Claire Maumo has experience in investment banking, strategic consultancy, and journalism. She has a Bachelor’s degree in Business Management and a Master’s in finance. She has a knack for making complex concepts easy to understand. Her primary focus is on crypto, blockchain, and financial instruments. Follow her for expert insights on trading and investment.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

Canada is one of the best places to trade forex for multiple reasons. To begin with, this activity is highly regulated by numerous authorities in the country, including the Canadian Investment Regulatory Organization (CIRO) and the Canadian Securities Administrators (CSA). It’s also supervised by myriad provincial authorities, like Ontario’s OSC and Quebec’s AMF.

If you are considering trading forex, dive in without any fear. CIRO and the other authoritative bodies have paved the way; you’ll enjoy fair practices, protection, and security. In most cases, your money will also be insured against issues like broker insolvency. Trade with any of the heavily regulated Canadian forex brokers I’ve recommended below to enjoy these and many other perks.

List of Forex Brokers

- Forex.com – Overall Best in Canada

- OANDA – Top for MT4 Users

- AvaTrade – Most Beginner-Friendly Forex Platform in Canada

- XTB – Cheapest Forex Trading Platform in Canada

- Interactive Brokers – Top Forex Broker for Professional Canadian Traders

Compare Platforms Table

I had first to conduct diligent research to ensure I recommend what I believe will benefit our readers. I started by collecting as many CIRO-regulated brokers as possible. Then, I put them through multiple tests while comparing their features, such as fees, demo accounts, currency pair availability, support service, and more, and shortlisted the most outstanding.

After shortlisting potential candidates, I analyzed user testimonials on Google Play, the App Store, and Trustpilot. Finally, I rated the chosen brokers and picked the top 5. Combining the results of all these processes enabled me to remain unbiased and only share brokers based on their features and services. Here is a brief comparison of the frontrunners:

| Best Forex Broker Canada | License & Regulation | Minimum Deposit | Commission & Spreads | Support Service | Software | Payment Method | Demo Account | Money Insurance |

|---|---|---|---|---|---|---|---|---|

| Forex.com | CIRO (Canada), FCA (UK), CFTC (US), CySEC (Cyprus), NFA (US), CIMA (Cayman Islands), FSA (Japan), MAS (Singapore), ASIC (Australia) | C$100 | From 0.0 points | 24/5 | WebTrader, Mobile App, MetaTrader 4, MetaTrader 5, TradingView | Credit/ debit card, Wire transfer | Yes | Yes |

| OANDA | CIRO (Canada), FCA (UK), CFTC (US), MAS (Singapore), ASIC (Australia) | C$0 | From 0.6 points | 24/5 | OANDA Mobile, OANDA Web, TradingView, MT4 | Debit card, Bank wire transfer, PayPal | Yes | Yes |

| AvaTrade | CIRO (Canada), CBI (Ireland), CySEC (Cyprus), PFSA (Poland), ASIC (Australia), FSA (Japan), FSCA (South Africa), ADGM (Abu Dhabi), ISA (Israel) | C$100 | From 0.5 pips | 24/5 | WebTrader, AvaOptions, AvaTrade App, Mac Trading, MT4, MT5, Automated Trading | Credit/debit card, Google Pay, Bank transfer | Yes | Yes |

| XTB | CySEC (Cyprus), FCA (UK), IFCS (Belize), CNMV (Spain), AMF (France), KNF (Poland) | C$0 | From 0.1 pips | 24/5 | XStation 5, xStation Mobile App | Bank transfers, Paysafe, PayPal, credit/debit cards | Yes | Yes |

| Interactive Brokers | CIRO (Canada), CFTC (US), SEC (US), FINRA (US), NFA (US) | C$0 | From 0.01 pips | 24/5 | Client Portal, IBKR Desktop, IBKR Mobile, Trader Workstation (TWS), IBKR GlobalTrader, IBKR APIs | ACH, Wire transfer, Check, Wise, Bank Transfer/ SEPA, BPAY | Yes | Yes |

Brokers Reviews

Below, I’ve shared my expert opinion about the best forex brokers in Canada. These mini-reviews are based on first-hand experience and hours of research. My goal is to make sure you know what each broker has to offer and make a suitable choice.

Note that I have covered the most crucial details here. After picking what seems to be the most fitting forex broker Canada has to offer, please visit the company’s official site and scour through every little detail just to be sure.

