Claire Maumo has experience in investment banking, strategic consultancy, and journalism. She has a Bachelor’s degree in Business Management and a Master’s in finance. She has a knack for making complex concepts easy to understand. Her primary focus is on crypto, blockchain, and financial instruments. Follow her for expert insights on trading and investment.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

If you are here, you’ve probably done your research and discovered that Canada hosts hundreds of trading platforms. The numerous options can inconvenience your choice, leaving you confused and wondering which platform to settle with. You must test as many trading platforms as possible and compare them based on various elements such as security, fees, performance, and more. This way, you can identify an option that aligns with your trading needs and guarantees an exciting experience.

Do not fret about undertaking these lengthy research procedures for the best trading platforms in Canada 2025. We did all the legwork and share below the best options for every trader. If you are a beginner, this comprehensive guide also explains what online trading in Canada is all about, how to make suitable choices, and more.

List of the Best Trading Platforms

- Saxo – Overall Best Trading Platform in Canada

- Interactive Brokers – Best Platform for Professional Canadian Traders

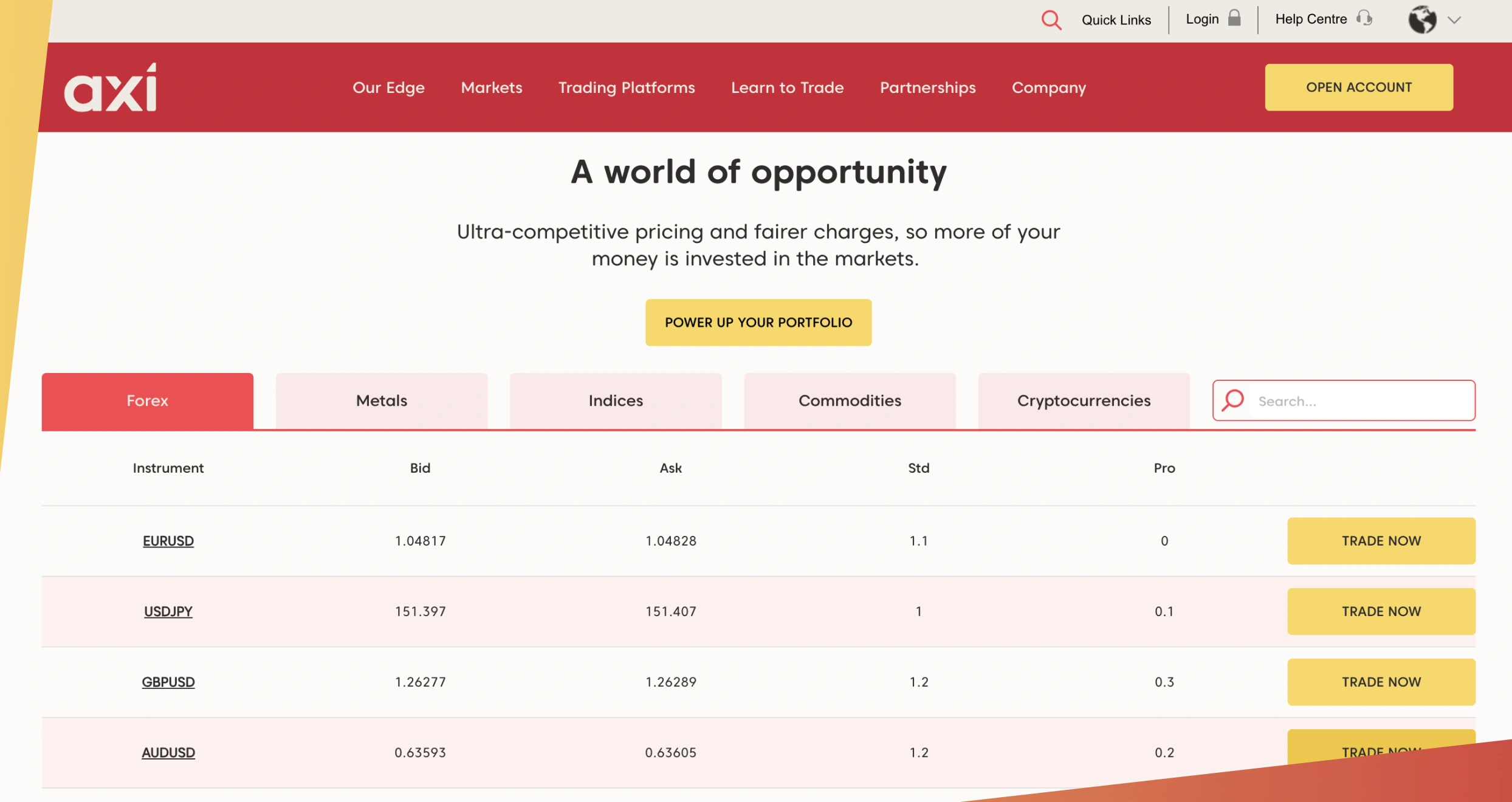

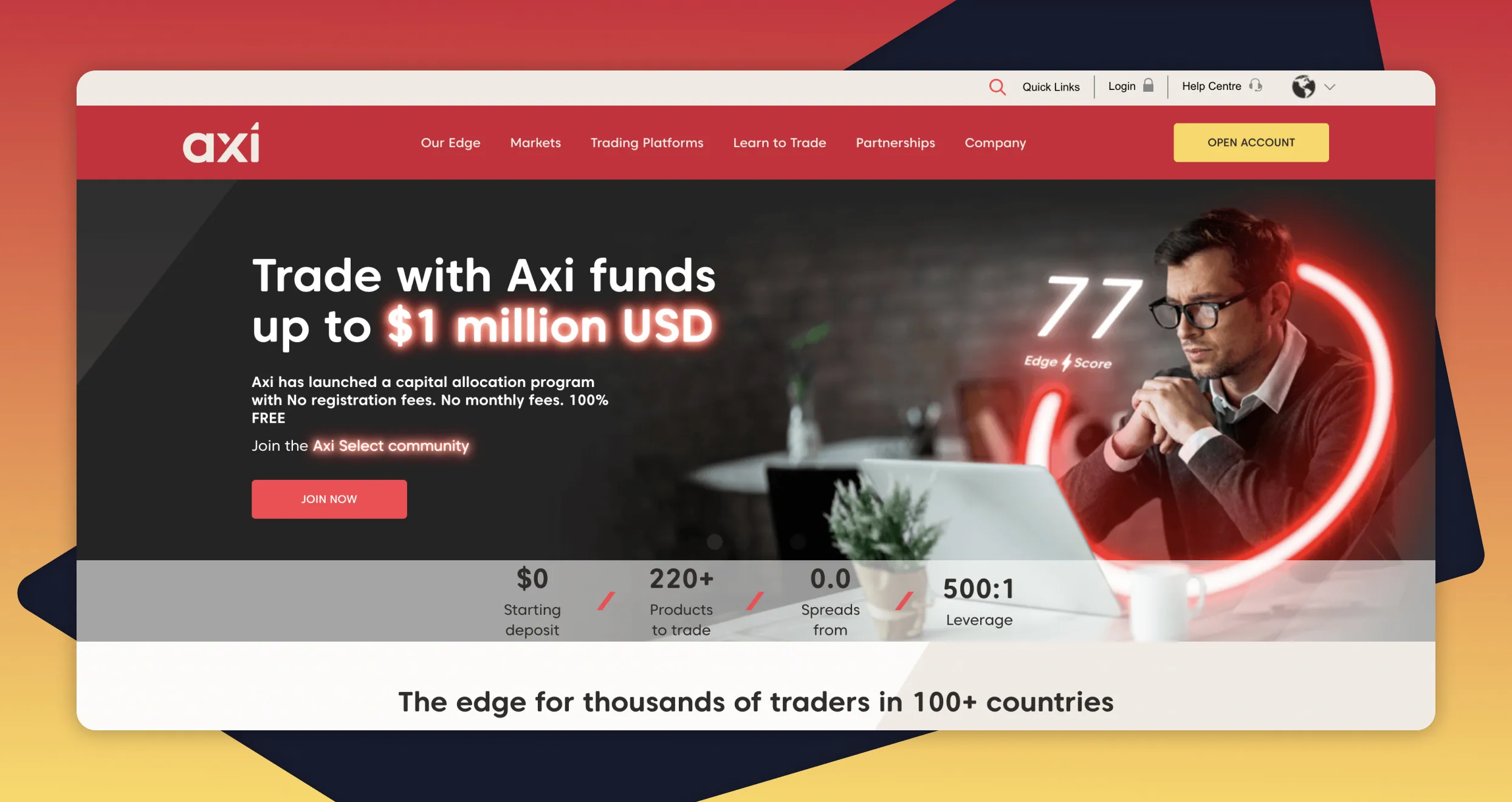

- Axi – Top Option for Copy Trading

- AvaTrade – Beginner-friendly Trading platform in Canada

- XTB – Cheapest Trading Platform in Canada

- OANDA – Top Platform For MT4 Users

Canadian Trading Platforms: Comparison Table

Our market research for the best trading platforms Canada was lengthy and took hours to complete. We sampled hundreds of CIRO-regulated platforms and tested them based on various elements. We also compared them so we could easily shortlist those that met our specifications.

Since we strive to remain unbiased in our research, we visited Google Play, the App Store, and Trustpilot to sample user testimonials. Combining our findings with the test results, we settled on the platforms referenced in this guide as the best.

Feel free to explore our comparison table below, which shows the features of our top Canadian trading platforms. We hope you will be able to identify what best suits your trading requirements.

| Trading Platform | License & Regulations | Support Service | Software | Payment Method | Demo Account |

|---|---|---|---|---|---|

| Saxo | FCA, ASIC, CIRO, FSA, MAS, CBI, SFC | 24/5 | SaxoTraderGO, SaxoTraderPRO, SaxoInvestor | Bank Transfer, Credit/debit cards, PayPal | Yes |

