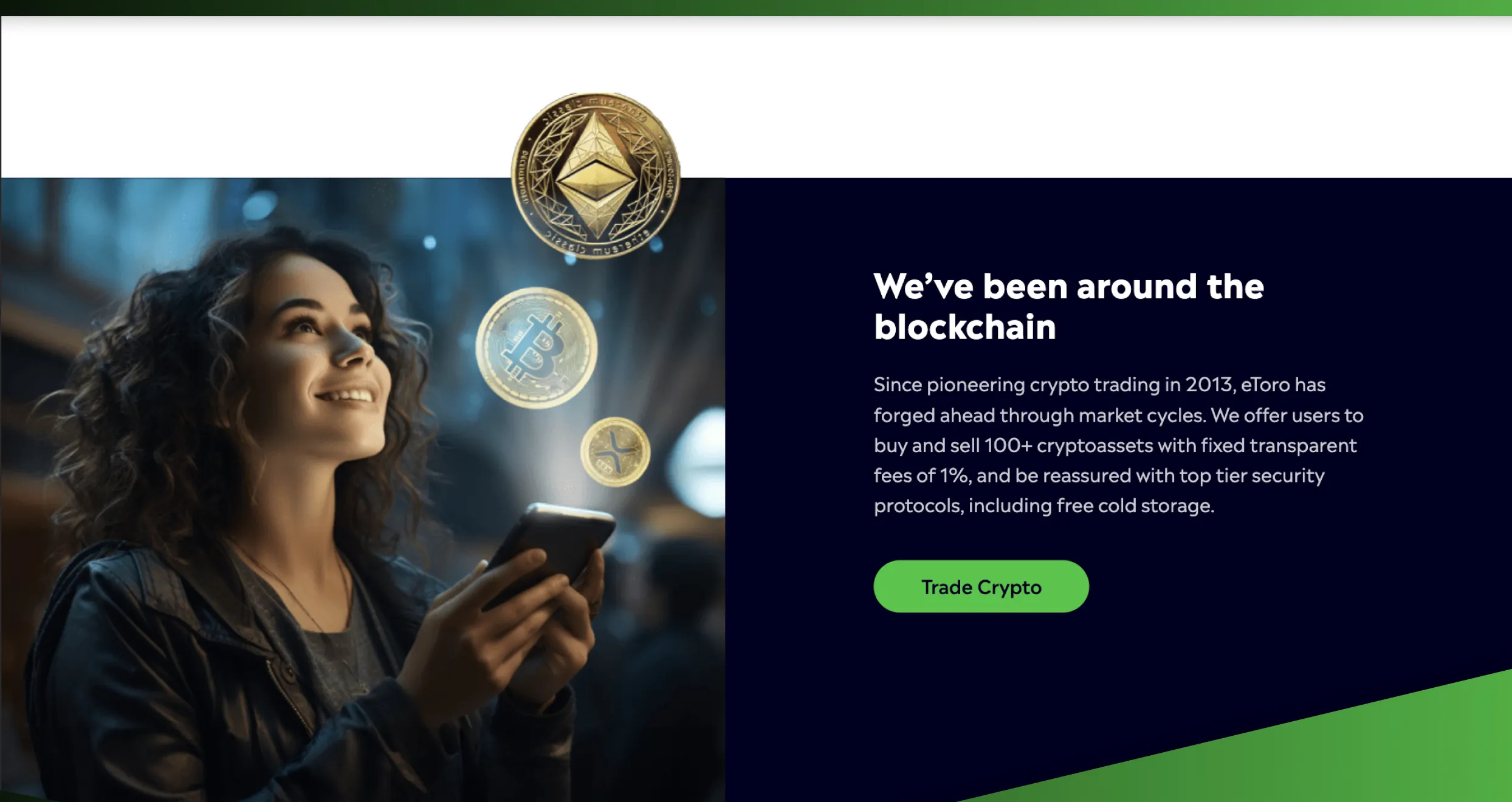

1. eToro Money – Overall Best Crypto Wallet in Australia

eToro Money crypto wallet is one of the most secure wallets for managing cryptos. With it, you will easily and securely transfer, manage, and store your tokens. We compared it with other options and liked that it has a user-friendly interface, which is perfect for both new and professional crypto traders. Moreover, eToro has an in-built exchange listing over 53 digital tokens to explore. These include Bitcoin, Litecoin, Ethereum, Solana, and more.

Another element we found interesting in the eToro Money wallet is its ability to allow users to send cryptos to another wallet. Any trader in Australia is eligible for this wallet as long as they have their accounts fully verified. Plus, eToro Money is compatible with desktop and mobile devices, allowing you to manage your cryptos anywhere you see fit. It also operates as a fully licensed and regulated exchange by ASIC.

Pros

- Polished, beginner-friendly user interface

- Transferring cryptos from eToro exchange to wallet if free

- The parent company offers quality learning resources

- Integrated with the eToro Money app

Cons

- Supports fewer crypto assets compared to other popular products

- High blockchain fees

The eToro wallet allows you to receive or send digital assets to other wallets for free. We consider this to be one of its fortes. And if you’re a high-volume user, you can send or receive up to $50,0000 per transaction and $200,000 per day.