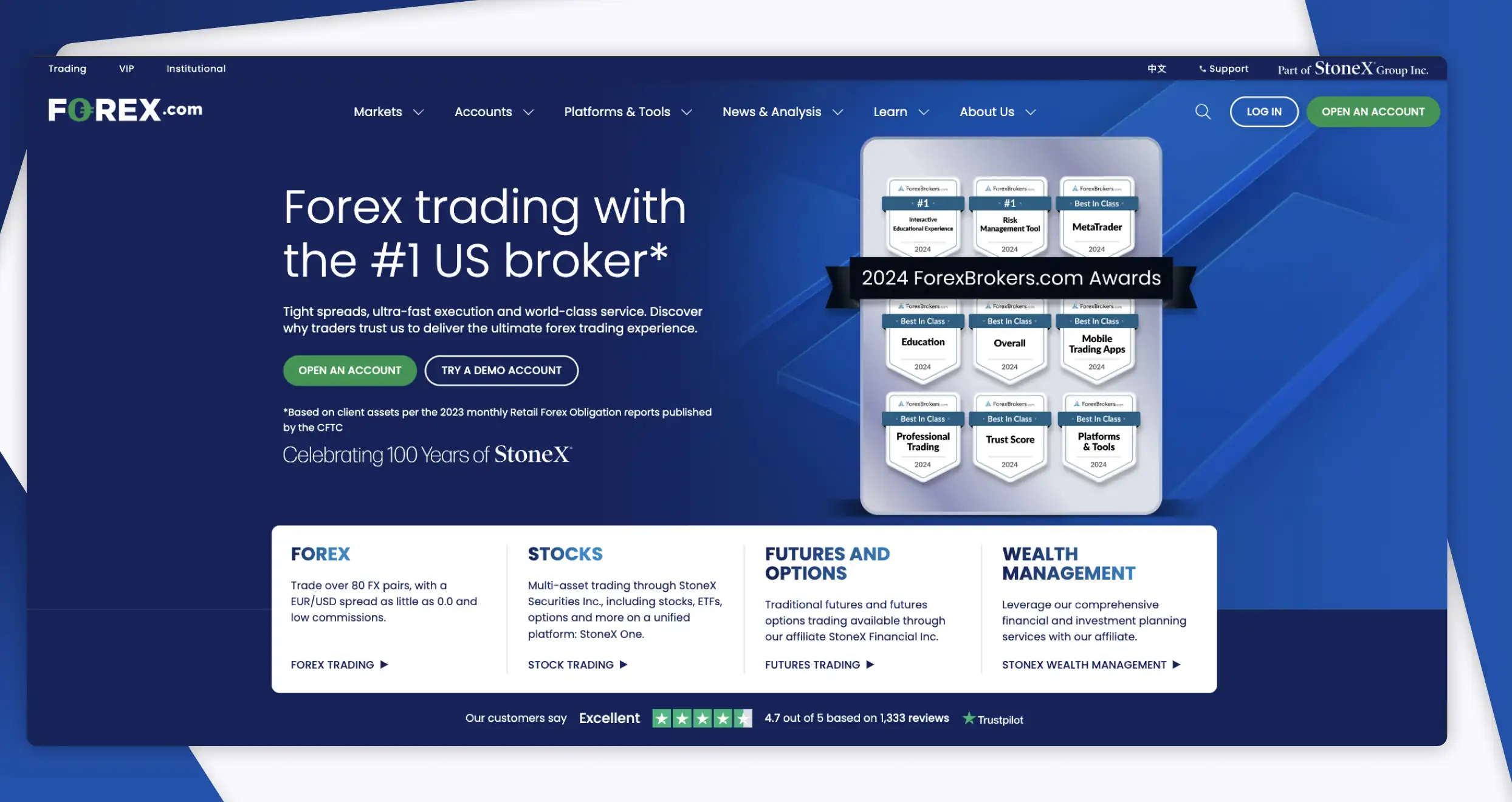

1. Forex.com – Overall Best in Canada

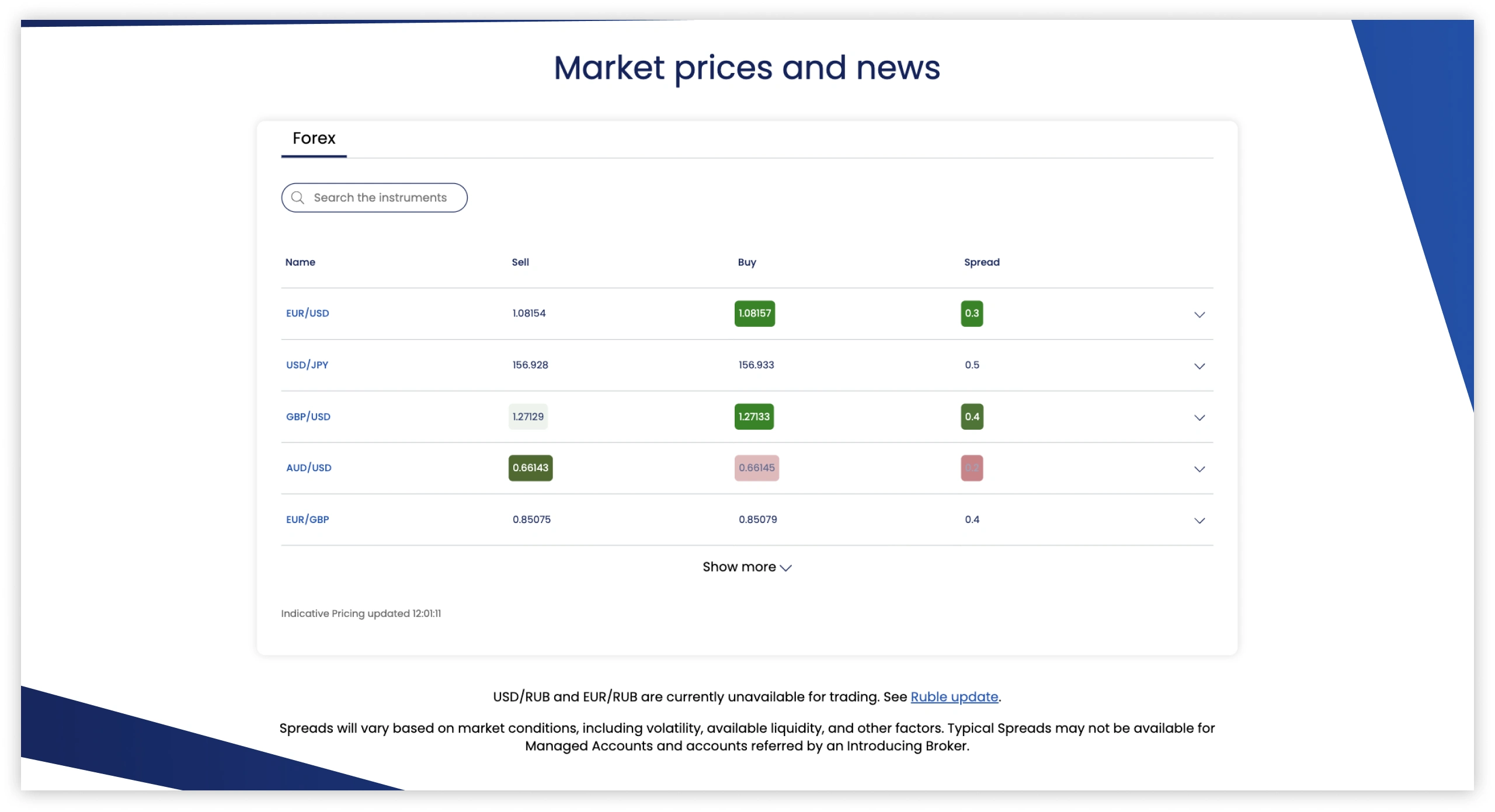

Forex.com is one of the brokers with the most user-friendly interface I’ve ever encountered. Based on my seamless experience while trading with it, it’s perfect for both new and professional forex traders. I also like its commission-free trades on forex trading and low spreads from 0.0 pips on major currency pairs.