| IBKR | CIRO, FCA, SEC, FINRA, ICS, CBH, ASIC, SFC, MAS | 24/5 | IBKR Desktop, IBKR Trader Workstation (TWS), IBKR Mobile, IBKR GlobalTrader | Check, wire transfer, direct bank transfer (ACH) | Yes |

| Axi | FCA, CySEC, ASIC | 24/7 | MT4 | Credit/debit cards, PayPal, International bank transfer, Domestic bank transfer | Yes |

| AvaTrade | CBI, FMA, FCA, FSCA, CySEC, CIRO, PFSA, ASIC, FSC, FSA | 24/5 | WebTrader, AvaOptions, AvaTrade App, MT4, MT5, Automated Trading | Credit/debit cards, Neteller, Skrill, Wire transfer, WebMoney | Yes |

| XTB | FCA, KNF, CySEC, CIRO, BaFin, IFSC | 24/5 | xStation 5, MT4 | Bank Transfer, Credit/debit cards, PayPal | Yes |

| OANDA | CIRO, FCA, CFTC, ASIC, FSA | 24/5 | OANDA Platform, MT4, MT5 | Bank Transfer, Credit/debit cards, PayPal | Yes |

Platforms Short Overview

When searching for the best trading platforms in Canada, you must consider various elements. While we will discuss these features later in this guide, let’s first understand the applicable fees and assets offered by our top platforms. We noticed that these features are the most prioritized by users and want to ensure you get an affordable platform hosting the right securities.

Fees

| Trading Platform | Minimum Deposit | Commission/Spreads | Deposits/Withdrawals | Inactivity Fee |

|---|---|---|---|---|

| Saxo | C$0 | From 0% commission | Free | None |

| IBKR | C$0 | From 0.1 pips | Free | None |

| Axi | C$5 | From 0 pips* on Pro accounts | Free | C$10 monthly |

| AvaTrade | C$100 | From 0.8 pips | Free | C$50 after every 3 months of inactivity |

| XTB | C$0 | From 0% commission | Free | C$10 monthly |

| OANDA | C$0 | From 1 pip | Free | C$10 monthly |

*Commission charges apply.

Assets

| Trading Platform | Stocks | Forex | Crypto | Commodities | Indices | ETFs | Options |

|---|---|---|---|---|---|---|---|

| Saxo | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| IBKR | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Axi | Yes | Yes | No | Yes | Yes | No | No |

| AvaTrade | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| XTB | Yes | Yes | Yes | Yes | Yes | Yes | No |

| OANDA | Yes | Yes | Yes | Yes | Yes | Yes | No |

Our Expert Opinion about Trading Platforms

As mentioned earlier, we did thorough market research ourselves before coming up with these broker recommendations. Below, we share our mini-reviews and expert opinions about these top trading platforms in Canada. We have categorized each platform based on what we believe they excel at to ensure you choose the one that will give you the maximum experience.