That said, there’s a transfer fee when you move cryptocurrencies from eToro’s trading platform to your wallet. Your position determines the exact amount to be deducted. There’s usually a maximum transferable amount for voluminous transfers.

- Asset transfer charge: 2% of the transaction size

- Minimum charge: $1 (in units)

- Maximum charge: $100 (in units)

Our experts compiled the following table detailing the wallet’s transfer fees for common digital coins:

| Crypto | Minimum position (units) | Fee | Minimum charge | Maximum charge |

|---|---|---|---|---|

| Bitcoin (BTC) | 0.007195 | 2%/td> | $1 | $100 |

| Litecoin (LTC) | 0.6 | 2% | $1 | $100 |

| Bitcoin Cash (BCH) | 0.6 | 2% | $1 | $100 |

| Ethereum (ETH) | 0.107588 | 2% | $1 | $100 |

| XRP (XRP) | 120 | 2% | $1 | $100 |

| Stellar (XLM) | 600 | 2% | $1 | $100 |

| Tron (TRX) | 750 | 2% | $1 | $100 |

| Cardano (ADA) | 150 | 2% | $1 | $100 |

eToro also charges a blockchain fee. This charge goes to network miners who confirm, validate, and add transactions to the right ledgers. You’ll get an estimate of the blockchain cut once you confirm the transfer.

The system usually debits these charges from your balance in the same digital currency you’re moving. For instance, if you’re transferring Ethereum, your balance should have enough to cover the amount you’re moving, plus all associated charges.