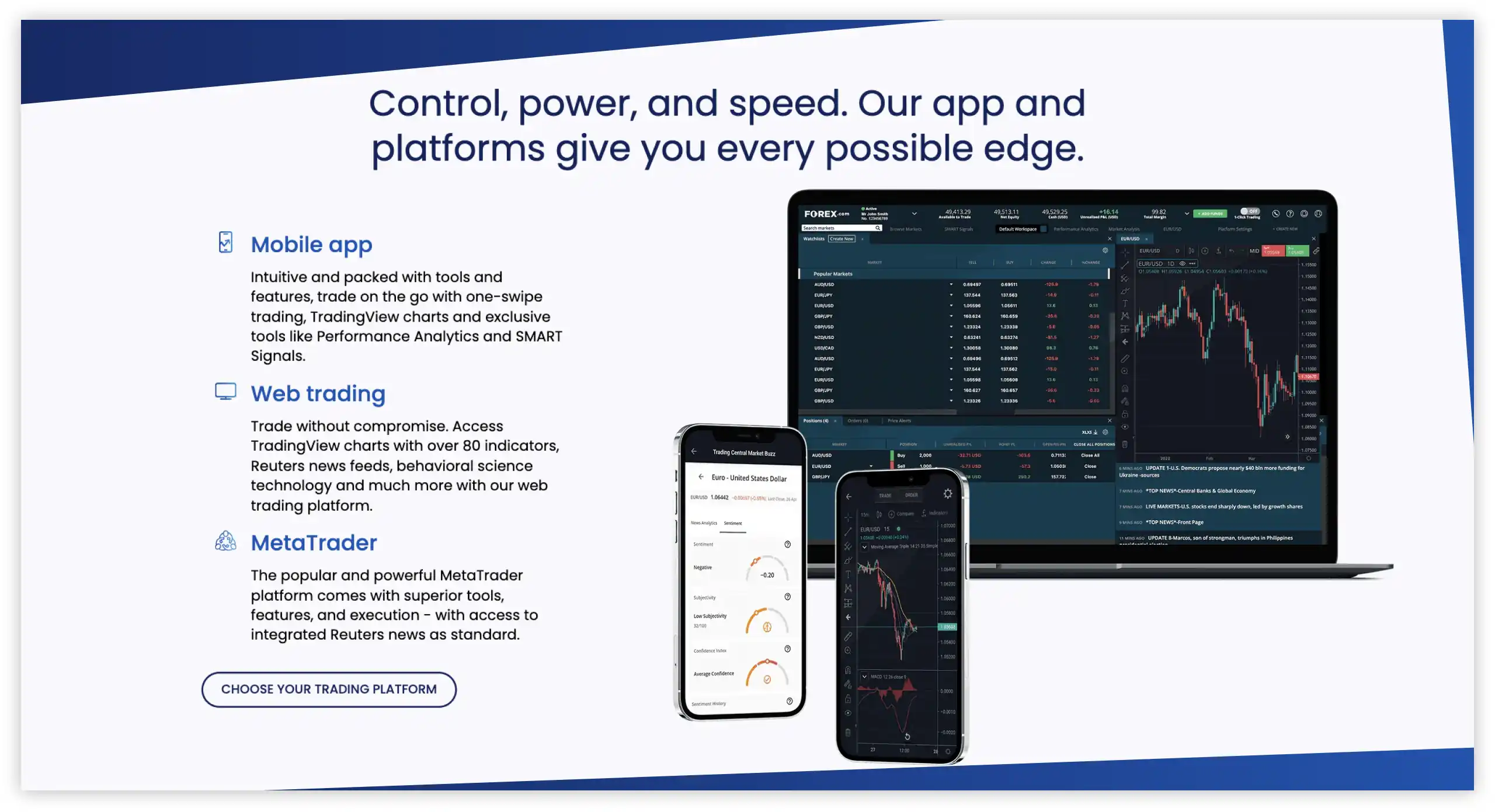

Plus, my experience with its trading app was seamless. Its search function made it easier for me to navigate its features on both Android and iOS devices. And when it comes to the choicest platforms, you can rely on Forex.com’s options, including the MT4, TradingView, and MT5 platforms.

Overall, I explored over 80 currency pairs at Forex.com, including majors, minors, and exotics. As a Canadian, you’ll get ample chances to trade CAD pairs, ranging from USD/CAD and CAD/NOK to AUD/CAD, CAD/JPY, and CAD/CHF. There are also plenty of securities for diversification on the platform, including CFDs on indices, crypto, and precious metals.

In addition, plenty of forex learning resources, such as articles, guides, recorded videos, and more, help in skills development. If you’re a newbie, these will come in handy. When you are ready to trade forex, this broker has a virtually funded demo account with which you can gauge your skill level.

Pros

- Low spread from 0.0 pips

- Plenty of learning and research materials

- Lists over 80 currency pairs

- Low fees on forex

- MT4, MT5, and TradingView available

- Clean, intuitive interface

Cons

- C$15 monthly inactivity fee

- Higher Standard spreads

2. OANDA – Top for MT4 Users

OANDA got me glued with its welcome bonus offer, which ranges from C$100 to a whopping C$100,000. The higher your trading volume, the bigger the reward. Mine was low since I was only testing the service provider, but I bagged a cool C$100 nonetheless.

Getting started with this platform was seamless, and I set up my trading account in minutes. From my exploration and comparison with its peers, I found it reliable and primarily recommend it to MT4 users. Besides the MT4 platform being user-friendly, you will find quality market analysis tools that will boost your research experience. These include an advanced charting package, automated trading, frequent updates, fast trade execution speed, and more.

When it comes to currency pairs, OANDA lists over 68 options. The best part is that forex training attracts low spreads from 0.6 pips on major currency pairs. Besides the MT4, OANDA hosts additional powerful platforms, including TradingView and OANDA Web. There are also additional securities, like stocks, commodities, indices, bonds, and more, for your portfolio diversification.