1. Saxo – Overall Best Trading Platform in Canada

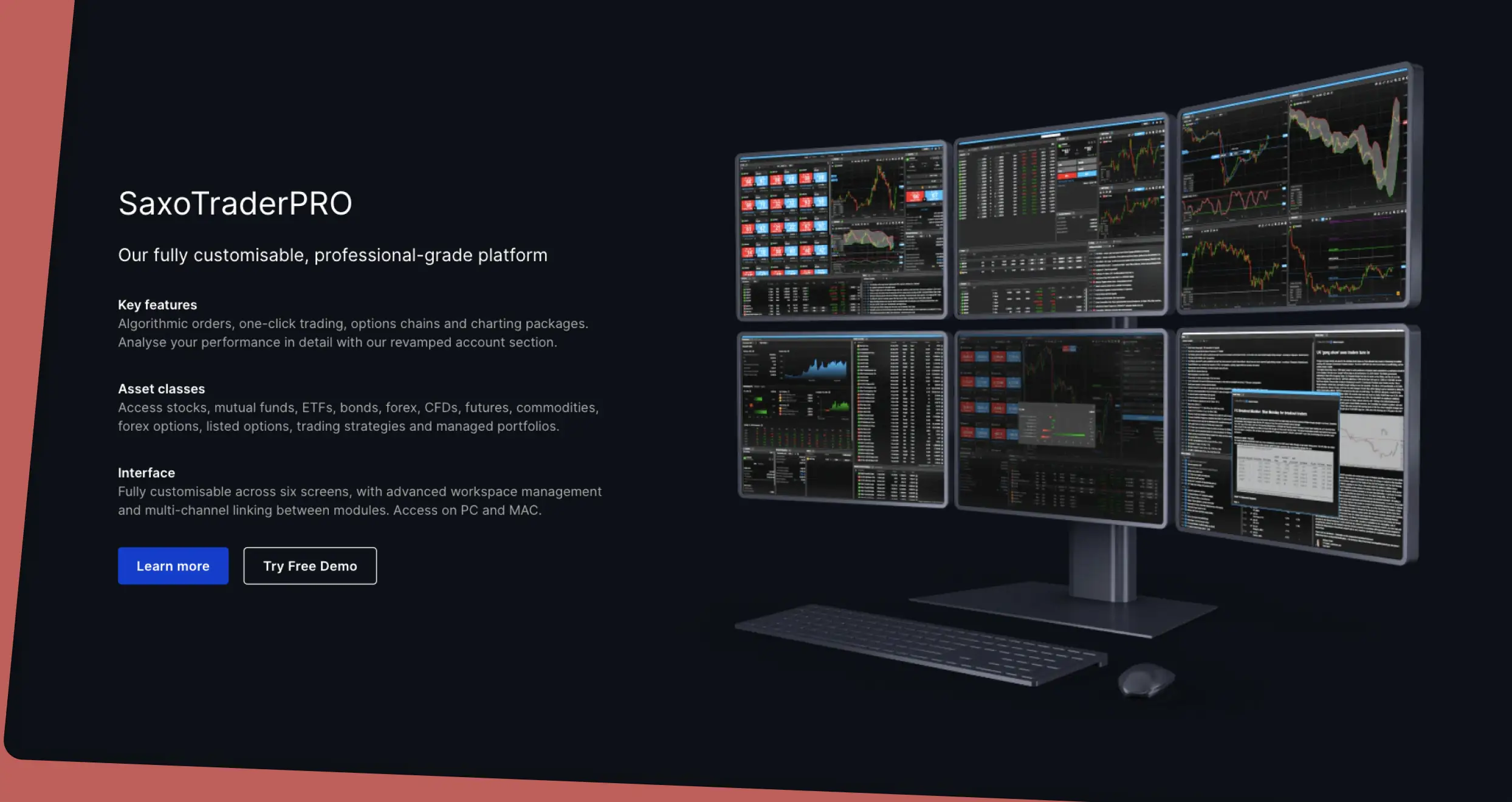

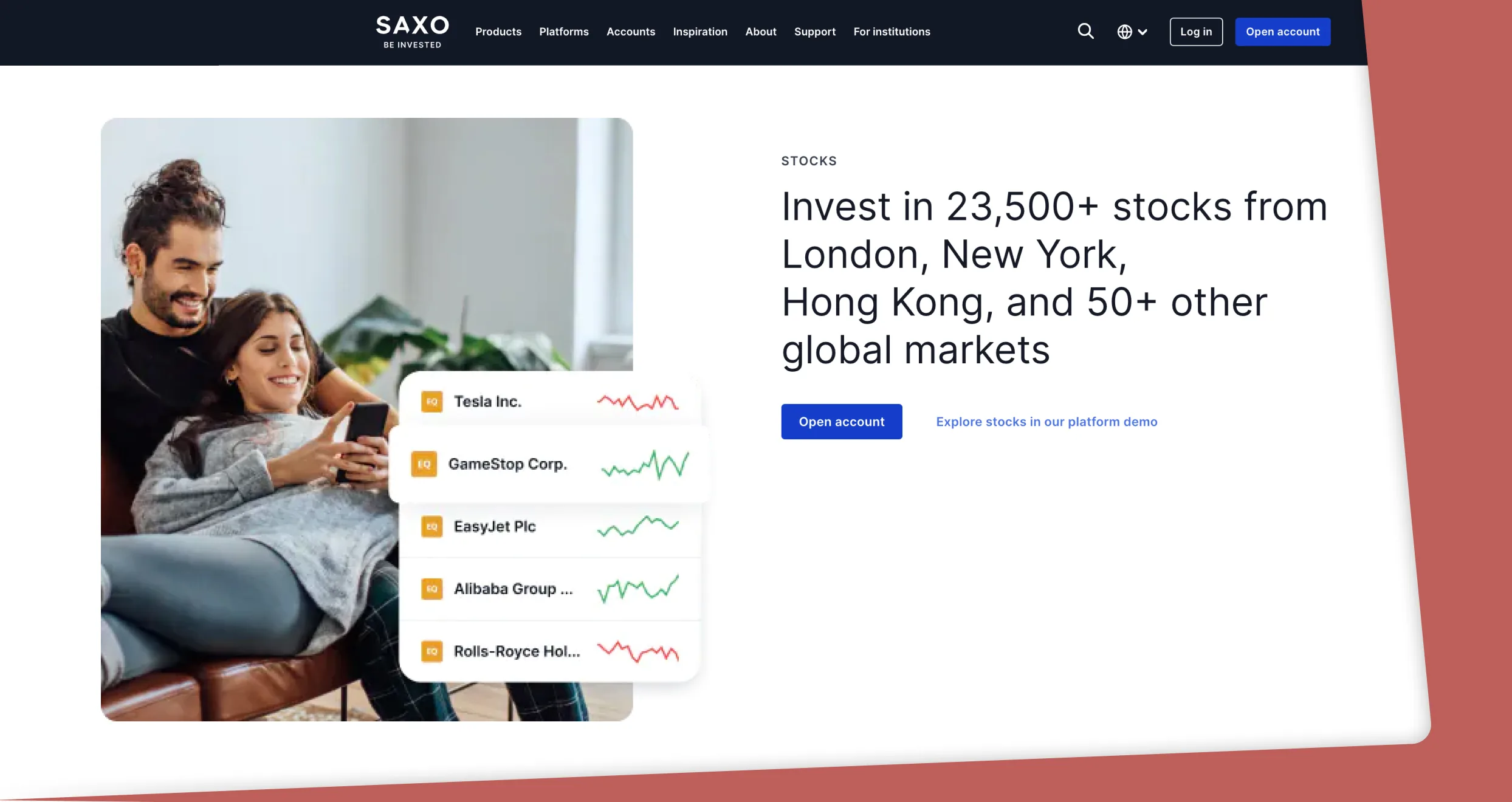

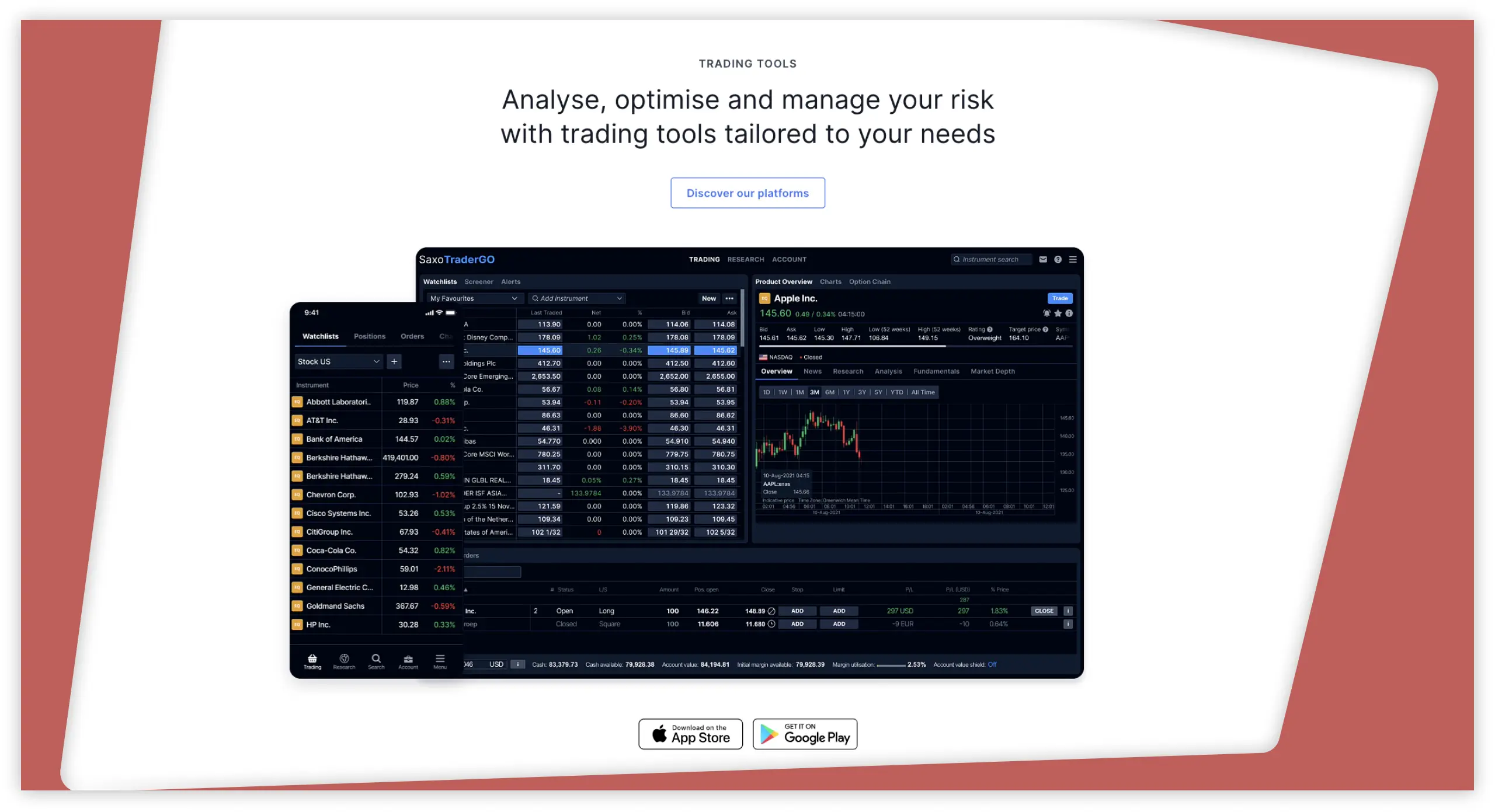

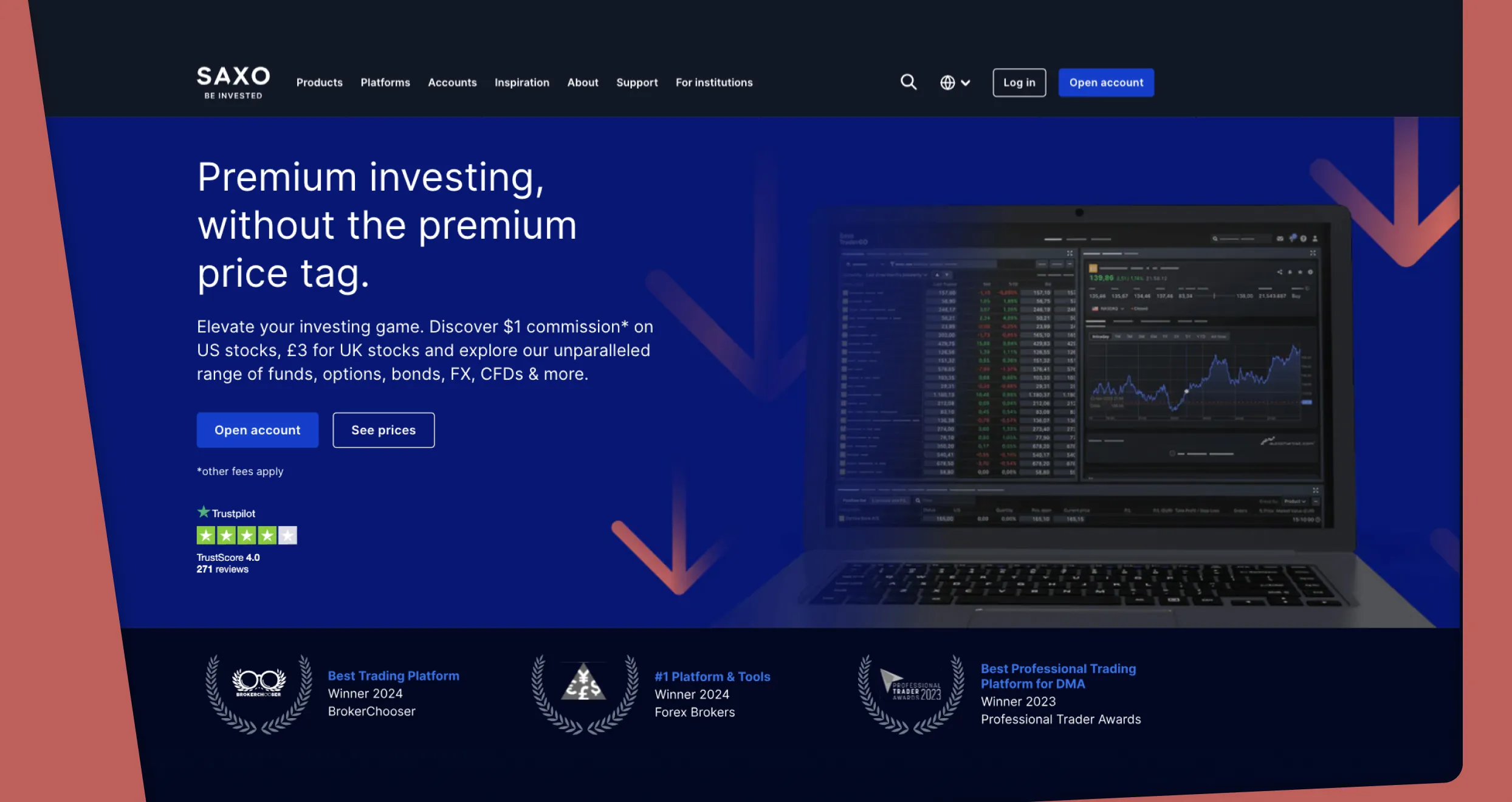

Among the trading platforms we tested for Canadian traders, we found Saxo to be an excellent choice for this category. This is because its features and services accommodate all types of users, whether newbies or professionals. It not only has a user-friendly and intuitive design platform but is also customizable and has fast trade execution speed. We also like its SaxoTraderGO app, which has proven efficient when it comes to managing mobile trading activities. Canadian traders can start using Saxo with any amount of capital they can afford since there is no minimum deposit requirement.

Saxo is highly secured and regulated by multiple tier-one authorities, including CIRO, FCA, and more. Its advanced resources on its SaxoTraderPro and SaxoInvestor platforms make it easier for users to access everything they need on a single platform. Moreover, there