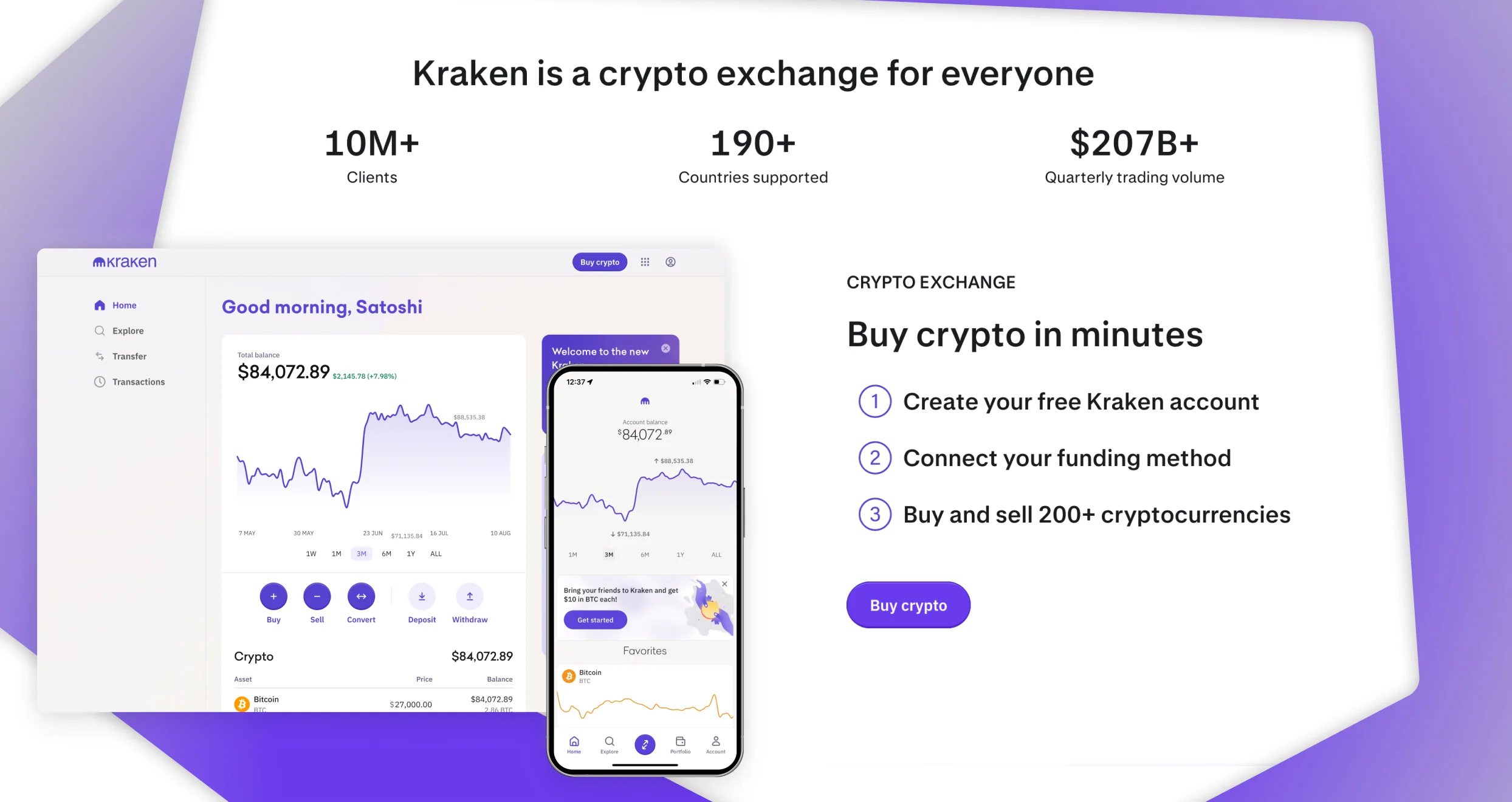

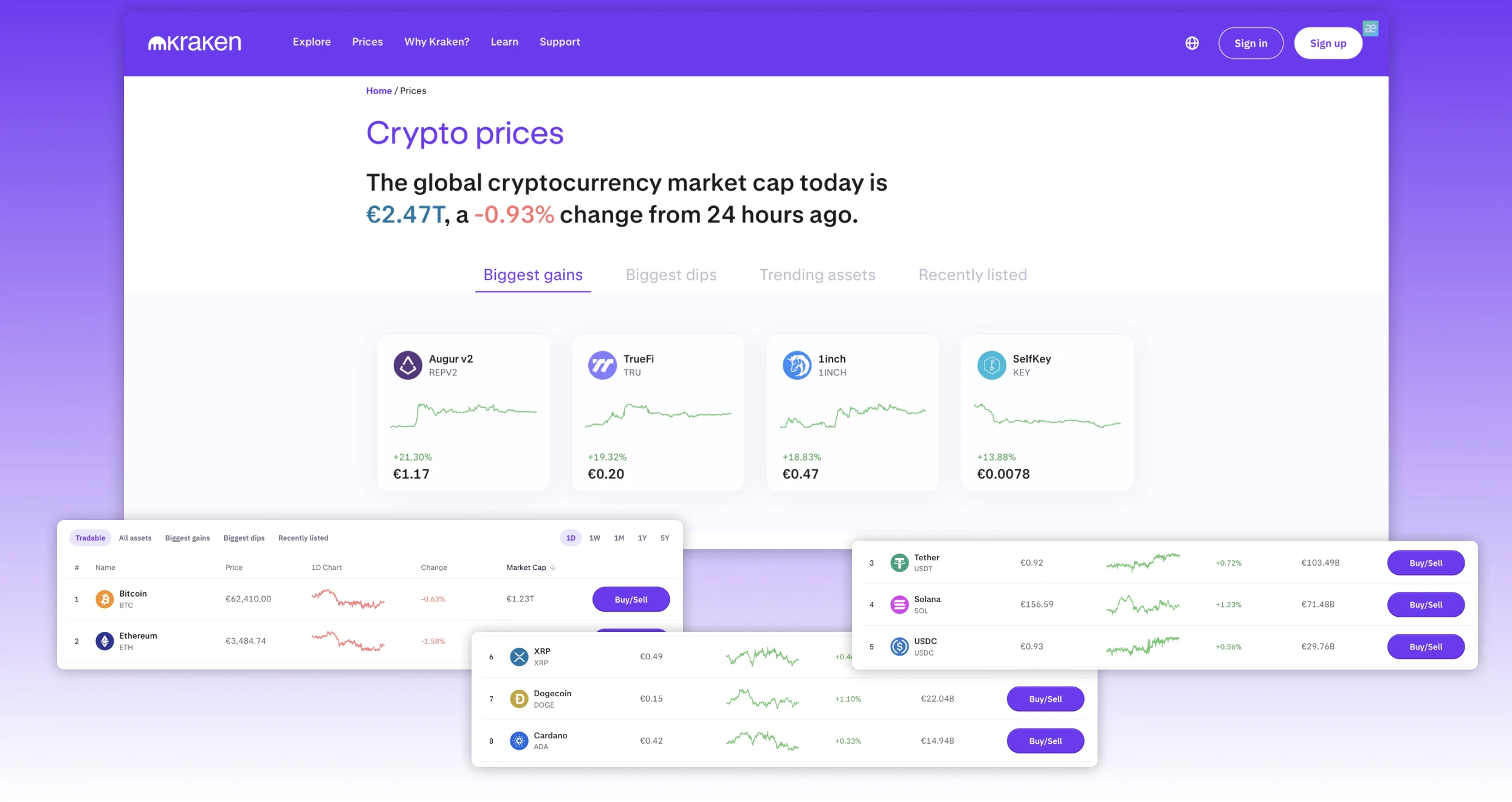

2. Kraken – Top Crypto Wallet For Australian Mobile Traders

If you are always on the move or like to use your mobile device to trade, Kraken is a reliable wallet. From our analysis, its app is known for robust security measures, like 2FA and face ID. Moreover, Kraken supports over 2,000 digital tokens, thus giving you an opportunity to select the best for your portfolio diversification. The wallet is self-custody, tailored to securely connect you to the decentralised web and seamlessly manage your DeFi positions.

We also like Kraken because it has an in-built exchange. Plus, you can use it to explore the NFT marketplace across multiple networks. So far, more than 10 million investors and traders trust Kraken—an indication that it is secure. You can download this crypto app from Google Play or the App Store.