Pros

- Lists over 68 currency pairs to explore

- Social traders can leverage the power of TradingView

- Hosts the MT4 trading platform with quality trading resources

- Offers users an opportunity to earn interest from unused margin

- No minimum deposit requirement

- Traders can invest through OANDA TMS

Cons

- C$10 monthly inactivity fee

- Not available in Alberta

OANDA broker has a clear fee structure with no hidden charges. This makes it easier for you to know how much you will be paying once you make a commitment. Some of the fees to incur at OANDA include the following:

| Trading and Non-Trading Charges | Details |

|---|---|

| Account Opening | $0 |

| Management Fee | $0 |

| Minimum Deposit Requirement | From $0, depending on your jurisdiction |

| Commission | From 0% on US-listed shares |

| Spreads | From 0.6 points |

| Deposits and Withdrawals | Free deposits. Withdrawal fees apply based on the payment method used |

| Inactivity | $10 after 12 months |

| Overnight Funding | Varies based on global market conditions |

| Currency Conversion Fee | Calculated by applying a 0.5% mark-up or mark-down |

3. AvaTrade – Most Beginner-Friendly Forex Platform in Canada

If you are a beginner trader looking to venture into the currency market, AvaTrade is the best broker for you. I tested it, and it is among the most user-friendly on both desktop and mobile devices. Besides, many users on Google Play, the App Store, and Trustpilot highly rate it as efficient and reliable.

With AvaTrade, rest assured, you’ll enjoy unlimited access to quality learning materials and a virtually funded demo account to get started with. These are goldmines, especially if you’re just starting out and need to polish your knowledge and skills. All you have to do is sign up for an account and deposit at least C$100 as per its minimum deposit requirement.

I sample forex across more than 60 currency pairs, including CAD pairs like USD/CAD and GBP/CAD, with tight spreads starting from 0.5 pips. I also explored additional securities, including CFDs on stocks, indices, bonds, and commodities.

While AvaTrade’s asset offerings are limited compared to its peers, beginners have adequate options to get started with and diversify their portfolios. I also like that it hosts multiple platforms with advanced resources to help with market analysis, including WebTrader, MT4, and MT5.

Pros

- User-friendly platforms, including the AvaTradeGo app, MT4, and MT5

- A vast collection of educational resources, especially on AvaAcademy

- Commission-free forex trading and reasonable spreads

- Lists over 60 currency pairs to explore

- Simple, beginner-friendly user interface

Cons

- C$10 monthly inactivity fee after 2 consecutive months of dormancy

- Limited asset class collection compared to its peers

Our experts investigated the AvaTrade broker’s fees and charges. We first noticed that the platform has a modest minimum deposit requirement of $100. What’s more, its users pay no additional costs while depositing funds or cashing out. That makes AvaTrade an ideal broker for both cost-conscious and newbie traders who want to test their waters with small capital before going all in.

That said, AvaTrade requires dormant account holders to pay $50 after every 3 consecutive months of inactivity. Moreover, if you let your account remain inactive for over successive months of inactivity, the broker will charge you a $100 administration fee. Not to forget, AvaTrade requires traders who hold positions overnight to cover a premium.

Here’s a breakdown of the fees you should expect to encounter while trading with this service provider:

| Fees and Charges | Amount |

|---|---|

| Spreads | From 0.9 pips |

| Administration fee | $100 |

| Inactivity fee | $50 |

| Overnight premium | Yes |

4. XTB – Cheapest Forex Trading Platform in Canada

Many traders are skeptical about taking the first step in trading forex due to the fear of overspending. If this is holding you back, I have splendid news. With XTB , you can trade the markets without breaking the bank. Here’s why I’ve said that.

Besides having a free and straightforward account setup procedure, this broker has no minimum deposit requirement. This means you can start trading with as little as C$1. Moreover, it hosts a funded demo account, which allows you to explore its features and the FX market without spending your hard-earned money. Sweet, right? That’s just the tip of the iceberg.

XTB has more than 7,500 financial instruments, among them being 70+ currency pairs. Spreads for forex trading are low, starting from 0.0 pips. While trading forex pairs and CFDs on diverse financial instruments, you can also buy/sell stocks and ETFs.