are multiple accounts for all traders, hosting over 71,000 instruments, including stocks, forex, ETFs, bonds, and more. For newbies, this provider has a demo account with C$100,000 virtual funds for you to test it with and decide whether it is worth your commitment.

Pros

- Charges low trading fees with commissions from C$1 on US-listed stocks

- No minimum deposit requirement

- No inactivity fee

- Plenty of learning and research materials

- Allows you to invest in global stocks and take full ownership

Cons

- Its demo account is only available for 20 days after activation

- There are no third-party platforms like the MT4/5

2. Interactive Brokers – Best Platform for Professional Canadian Traders

If you are a professional Canadian trader looking for a reliable platform with advanced resources, then you should consider Interactive Brokers (IBKR). According to our analysis, there are vast market analysis tools on its multiple hosted platforms. These include 90+ order types, comprehensive reposting, event calendars, news feeds, and more. Additionally, IBKR has no minimum deposit requirement, allowing advanced traders to easily get started. Its low commissions also allow you to manage multiple positions without worrying about overspending.

There are over 10,000 securities at IBKR to trade and diversify your portfolio with. Besides the desktop platforms, we like its user-friendly IBKR GlobalTrader app, which we believe any new trader will find useful. The best part is that IBKR offers an amazing Free Trial account for testing it out with before deciding whether it is worth your commitment. And when it comes to learning resources, rest assured of a comprehensive supply that will keep you engaged long-term.

Pros

- It has no minimum deposit requirement

- Hosts multiple platforms, including Trader Workstation, IBKR Desktop, IBKR Mobile, and IBKR GlobalTrader, with quality trading tools

- Features IBKR APIs, which allows you to automate your activities and create your own custom trading solutions

- Lists over 10,000 securities, including forex, stocks, ETFs, futures, mutual funds, and more