Pros

- Supports over 2,000 cryptocurrencies

- No crypto deposit fees

- Excellent security and privacy features

- Helpful, 24/7 customer support

- Users can manage crypto, DeFi, and NFTs

Cons

- Limited support for fiat

- It can be complex for beginners

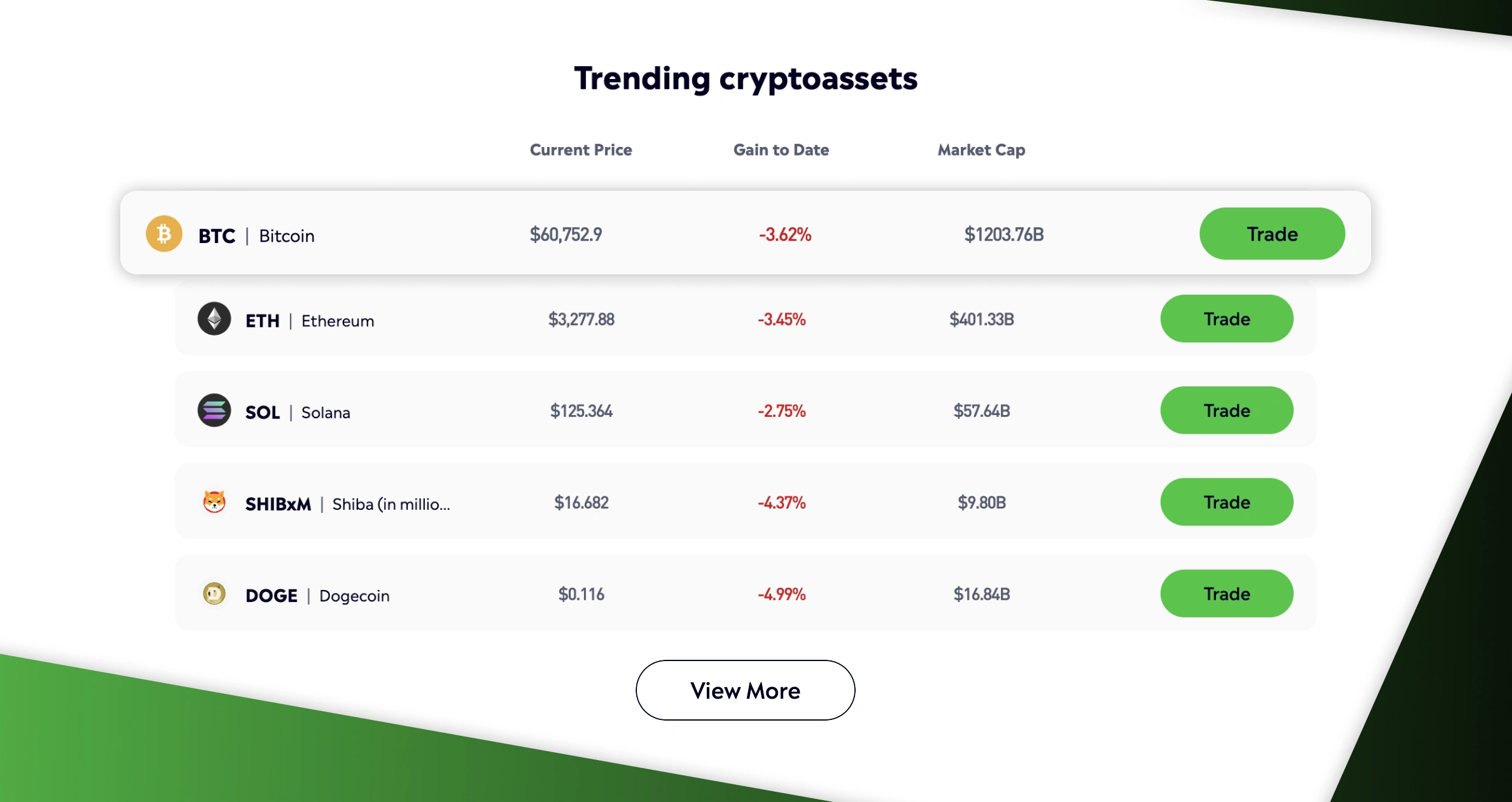

Fees are a bone of contention with Kraken because while some praise the platform’s affordability, lenient fees are mostly available to pro users and high-volume traders. For instance, individuals with a 30-day trading volume can enjoysuper-low maker fees starting from 0.00%. On the other hand, the maker/taker fees for low-volume traders can go as high 0.25%/0.4%. We’ve outlined some of the fees that our gurus unearthed while evaluating Kraken in the table below.