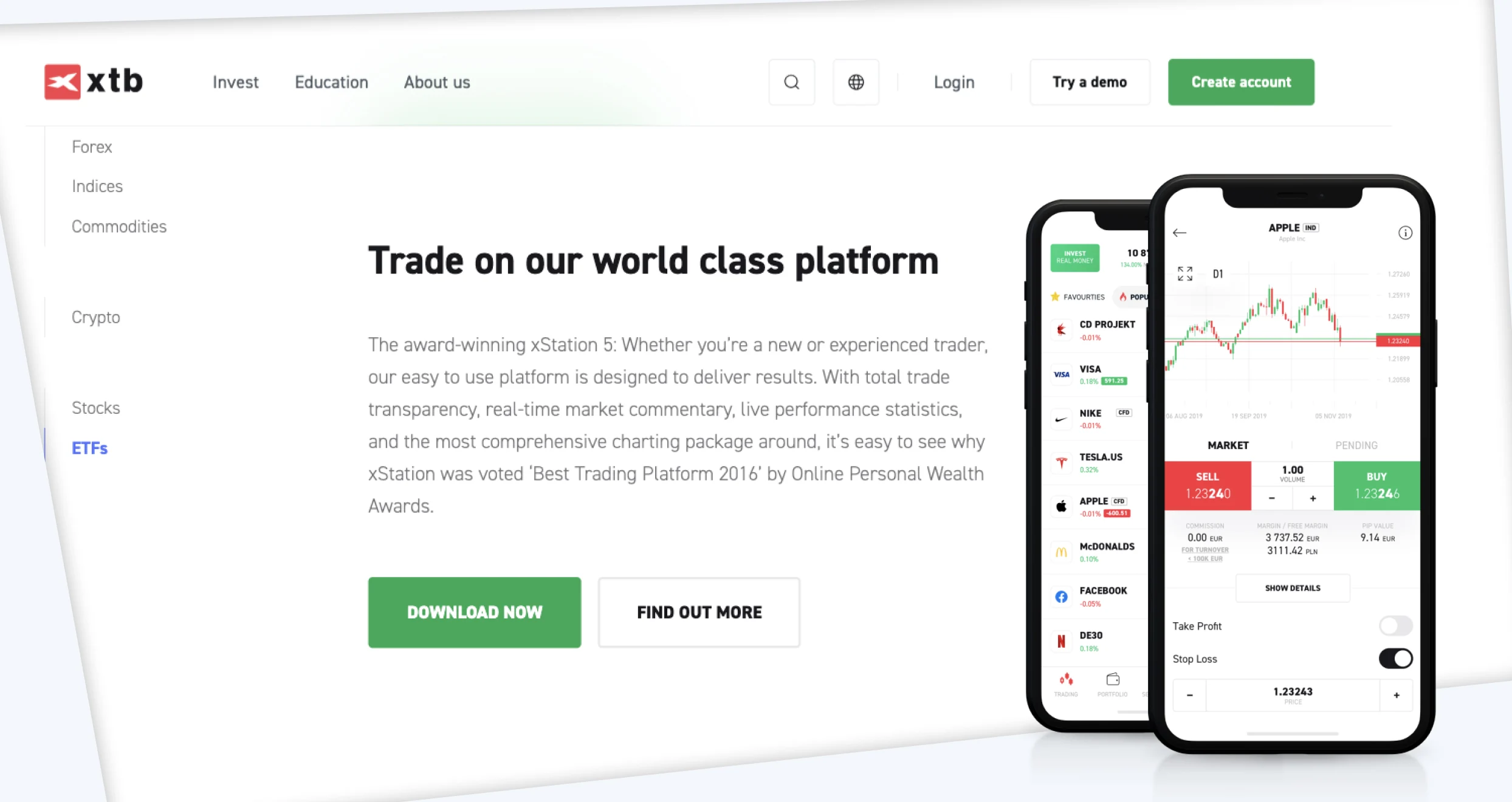

I also recommend this broker because it supports micro lot trading, which allows you to manage positions from 0.01 lots. And although there are no third-party platforms like the MT4/5, its xStation 5 and xStation Mobile platforms host quality trading materials that will keep you glued long-term.

Pros

- No set minimum funding requirement

- Tight spreads from 0.0 pips

- 70+ currency pairs, including AUD/CAD, CAD/CHF, etc.

- CFDs on 2,300+ instruments for diversification

- Traders can invest in real stocks and ETFs

Cons

- C$10 monthly inactivity fee

- No third-party trading software

We love XTB because it is one of the most affordable brokers out here. How so? For starters, there are no XTB minimum deposit requirements. Moreover, the broker’s users don’t have to pay additional fees while funding their accounts or cashing out. Most importantly, XTB doesn’t require traders to cover account opening, maintenance, or inactivity fees. In the table below, we’ve highlighted the fees, commissions, and costs you should take note of before committing to XTB.

