Claire Maumo has experience in investment banking, strategic consultancy, and journalism. She has a Bachelor’s degree in Business Management and a Master’s in finance. She has a knack for making complex concepts easy to understand. Her primary focus is on crypto, blockchain, and financial instruments. Follow her for expert insights on trading and investment.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

Starting trading online for beginners in Canada requires a diligent approach and proper support. Start by learning the markets you plan to invest in and select the right assets you believe will maximise your profitability. The good news is that there are many beginner-friendly platforms in Canada to offer you the best support. Such platforms host numerous tools to help you boost your skills and make informed decisions. Plus, they are backed up with demo accounts, which are essential for every beginner looking to test a platform’s performance and gauge their skill level risk-free.

While there are many options for beginners, the challenge remains selecting the best for your trading needs. Many traders find the research process lengthy and overwhelming, leading to wrong choices. Luckily, we did all the legwork, so you don’t have to. Below, we share the best trading platforms under various categories. The goal is to ensure you make a suitable choice and start exploring the financial market on a good note.

List of the Best Trading Platforms for Beginners

- AvaTrade – Overall Best Beginner-Friendly Trading Platform in Canada

- Forex.com – Best Trading Platform for Beginner Forex Traders

- OANDA – Top Beginner-Friendly Platform With no Minimum Deposit Requirement

- XTB – Cheapest Trading Platform For Beginners in Canada

- Saxo – Top-Beginner-Friendly Platform With Numerous Trading Tools

Canadian Beginner-Friendly Platforms: Comparison Table

Conducting market research and creating this list of recommendations above was not easy. We spent many hours in this process, comparing and testing as many beginner-friendly trading platforms as we could. We considered various elements to shortlist the best. These include regulatory status, fees, support service, platform performance, asset offerings, and more.

Besides testing and comparing Canadian trading platforms, we incorporated user feedback into our research process. This procedure helped us understand other traders’ opinions regarding their experiences with various platforms. It also ensured we remained unbiased and rated the platforms solely based on their features and functionality.

See our comparison table below, which shows the key features of our best beginner-friendly trading platforms in Canada.

| Trading Platforms for Beginners | License & Regulations | Support Service | Software | Payment Method | Demo Account |

|---|---|---|---|---|---|

| AvaTrade | CBI, FMA, FCA, FSCA, CySEC, CIRO, PFSA, ASIC, FSC, FSA | 24/5 | WebTrader, AvaOptions, AvaTrade App, MT4, MT5, Automated Trading | Credit/debit cards, Neteller, Skrill, Wire transfer, WebMoney | Yes |

| Forex.com | CIRO, FCA, CFTC, ASIC, FSA | 24/5 | Forex.com Platform, MT4, MT5 | Bank Transfer, Credit/debit cards, PayPal | Yes |

| OANDA | CIRO, FCA, CFTC, ASIC, FSA | 24/5 | OANDA Platform, MT4, MT5 | Bank Transfer, Credit/debit cards, PayPal | Yes |

| XTB | FCA, KNF, CySEC, CIRO, BaFin, IFSC | 24/5 | xStation 5, MT4 | Bank Transfer, Credit/debit cards, PayPal | Yes |

| Saxo | FCA, ASIC, CIRO, FSA, MAS, CBI, SFC | 24/5 | SaxoTraderGO, SaxoTraderPRO, SaxoInvestor | Bank Transfer, Credit/debit cards, PayPal | Yes |

Platforms Short Overview

It is crucial to have a budget before choosing the best trading platform in Canada for beginners. This will ensure you settle with a trading platform you can afford, thus avoiding overspending. Remember, trading is all about taking risks. While you can earn profits, losses are inevitable. Therefore, set aside funds you are comfortable losing.

Besides affordability, many traders consider the availability of trading instruments in a platform. It is crucial to explore assets you are familiar with to increase your chances of managing profitable trades.

That being said, check out our tables below highlighting the fee structures and assets offered by our top trading platforms in Canada.