| Fees and Charges | Details |

|---|---|

| Maker/taker fees | From 0.00%/0.10% |

| Margin trading fees | Between 0.01% and 0.02% |

| Rollover fee | Up to 0.02% (per 4 hours) |

| Instant buy fees | Yes |

| Account inactivity fees | No |

| Minimum deposit requirement | 0.00001 BTC |

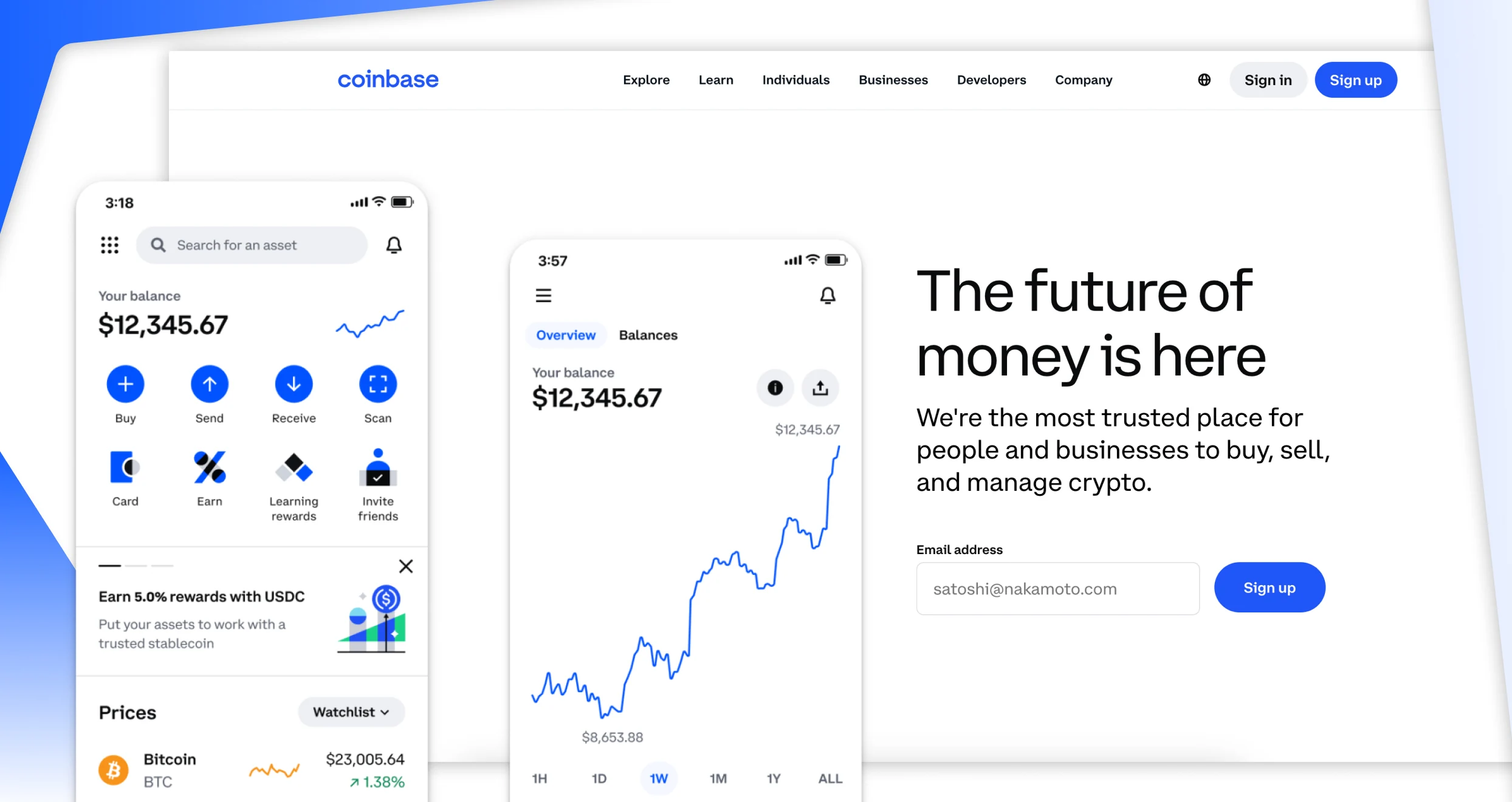

3. Coinbase – Best Multi-Currency Crypto Wallet in Australia

We find Coinbase to be the best multi-currency crypto wallet in Australia primarily due to its support for hundreds of thousands of digital tokens. With it, you can efficiently store and manage your crypto, NFTs, and multiple wallets in one place. Some of the popular assets at Coinbase include Bitcoin, Litecoin, Solana, Dogecoin, and every ERC-20 from Aave to ZRX.

Coinbase is a self-custody wallet, meaning that it gives users full control of their tokens. With its in-built exchange, you can efficiently manage your crypto investments without seeking other alternatives. This wallet also has an NFT marketplace, and it is trusted by over 50 million global clients. Coinbase is compatible with both desktop and mobile devices.

Pros

- Provided by a publicly traded company

- Supports hundreds of thousands of crypto assets

- World-class security measures and protocols

- Users can store NFTs and access dApps

- Beginner-friendly, intuitive interface

Cons

- If you lose your login credentials, Coinbase can’t help

- Its support service response rate can be improved

Coinbase doesn’t have a fixed minimum deposit requirement, which should be terrific news to people working with a limited budget. Moreover, the exchange covers transaction charges on behalf of its clients, so you don’t have to worry about additional costs while topping up your Coinbase account. To make everything better, the company allows its users to send crypto to other Coinbase users free of charge.

That said, our experts discovered numerous fees and charges while researching and evaluating Coinbase. For starters, the company charges a 0.1%C Lighting Network fee as well as variable exchange fees that depend on numerous factors, including market conditions, order size, and the involved payment method. Coinbase users who require asset recovery services are also subject to network and recovery fees.