Cons

- There are no third-party platforms like the MT4/5

- Many users find its desktop platform a challenging one for newbies to use

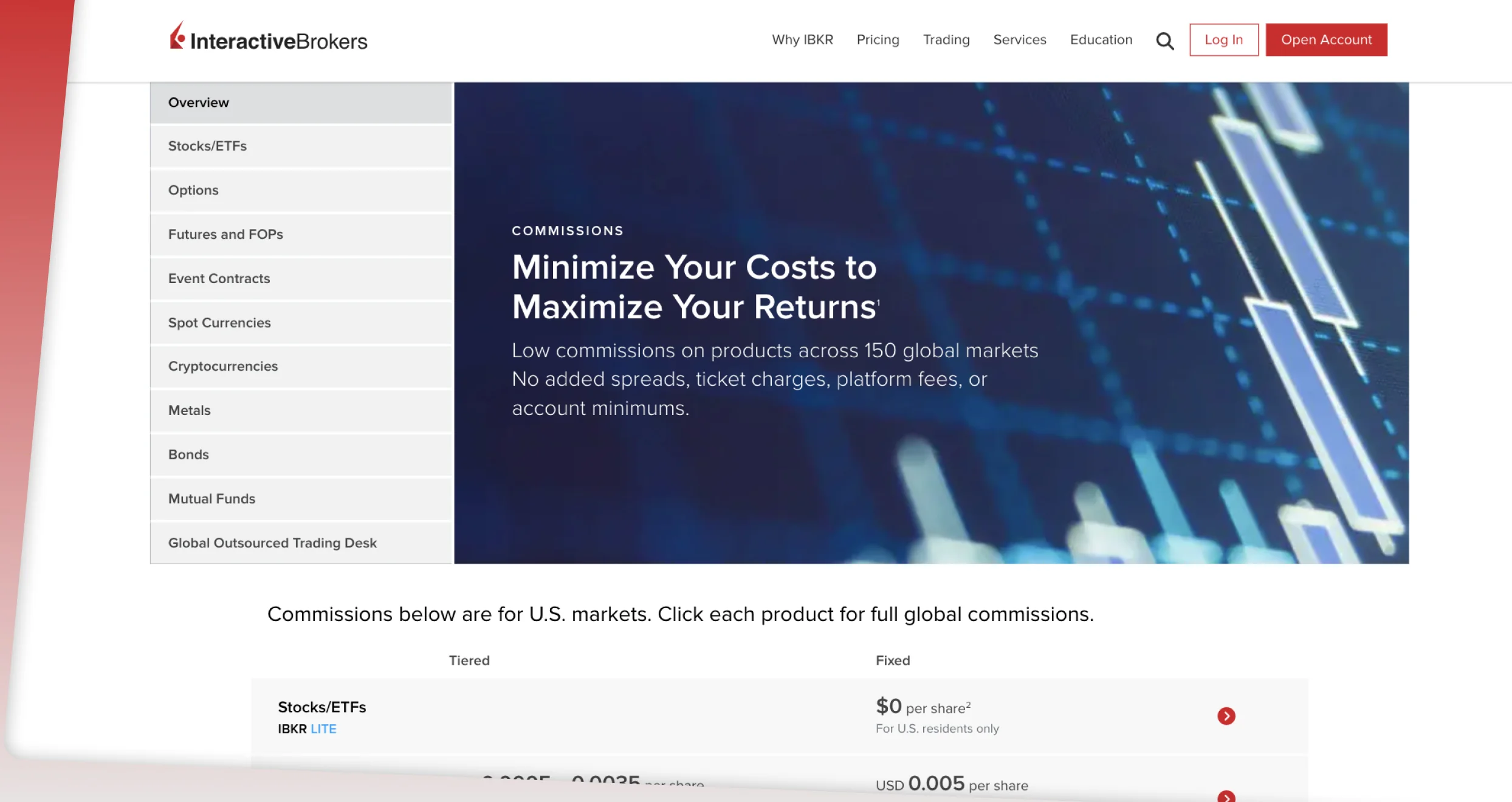

After conducting thorough research and extensive assesments, we can confidently categorize Interactive Brokers as one of the most affordable service providers out here. As we’ve already mentioned, this company has no minimum deposit requirement. Plus, it allows traders to fund their accounts with payment methods like ACH and wire transfer at no additional cost. We also highly recommend IBKR because, unlike other brokers, it doesn’t require traders to pay inactivity fees for dormant accounts.

Here’s an overview of the Interactive Brokers fees and charges our team unearthed during our evaluation and exploration:

| Type | Fee |

|---|---|

| Account opening and maintenance | $0 |

| Deposit | $0 |

| Withdrawal | Yes |

| Inactivity | $0 |

| Overnight charges | Yes |

| Currency conversion | 0,5% |

3. Axi – Top Option for Copy Trading

Copy trading has helped many traders, especially newbies, get comfortable with investing in the financial space. While it doesn’t guarantee profits, following and copying expert traders’ positions maximizes your potential. With Axi, copy trading offers a simple way to discover new trading opportunities and develop your trading skills. I discovered that the service is free, and you get to copy as many signal providers as you can.

Another impressive element about Axi’s copy trading is that it doesn’t limit the features you get to enjoy. For instance, you can copy trades across all featured 260+ instruments. You can also link it to your MT4 account and enjoy added features for an exciting experience. On top of that, copy trading is automated. All you have to do is find a trader to follow, adjust your trade size and risk tolerance, and copying will automatically begin.

I like that Axi has the interest of all traders in mind. While experts get advanced resources on the MT4 platform, beginners have quality learning resources at their disposal. These include articles, courses, guides, videos, and more. Plus, a reliable 24/7 support service is a call or message away for assistance or guidance.

Pros

- No restrictions on accessing the copy trading platform

- You get to trade over 260 CFD instruments

- Quality learning and research materials

- A user-friendly and intuitive desktop and mobile platform

- Multiple accounts to choose from

- Has an “Axi Select” feature that allows you to manage larger positions with a small capital

Cons

- Only CFD trading is supported

- The Axi Select program is available for advanced traders only

Promoted by AxiTrader Ltd. CFDs carry a high risk of investment loss. Not available to AU, NZ, EU & UK residents. Spreads and other fees apply.

The Axi Copy Trading App is provided in partnership with London & Eastern LLP. Copying other traders carries inherent risks, such as the possibility of replicating poor trading decisions or copying traders whose objectives, financial situation and needs differ from your own. Any accounts available for copying have not been authorized or approved by Axi.

The Axi Select program is only available to clients of AxiTrader Limited. In dealings with you, AxiTrader acts as a principal counterparty to all of your positions. AxiSelect is not available to residents of AU, NZ, EU, and the UK. For more information, please refer to the AxiSelect Terms of Service.

4. AvaTrade – Beginner-friendly Trading platform in Canada

AvaTrade is one of the most user-friendly platforms for desktop and mobile devices. As a beginner, you will benefit from the platform’s intuitive design and search function, which contributes to easy navigation. From our experience, we discovered a plethora of learning materials for newbies, including articles, guides, recorded videos, webinars, and more. We also find its support service team among the most professional, with relevant solutions to keep you trading for a long time.

AvaTrade has a minimum deposit requirement of C$100, which you get to deposit free of charge. Multiple transaction methods, including debit/credit cards, e-wallets, and bank transfers, are also at your disposal. Moreover, if you want to explore advanced trading tools, AvaTrade has the MT4 and MT5 platforms to cater to your needs. And although its asset offerings are not as comprehensive as its peers, you still have adequate options for your portfolio diversification. These include forex, stocks, bonds, indices, and commodities.

Pros

- Low minimum deposit requirement for Canadian clients

- Free deposits and withdrawals

- Excellent selection of learning materials

- A user-friendly and customizable trading platform

Cons

- You can only trade the assets as CFDs

- Limited asset offerings compared to its peers

Our experts investigated the AvaTrade broker’s fees and charges. We first noticed that the platform has a modest minimum deposit requirement of $100. What’s more, its users pay no additional costs while depositing funds or cashing out. That makes AvaTrade an ideal broker for both cost-conscious and newbie traders who want to test their waters with small capital before going all in.

That said, AvaTrade requires dormant account holders to pay $50 after every 3 consecutive months of inactivity. Moreover, if you let your account remain inactive for over successive months of inactivity, the broker will charge you a $100 administration fee. Not to forget, AvaTrade requires traders who hold positions overnight to cover a premium.

Here’s a breakdown of the fees you should expect to encounter while trading with this service provider:

| Fees and Charges | Amount |

|---|---|

| Spreads | From 0.9 pips |

| Administration fee | $100 |

| Inactivity fee | $50 |

| Overnight premium | Yes |

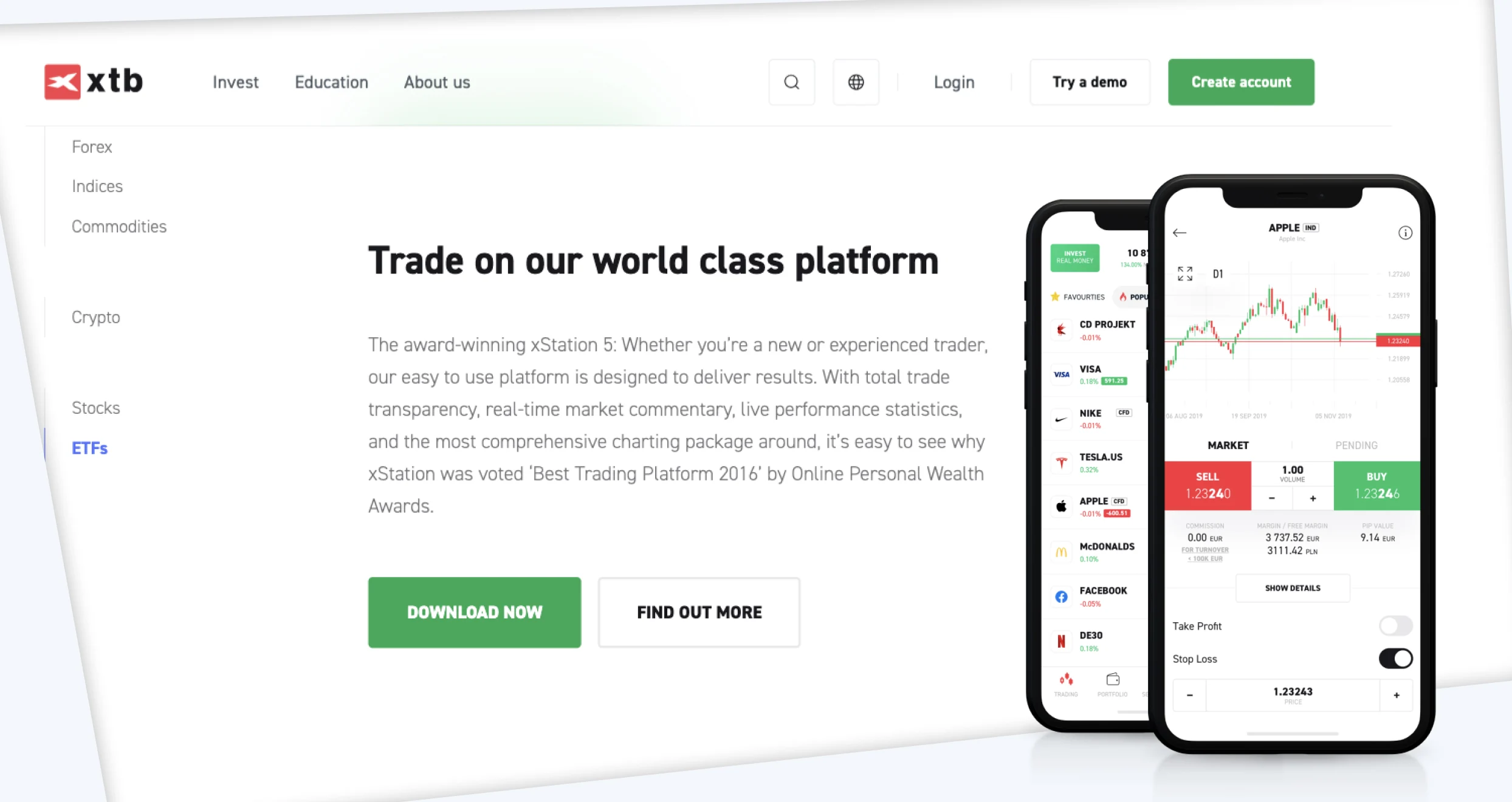

5. XTB – Cheapest Trading Platform in Canada

XTB is another top trading platform we highly recommend to Canadian traders, especially the low-budget ones. We discovered over 6,200 tradable assets across diverse classes, including forex, shares, commodities, indices, and more. We also like the fact that there is no minimum deposit requirement, and all transactions are free of charge. When it comes to trading charges, XTB imposes low commissions, from 0%, on stocks and ETFs, up to 100,000 EUR per month.

Besides being affordable, XTB has quality trading tools for research and skills development. Its award-winning xStation 5 and xStation Mobile platforms ensure you are comfortable enough to face the challenges that await you in the financial space. On top of that, users are given an opportunity to earn up to 5% interest on their uninvested funds and manage their positions with risk management controls like stop-loss and take-profit orders.

Pros

- Hosts diverse asset classes for portfolio diversification

- Low trading fees with commissions from 0%

- Free deposits and withdrawals

- Hosts a virtually funded demo account and plenty of learning materials for newbies

Cons

- No third-party platforms like the MT4/5

- Has an inactivity fee of C$10 monthly after one year of the account’s dormancy

We love XTB because it is one of the most affordable brokers out here. How so? For starters, there are no XTB minimum deposit requirements. Moreover, the broker’s users don’t have to pay additional fees while funding their accounts or cashing out. Most importantly, XTB doesn’t require traders to cover account opening, maintenance, or inactivity fees. In the table below, we’ve highlighted the fees, commissions, and costs you should take note of before committing to XTB.

| Fees and Charges | Amount |

|---|---|

| Account opening and maintenance | $0 |

| Minimum deposit | $0 |

| Deposit fee | $0 |

| Withdrawal fee | $0 for withdrawals above $50; $30 for withdrawals below $50 |

| Investing commission | From 0% |

| Spreads | From 0.3 pips |

| Currency conversion fee | 0.5% |

| Inactivity fee | $0 |

6. OANDA – Top Platform For MT4 Users

The MT4 platform is among the most sought-after, considering its vast, advanced resources for currency trading. If you are seeking a provider hosting this platform, OANDA is your best option. From our experience, its MT4 trading platform is user-friendly with a modern design to maximize your experience. Moreover, OANDA features an MT4 premium upgrade platform with powerful forex and CFD indicators. And the best part is that you can trade on the MT4 platform using your desktop or mobile device. All you have to do is deposit any amount you can afford to get started since OANDA has no minimum deposit requirement.

From our analysis, OANDA is suitable not only for MT4 users but also for other types of traders. We like its welcome bonus deals that give newbies an opportunity to maximize their experience. There are also various account types, including Elite Trader and Regular, catering to all types of traders. Other platforms to explore include OANDA Web, TradingView, and OANDA Mobile. You can test the broker via its demo account to determine whether it aligns with your trading requirements.

Pros

- No minimum deposit requirement

- A user-friendly and modern-design platform

- Quality learning and research materials

- Various account types and platforms to choose from

Cons

- Its trading fees are higher compared to most of its peers

- You can only trade the assets as CFDs

OANDA broker has a clear fee structure with no hidden charges. This makes it easier for you to know how much you will be paying once you make a commitment. Some of the fees to incur at OANDA include the following:

| Trading and Non-Trading Charges | Details |

|---|---|

| Account Opening | $0 |

| Management Fee | $0 |

| Minimum Deposit Requirement | From $0, depending on your jurisdiction |

| Commission | From 0% on US-listed shares |

| Spreads | From 0.6 points |

| Deposits and Withdrawals | Free deposits. Withdrawal fees apply based on the payment method used |

| Inactivity | $10 after 12 months |

| Overnight Funding | Varies based on global market conditions |

| Currency Conversion Fee | Calculated by applying a 0.5% mark-up or mark-down |

Trading in Canada

Trading in Canada has proven to be lucrative, considering the opportunities available. The activity is legal, and you can venture into forex, stocks, commodities, cryptos, and more using a brokerage firm like the ones we recommend above. With a broker or platform, you will have access to diverse assets plus quality trading tools for skills and strategy development.