| Fees and Charges | Amount |

|---|---|

| Account opening and maintenance | $0 |

| Minimum deposit | $0 |

| Deposit fee | $0 |

| Withdrawal fee | $0 for withdrawals above $50; $30 for withdrawals below $50 |

| Investing commission | From 0% |

| Spreads | From 0.3 pips |

| Currency conversion fee | 0.5% |

| Inactivity fee | $0 |

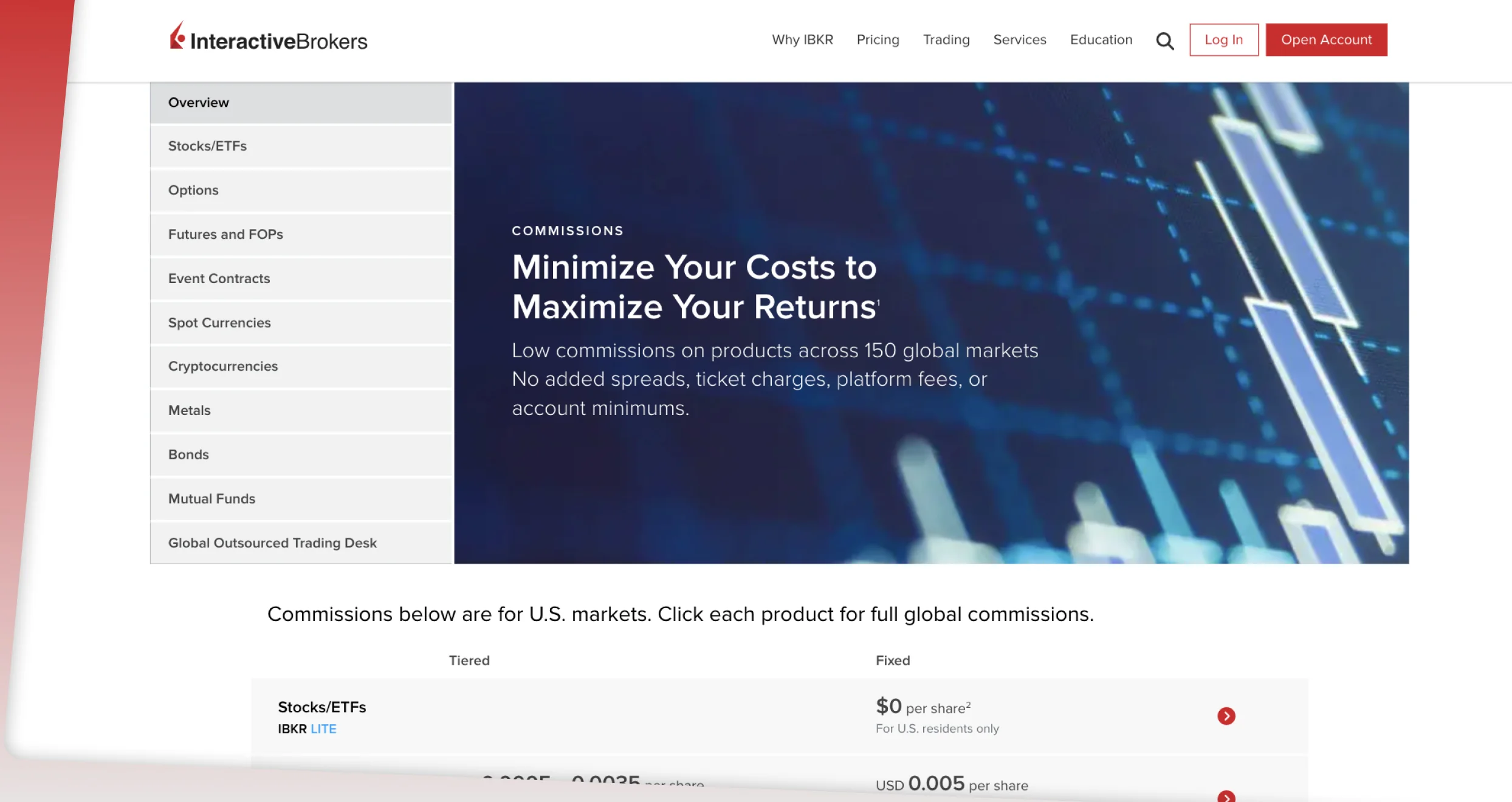

5. Interactive Brokers – Top Forex Broker for Professional Canadian Traders

Interactive Brokers (IBKR) is one of the most highly rated global broking firms. I tested it and liked its superior services, which kept me trading for an extended period. I find it the best for professional traders, primarily due to its vast selection of free and premium market research analysis tools.

Learning resources and demo accounts are also provided for traders looking to boost their knowledge and skill levels. All these resources and more are offered on its IBKR GlobalTrader, IBKR Desktop, IBKR Mobile, and Trader Workstation platforms. You can also use your demo mode to gauge these trading tools before committing.

I also urge you to try out IBKR because it has no minimum deposit requirement and its forex trading fees are reasonably low. Day traders can trade multiple times without overspending, thanks to the broker’s low fees, starting from 0.1 pips. You’ll also trade and take breaks without fretting since IBKR has no inactivity fee.

Not to forget, an additional 10,000+ securities are also at your disposal for portfolio diversification. They range from low-commission stocks, ETFs, and options to US spot gold, bonds, and futures/FOPs.