Let’s review some of the fees and charges that you might encounter while trading with Coinbase:

| Fees and Charges | Details |

|---|---|

| Minimum deposit | None |

| Fiat deposit fees | $10 (wire), €0.15 (SEPA) |

| Fiat withdrawal fees | $25 (wire), £1 (SEPA) |

| Crypto transfer fee | None |

| Exchange fees | From 5bps/0bps taker/maker fees |

| Lightning Network fee | 0.1% |

| Staking commission | From 25% |

4. Exodus – Beginner-Friendly Crypto Wallet in Australia

Exodus is a powerful crypto wallet that we find suitable for newbies. We like the wallet’s modern design interface, which is also user-friendly. Plus, it is compatible with desktop and mobile devices, allowing newbies to start exploring the crypto landscape with any device that suits their preferences. Moreover, Exodus will enable users to swap between thousands of digital tokens, including Bitcoin, Ethereum, Litecoin, and more.

We also like Exodus Web3 Wallet, which you can install on Brave or Chrome. This multichain wallet connects users to 15+ networks, including Ethereum, Solana, and BSC, with the Exodus Chrome browser extension. Moreover, it integrates with Trezor hardware wallet to accommodate users who prefer offline storage. Another feature worth noting about Exodus is its ability to offer users an opportunity to earn rewards on their staked cryptos.

Pros

- Integrates with Trezor seamlessly

- Supports thousands of crypto assets

- Allows users to purchase, sell, stake, and swap crypto

- 24/7 human support is available

- Top-notch design and user-friendly interface

Cons

- Trezor is a bit pricey

- Higher exchange fees than its peers

5. Crypto.com – Best Wallet For DeFi Services in Australia

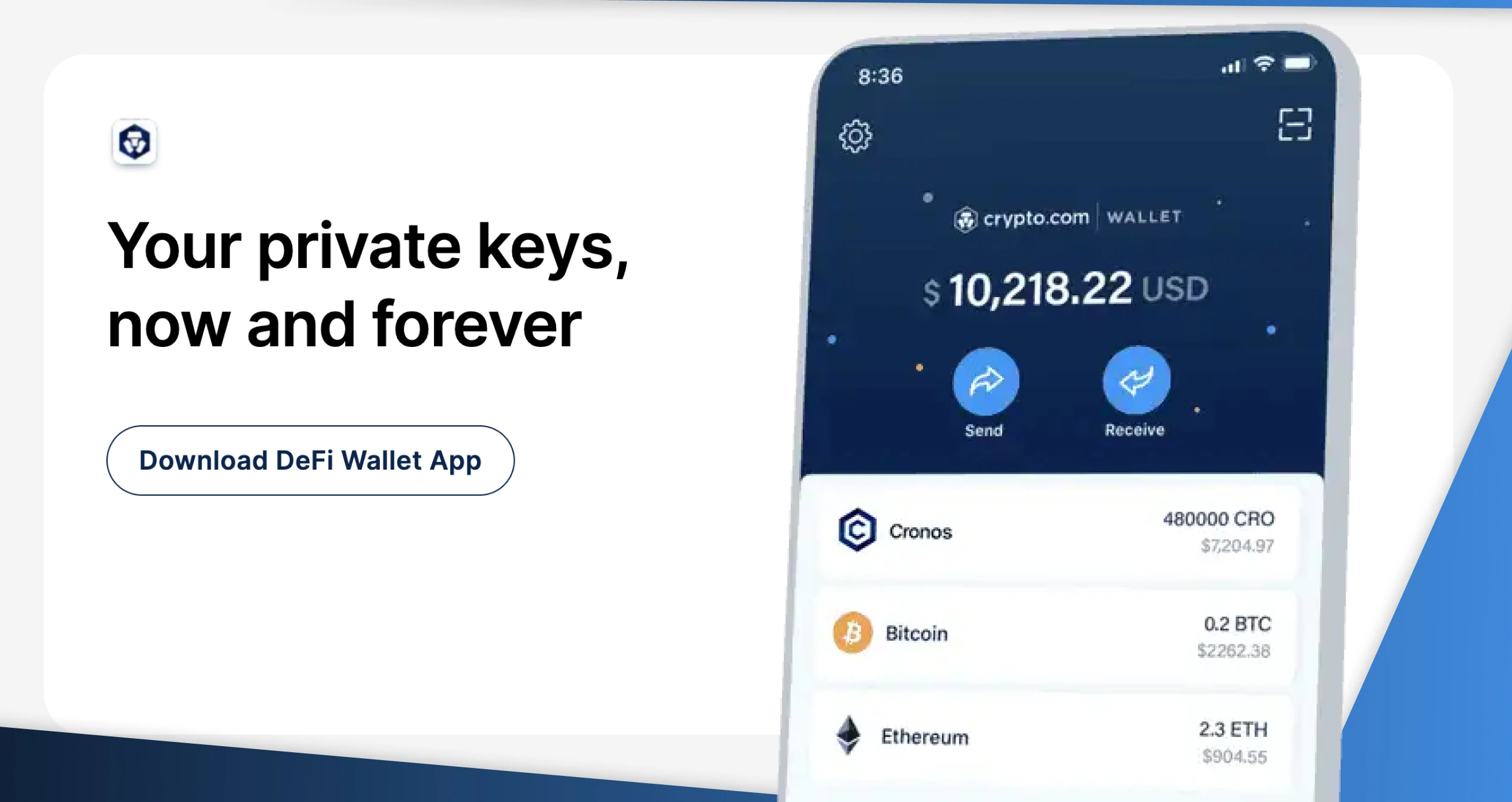

Looking to explore the NFT marketplace? Crypto.com is your go-to non-custodial wallet. From our evaluations, the wallet is user-friendly and compatible with desktop and mobile devices. Its DeFi wallet is non-custodial and allows you to manage over 350 tokens, including Bitcoin, Ethereum, Litecoin, and more. Note that Crypto.com is licensed by ASIC, and trusted by over 100 million global clients.