The Canadian Investment Regulatory Organization (CIRO) is responsible for overseeing the region’s financial market activities. This means that any broker regulated by this authority is worth considering, as you are guaranteed maximum safety and favorable conditions. With trading, there is no profit guarantee, so you must be strategic and have solid plans for an increased profit potential.

Under tax regulations, Canadian traders must pay capital gains tax to the Canada Revenue Agency (CRA) on all profits earned from trading. This is because, unlike some countries that consider trading a gambling activity, Canada considers it a business activity. Therefore, include potential tax deductions when planning for our activities to understand potential returns should a trade work out in your favor.

What is a Trading Platform?

A trading platform is an online space that allows traders to explore various financial market instruments, including shares, commodities, forex, and more. Platforms come in different forms to meet all traders’ needs and requirements. Moreover, they allow trading in various strategies, whether day trading, scalping, or more. Some platforms also give users access to global stock exchanges, where they can buy company equities and take full ownership.

Simply put, trading platforms give you easy access to the financial markets. Therefore, it is crucial to select a suitable option by considering the elements below for a worthwhile experience.

How to Choose the Best Trading Platform in Canada

Canada’s financial landscape is dynamic, hence the need for the best trading platform. As a newbie, conduct thorough market research and consider the elements below for a suitable choice.

In Canada’s financial landscape, legitimate and fraudulent trading platforms exist. We have witnessed many individuals get scammed simply because they were attracted to enticing offers. As a trader, it is crucial to stick to trading platforms that are regulated within Canada and other global regions. The Canadian Investment Regulatory Organization (CIRO) oversees the financial activity of brokerage firms in the region. Therefore, platforms that are licensed and regulated by it guarantee an exciting and secure trading experience. Your funds will be secured in a segregated bank account, and you will trade under favorable conditions.

Choose a trading platform you can afford to avoid spending more than what you had budgeted for. Thoroughly analyze a platform’s fee structure and confirm charges like commissions/spreads, inactivity fees, deposits and withdrawal costs, overnight funding fees, and more. It is also vital to check a platform’s minimum deposit requirement and ensure affordability.

The best trading platform in Canada will be user-friendly and have fast trade execution. Plus, check the customizability feature to guarantee long-term commitment. And for effective market analysis, ensure your platform hosts adequate research tools. It must also supply users with learning materials and a demo account for continuous learning. If you are into mobile trading, your platform should have an app you can easily download and use on your Android or iOS mobile device.

Every trader has a favorite asset to explore, whether forex, shares, commodities, cryptos, or more. Regardless of your choice, the platform you select must host it and support the trading style you prefer. This is whether you want to buy the asset and take full ownership or trade it as a derivative. Platforms with numerous options are worth prioritizing, as they make it easier for you to try new options and diversify your portfolio.

Challenges while trading will always occur, whether you are new to trading or have been venturing into this landscape long-term. It is crucial to stay safe by choosing the best Canadian trading platform with a reliable support service. Contact your preferred platform’s support team and gauge their responsiveness. They must be prompt and offer relevant solutions to ensure your open positions do not get affected. Plus, the team’s availability must align with your trading schedule, whether 24/7 or five days a week.

Besides checking and comparing platforms’ features, visit Google Play, the App Store, and Trustpilot to analyze user testimonials. Previous and current user opinions will enlighten you more about a platform’s services from a user perspective. As a result, you will easily make a suitable choice.

Trading Risks for Canadian Traders

While trading in the financial landscape has proven lucrative, success is not a walk in the park. There are various risks associated with trading in Canada, including the following:

- Leverage risks

Trading with a CIRO-regulated platform gives you an opportunity to apply leverage in your trades. While this feature can maximize your returns, there is a risk of losing more than your initial capital. It is always crucial to understand what leverage trading is all about and have a solid strategy before incorporating it into your activities.

- Volatility risks

The financial market can be highly volatile due to developing political or economic conditions. With high volatility, asset prices tend to constantly change. This makes it challenging for traders to make the best predictions or the right moves with their open positions. While market volatility can work in your favor, the risk of losing money is also there.

- Cash management risks

The development of internet-enabled mobile devices has made it easier for traders to explore the financial market. However, many do not have solid plans and open positions based on emotions, which always cloud judgment. As a result, they end up overspending and exhausting their nest eggs, leaving them emotionally distressed and frustrated.

- Liquidity risks

Some assets in the financial space are highly liquid, and getting markets for them when needed is easy. There are also illiquid assets, which are highly risky considering their low demand. Exiting a position with an illiquid asset at a fair price can be challenging.

- Security risks

Trading instruments like cryptocurrencies have regulatory uncertainties, leaving traders with no protection or insurance on their lost funds. Plus, the history of hacking digital tokens makes the market a risky one to venture into.

Pros & Cons of Trading with Trading Platform

Before you start trading in the Canadian financial space, you must be familiar with the pros and cons of using a trading platform for your activities. Some of the benefits and drawbacks worth noting include:

| Pros | Cons |

|---|---|

| Trading platforms give you access to financial instruments, including forex, shares, cryptos, and more. | There is no profit guarantee while trading since the market can be highly volatile sometimes. |

| With a trading platform, it’s easy to analyze the market and boost your skill level. This is because of the availability of quality research and learning materials. | While leverage can give you good profits, it can also leave you with massive losses. |

| Trading platforms expose you to leverage trading, which can yield good profits. You will manage a larger position with a small capital. | Not all platforms will meet your needs; hence, there is a need for thorough market research. The process can be lengthy and overwhelming. |

| A trading platform makes it easier for you to explore multiple assets and diversify your portfolio. | |

| CIRO-regulated trading platforms offer a safe environment and favorable conditions. |

Conclusion

Trading in Canada is all about taking risks, hoping your strategy will work out in your favor so you can earn profits. Since there is no profit guarantee, choose the best trading platform like the ones we recommend above for an exciting experience. Such platforms are safe and support you with quality resources. It is also essential to have a plan and start trading with funds you are comfortable losing. You can utilize a platform’s demo account to familiarize yourself with the financial market and gauge your skill level. And when you begin live trading, use a journal to note all your strategies so you can easily identify your weaknesses and work on them.

Great breakdown of the platforms! If you're just getting your feet wet, AvaTrade or XTB could be a good starting point

I’ve tried a few of these platforms, and Saxo really stands out for me