Pros

- No minimum deposit requirement

- Powerful trading systems ideal for professionals

- Comprehensive research and reporting tools

- Competitive spreads from 0.1 pips

- Up to 3.83% interest on instantly available cash balances

- Zero inactivity fees

Cons

- Doesn’t host third-party trading software

- Only 1 free withdrawal per month

After conducting thorough research and extensive assesments, we can confidently categorize Interactive Brokers as one of the most affordable service providers out here. As we’ve already mentioned, this company has no minimum deposit requirement. Plus, it allows traders to fund their accounts with payment methods like ACH and wire transfer at no additional cost. We also highly recommend IBKR because, unlike other brokers, it doesn’t require traders to pay inactivity fees for dormant accounts.

Here’s an overview of the Interactive Brokers fees and charges our team unearthed during our evaluation and exploration:

| Type | Fee |

|---|---|

| Account opening and maintenance | $0 |

| Deposit | $0 |

| Withdrawal | Yes |

| Inactivity | $0 |

| Overnight charges | Yes |

| Currency conversion | 0,5% |

How to Start with a Canadian Forex Broker

Whether you want to trade forex on the side or do it professionally, using the right platform is paramount. You will only go far while trading on a site or an app with superior security, the necessary tools, and reasonable charges. Otherwise, if you make a lousy broker your service provider, you will be hampered by countless issues, like slow order execution, constant glitches, and poor support.

Start trading with the right Canadian forex brokers by following these steps:

The broker you choose will determine your entire trading experience, so this step is crucial. We’ve covered 5 of the most reputable and reliable service providers here, so you don’t have to risk your money and peace of mind on shoddy brands. Just pick the right broker from my list, while considering factors like your trading experience, preferred trading tools, etc.

Visit your chosen broker’s official site and explore; I’d like you to have a first-hand view of the offerings. If you see a platform you like, test it with a demo account. And if you need clarification about anything like fees, contact support.

To officially get started, hit the sign-up button. It may have a different label, like “Register” or “Open Account” but it’ll get the job done. The next step is providing your personal information. Make sure everything is factual and valid. For instance, your name must be as it is on your ID, and the email you share must be active.

Next, most brokers will ask you to set your password and other security details. The former should have a mix of 12 or more uppercase/lowercase letters, numbers, and special characters. Don’t set a weak password with your name or any other easy-to-guess information.

You must verify your new trading account before you start trading and accessing other crucial functions. Simply put, you need to confirm your identity and location. No regulated broker will allow you to skip this step and proceed undeterred because regulations set by CIRO and other authorities require all service providers to collect KYC information from new customers.

You’ll be required to provide 2 types of documents in most cases: proof of identity (government ID) and proof of address (like a recent bank statement). While taking pictures, make sure all images are legible and clear. You may also be required to take a selfie while holding your ID, so be prepared.

After successful account verification, go to your broker’s deposit section and pick the best payment method for depositing funds. As you know, you need money to trade forex and other markets. To avoid disappointment, check every funding method’s transaction processing time and fees before authorizing deposits and withdrawals.

While funding your account, ensure you meet or exceed the broker’s minimum deposit requirement. If you’re using a payment method that guarantees instant deposits, expect the funds to appear in your account within a few minutes at most. Otherwise, be patient and wait for your deposit to be processed.

With a registered, verified, and funded account, you can dive into trading headfirst. To increase your odds of success, work with a well-defined strategy, like scalping or news trading. If you don’t have a strategy, find one before risking your hard-earned money.

Pick currency pairs to trade with utmost caution. Keep in mind that majors like USD/CAD have high liquidity, while most minors and exotics often have lower liquidity. Also, geopolitical events and other factors can significantly influence FX pairs.

How We Test

At BrokerRaters, we take our commitment to guiding our readers to the best brokers very seriously. Rest assured that the service providers recommended here and in other guides are the most credible and reliable. I say these words with unwavering confidence since we diligently research and test every service provider before making recommendations.

While conducting research and tests, our gurus scrutinize and gauge various functions, from regulatory status, security, and tools to customer support, educational resources, and online reputation. That’s how thorough we are. And we never favour or taint any broker’s reputation; we are always focused on informing and guiding you, our reader, with factual and unbiased information.

Having said that, we remind you to trade responsibly at all times. That is the surest route to enjoying sustainable and successful trading experiences.

Conclusion

Forex trading is legal in Canada, but the stringency of regulations varies from province to province. Places like Ontario have super-strict mandates, making it harder for most brokers to offer services there. Others, like Alberta, are less restrictive and preferred by both local and international trading service providers.

Remember to check each service provider’s availability in your province while searching for the best forex broker. Also, read and familiarize yourself with national and provincial tax mandates.

Additionally, consider exploring high leverage forex brokers if you seek greater potential for returns, but ensure you understand the risks involved.

I’ve had a great experience with Forex.com, but I’d also recommend checking out IG Group for their user-friendly platform and solid customer support.