The DeFi services we noted at Crypto.com include an opportunity to grow your assets and earn passive income. Moreover, you can rake in returns from Compound Lending via the Crypto.com wallet. We also like the wallet’s Crypto.com Pay feature, whereby you utilise its built-in payment option to shop and earn amazing rewards. Not to forget, Crypto.com wallet users can explore a wide variety of dApps, from Uniswap and SushiSwap to Axie Infinity and CryptoKitties. You can also use this solution to swap over 1,000 tokens across diverse chains, including Cosmos, Cronos, and Ethereum.

Pros

- Supports 1,000+ tokens and 30+ blockchains

- Users can earn rebates on over 25 tokens

- Supports NFT deposits

- Swapping over 1,000 tokens is possible

- Users can optimise security with 2FA and biometric authentication

Cons

- It can be complex for beginners

- Support service response rate can be improved

The Crypto.com wallet is free, so you don’t have to worry about spending your hard-earned money on subscription fees and similar charges. That said, while using this wallet, you may be subject to transaction fees, swap fees, and other costs. They often vary from time to time, so we highly encourage you to review the company’s terms and conditions and stay on top of all arising developments.

Crypto Trading in Australia

Starting to invest in cryptocurrencies in Australia is easy as long as you have the best exchange and digital wallet. You must be of age (above 18 years) to engage in this activity since many exchanges will require proof of identity to activate your account. ASIC requires all exchanges and brokers to know and identify each client to secure the online trading platform from imposters and money laundering activities.

Crypto trading in Australia has proven lucrative, and many investors are earning good profits from the activity. However, succeeding in crypto trading is not a walk in the park. You must start by learning how the cryptocurrency market operates and be able to conduct market analysis for solid strategies. Most importantly, select the best crypto exchange and digital wallets like the ones we recommend for a worthwhile experience.

Investors can either buy cryptocurrencies and hold them for a certain period hoping that their prices will increase and be sold for profits in future. You can also trade the digital tokens as derivatives, whereby you only speculate on their price movements. The goal is to earn profits from the price difference when a trade closes. In CFD cryptocurrency trading, you will not take full ownership of the underlying asset.

When it comes to tax implications on crypto trading, the Australian Taxation Office requires investors to file tax returns on any profits earned from cryptocurrency trading and investing. Therefore, ensure you review the amount of capital gains tax deductions to plan accordingly and avoid getting in legal trouble in the long run.

How to Start Crypto Trading in Australia?

While this guide is tailored to take you through the best crypto wallets in Australia and how to secure them, we thought it would be best if you were also familiar with how to start cryptocurrency trading in Australia. Below are the simple steps involved.

To trade cryptocurrencies in Australia, start by conducting thorough market research to select a suitable crypto exchange and wallet. You can consider various elements in this process, including security, asset availability, charges, platform performance, and support service reliability. If an exchange/wallet has a trading app, ensure you install it on your mobile device to manage your activities while on the move. The good news is that our recommended crypto wallets Australia above have in-built exchanges, making it easier for you to kickstart your ventures.

Visit the official website of your chosen cryptocurrency exchange to register for a trading account. For most exchanges in Australia, you will be required to share your personal details to set up the account. These include your name, email, location, and more. You will also be advised to create a unique username and strong password for an added layer of safety. Before you participate in this procedure, read and understand the exchange’s terms of service.

To keep the online trading platform safe, your exchange provider will require you to verify your personal details. In this procedure, you will share a copy of your government-issued ID card. A link will also be sent to your email for verification.

If you prefer to secure your tokens on external crypto wallets Australia that are not integrated with an exchange, choose an option and set it up. This way, you will be fully prepared to secure your digital assets once you make a purchase.

Once your account is approved, make a deposit considering the minimum deposit requirement. With most exchanges, including the ones we recommend above, you can transact using fiats and cryptos. With fiats, you can make a deposit using credit/debit cards, e-wallets, and bank transfers.

With your funded account, your provider will automatically redirect you to its listed securities to trade. Choose what you are familiar with and have conducted research on, and start making purchases. Remember, choose a trade size and apply risk management controls like stop-loss orders to mitigate massive losses in case a trade disappoints.

Once you make your purchase, transfer them to your crypto exchange, especially if you are looking to hold them for a more extended period. Note that exchanges have been a target for bad actors, and holding your assets in a wallet will keep your tokens safe. Simply ensure you employ additional security measures to your wallet, including face ID, two-factor authentication, and more. And do not share your private keys with anyone, as this will give them access to your wallet.

How to Store Your Crypto with a Wallet?

As mentioned above, many crypto investors prefer securing their cryptocurrencies in a digital wallet. You first need to select a secure and reputable hot or cold wallet like the ones we recommend above. Then, set it up using your personal details and password. You can also add more security measures to your wallet, like 2FA and biometrics, to avoid unauthorised access.

Once your wallet is activated, you are free to transfer funds to it from a crypto exchange. Note that most exchanges integrated with wallets do not charge transfer fees, and you can still use the wallets to buy and sell the digital tokens.

With software or non-custodial hot wallets, users will be given private keys that are presented and 12-word phrases. We advise you to write down this private key and do not share it with anyone. Should you lose your private key and not remember it, you will not have access to the cryptocurrencies you have secured in your digital wallet.

Besides software wallets that are managed online, there are hardware wallets. Also known as cold storage, they are physical devices used to secure your tokens offline. To set up a hardware wallet, you will start by buying one and downloading its software online to activate it. Once active, you are free to transfer your tokens to it and wait to sell them once the prices go up.

How to Choose the Best Crypto Wallet in AU

Before engaging in cryptocurrency trading and securing your digital tokens in a wallet, ensure you make the right choices. Below, we help you identify the best crypto wallet in Australia by sharing some of the elements to consider in your research.

Trading cryptocurrencies online is risky, considering the history of cyberattacks on exchanges and wallets. To trade safely, choose a wallet that is highly encrypted to ensure no one will have unauthorised access to your tokens. Most importantly, the best wallet should ensure you employ additional safety measures like two-factor authentication and face IDs. Some wallets are also regulated by the Australian Securities and Investment Commission (ASIC), which proves their credibility further.

Every trader has their own preference, so choose a wallet supporting your preferred digital currencies. If you meet a wallet accepting multiple tokens, this is a plus. You will enjoy the flexibility of exploring additional securities and efficiently diversifying your portfolio. Some of the cryptocurrencies our recommended wallets above support include Bitcoin, Ethereum, Litecoin, Dogecoin, NFTs, and more.

Confirm the applicable charges on a crypto wallet you prefer. All costs attached must align with your budget to avoid spending more than you had anticipated. Some of the fees to confirm include those for account set-up, maintenance, currency conversion, asset transfer, commissions, and more. There should also be no hidden costs to avoid future surprises.

The best crypto wallet should be user-friendly and have an intuitive design to maximise your experience. Also, check mobile compatibility and make a choice depending on your preference. By managing your tokens on both desktop and mobile devices, it will be easier for you to take care of other personal activities. Plus, settle for one that has additional features like built-in exchanges, staking rewards, dApps support, and more.

The digital wallet you are considering must be backed up by a reliable and responsive support service. Whether the team operates 24/7 or five days a week, it must align with your trading schedule. Plus, they must be accessible via convenient channels, including phone, email, and live chat. You can test a support’s responsiveness and how it handles visitors by contacting them and asking questions.

It is important that you clear all doubts when considering a crypto wallet in Australia. In this regard, visit Google Play, the App Store, and Trustpilot to analyse as many testimonials as you can. The comments and ratings will help you understand an app’s strengths and weaknesses and make a decision based on what works best for you and can accommodate.

Crypto Trading Risks for AU Traders

Success in cryptocurrency trading in Australia does not come overnight. Understand that this investment has inherent risks, which, if not handled strategically, can leave you with losses. Let’s explore below some of the crypto trading risks for Aussie traders.

- Market volatility

The cryptocurrency market is generally highly volatile, meaning that crypto prices constantly change within a short period. If you are not willing to conduct thorough market research and make the best predictions, you may find yourself on the losing end. Take advantage of your exchange’s research resources and only open a position with funds you are comfortable losing.

- Regulatory uncertainty

Australia is taking the necessary measures to regulate cryptocurrency trading in the region. However, the crypto market is still uncertain, and it is challenging to understand what the future holds for it. As a crypto trader or investor, always stay abreast with the latest market developments, especially when it comes to regulatory status, to avoid legal implications.

- Safety risks

There are many online fraudsters looking to take off with innocent traders’ hard-earned money. With cryptocurrency wallets and exchanges managed online, there have been cases of hacking and other cyber attacks. Therefore, whether you select an exchange or wallet, ensure it is highly reputable and secure. Plus, store your private keys safely and employ additional safety to your account, such as two-factor authentication, strong passwords, face ID, and more.

- Liquidity risks

While many cryptos like Bitcoin, USDT, and more are highly liquid, some aren’t. This makes it difficult for you to sell them when you see an opportunity for a profit. Be careful when choosing such cryptos, or stick to the highly liquid ones.

- Cash management risks

We have witnessed many traders lose their money simply because they couldn’t efficiently manage their funds. In trading, we advise you to never base your decisions on emotions like fear, excitement, or greed. Take your time to analyse the market and only open a position when you see an opportunity.

Conclusion

The development of cryptocurrency wallets has saved many investors from losing their digital tokens through cyber attacks. However, not all wallets guarantee maximum safety. With our guide, you will partner with some of the best Australian crypto wallet providers. Simply ensure you make the right choice and do not share your recovery phrase or private keys with anyone. The last thing you want is to have your assets stolen simply because you shared your recovery phrase or private keys with someone you thought you trusted.

Overall, trade cryptocurrencies securely by making moves only when you see an opportunity. Have a plan, conduct thorough research, choose the right token, and track your positions to ensure everything works out as expected.

I personally like to focus on the ones with solid security and ease of use. It’s always good to test a few options and see what feels right for you!

As someone who's been trading crypto for a few years, I can confirm that having a secure wallet like the ones mentioned here is absolutely crucial