Fees

| Trading Platforms for Beginners | Minimum Deposit Requirement | Commission/Spreads | Deposits/Withdrawals | Inactivity Fee |

|---|---|---|---|---|

| AvaTrade | C$100 | From 0.8 pips | Free | C$50 after every 3 months of inactivity |

| Forex.com | C$0 | From 0.0 pips | C$25 withdrawal fee | C$15 monthly |

| OANDA | C$0 | From 1 pip | Free | C$10 monthly |

| XTB | C$0 | From 0% commission | Free | C$10 monthly |

| Saxo | C$0 | From 0% commission | Free | None |

Assets

| Trading Platforms for Beginners | Stocks | Forex | Crypto | Commodities | Indices | ETFs | Options |

|---|---|---|---|---|---|---|---|

| AvaTrade | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Forex.com | Yes | Yes | Yes | Yes | Yes | Yes | No |

| OANDA | Yes | Yes | Yes | Yes | Yes | Yes | No |

| XTB | Yes | Yes | Yes | Yes | Yes | Yes | No |

| Saxo | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Our Expert Opinion About Trading Platforms for Newbies

From our research process, we settled on these top trading platforms as our top options for newbies in Canada. Keep reading the mini-reviews below to understand what they offer and make an informed choice. Note that these reviews are based on our personal experience. We strive to supply accurate information to avoid misleading our readers.

1. AvaTrade – Overall Best Beginner-Friendly Trading Platform in Canada

We find AvaTrade to be our top option for newbies in Canada primarily due to its user-friendly and highly customisable platform. We had an exceptional experience with AvaTrade, and all trades were seamlessly executed on both desktop and mobile devices. Moreover, the majority of users recommend it to newbies, especially when it comes to learning resource availability and support service. We also like its robust security measures, which ensure users’ trading account remains safe from unauthorised access.

When it comes to trading charges, this platform imposes one of the lowest fees in the industry. This is perfect for any new Canadian trader, as they get to explore the financial space with a small capital. Additionally, the platform’s minimum deposit requirement is C$100. Compared to its peers, the amount is low and favourable to all types of traders. AvaTrade also streamlines user activity through its social trading feature. Advanced trading resources are also offered through its MT4 and MT5 platforms. You can test it out via its demo account to decide whether it fits your trading requirements.

Pros

- Low minimum deposit requirement for Canadian clients

- Free deposits and withdrawals

- Excellent selection of learning materials

- A user-friendly and customizable trading platform

Cons

- You can only trade the assets as CFDs

- Limited asset offerings compared to its peers

Our experts investigated the AvaTrade broker’s fees and charges. We first noticed that the platform has a modest minimum deposit requirement of $100. What’s more, its users pay no additional costs while depositing funds or cashing out. That makes AvaTrade an ideal broker for both cost-conscious and newbie traders who want to test their waters with small capital before going all in.

That said, AvaTrade requires dormant account holders to pay $50 after every 3 consecutive months of inactivity. Moreover, if you let your account remain inactive for over successive months of inactivity, the broker will charge you a $100 administration fee. Not to forget, AvaTrade requires traders who hold positions overnight to cover a premium.

Here’s a breakdown of the fees you should expect to encounter while trading with this service provider:

| Fees and Charges | Amount |

|---|---|

| Spreads | From 0.9 pips |

| Administration fee | $100 |

| Inactivity fee | $50 |

| Overnight premium | Yes |

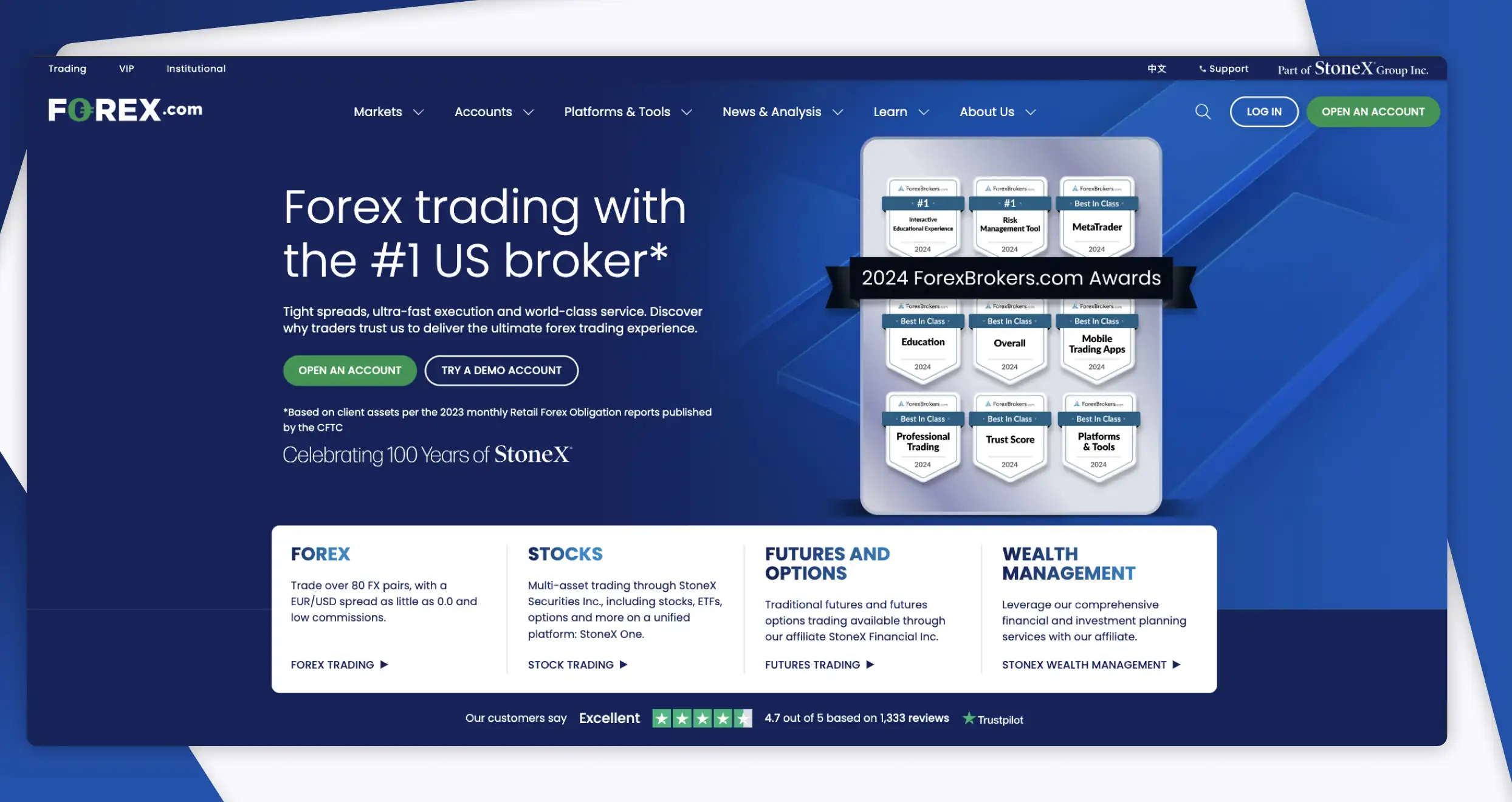

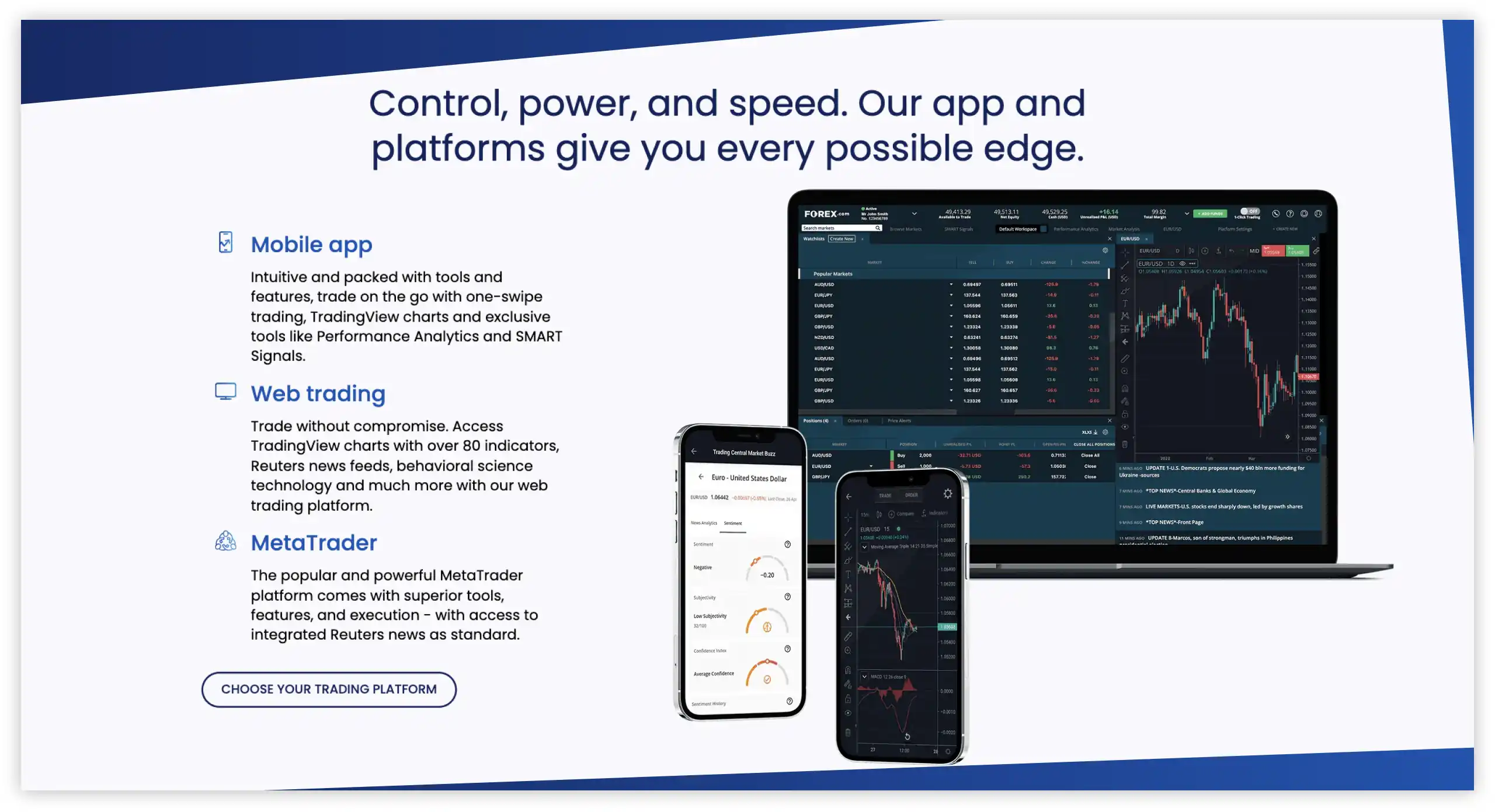

2. Forex.com – Best Trading Platform for Beginner Forex Traders

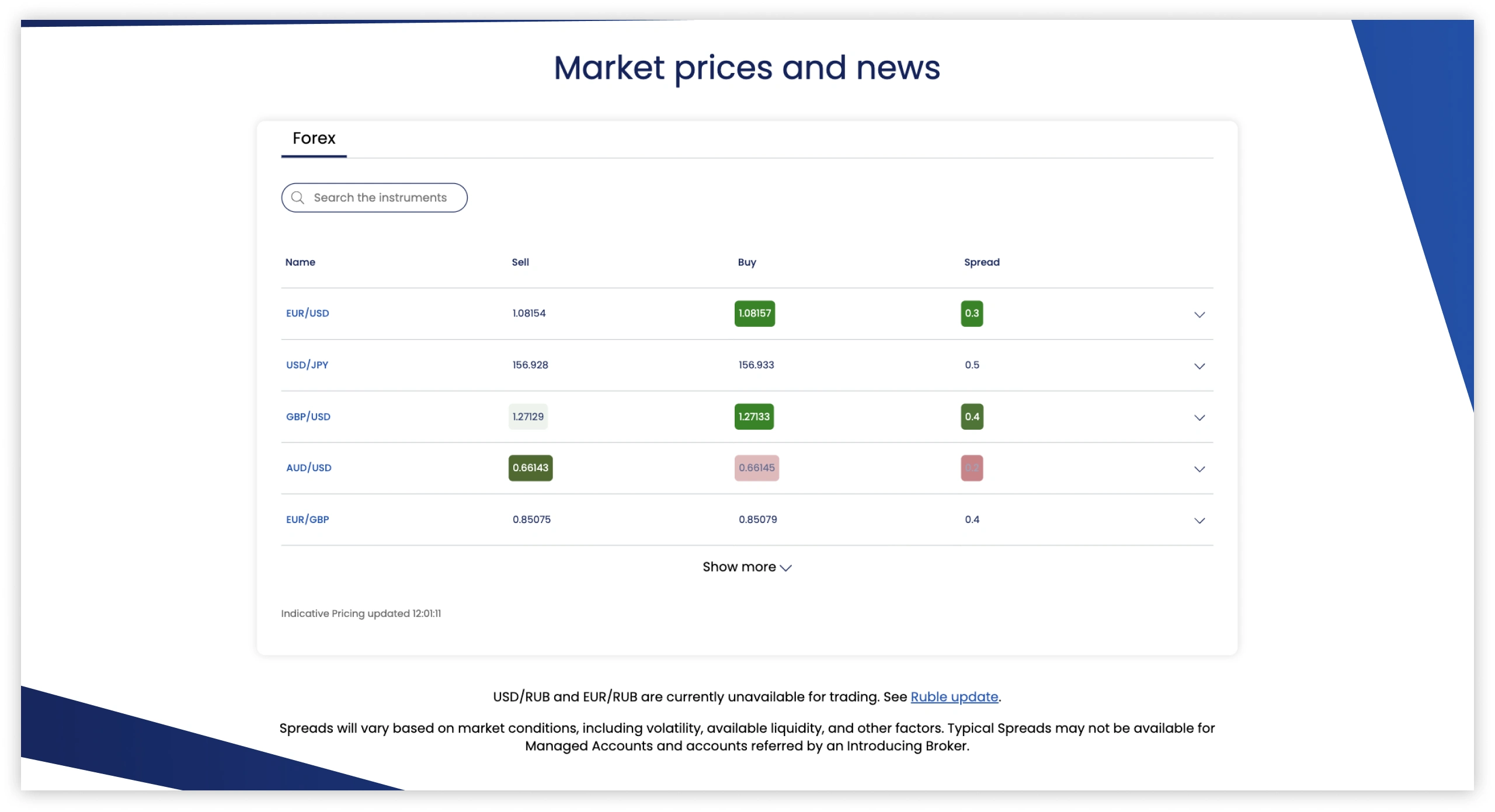

Forex.com is among the top platforms we like and primarily recommend it to beginner forex traders. Besides having a user-friendly and modern design platform, we like the fact that it seamlessly executes forex trades on both desktop and mobile devices. Moreover, this platform is customizable, allowing newbies to trade long-term while advancing their skills. While trading at Forex.com, we explored over 80 currency pairs at low fees, from 0.0 pips on major pairs. Getting started was also easy, considering its straightforward account opening procedure and zero minimum deposit requirement for Canadian traders.

Forex.com has a web trading platform with features perfect for any new Canadian trader. However, should you want to explore advanced resources, the broker partners with third-party platforms with such tools. These include TradingView and MT5 platforms. And when you are ready to start your forex trading ventures, this broker has a virtually funded demo account for you to gauge your skill level with. We were also impressed by its automated trading feature, which has proven resourceful to many traders, especially those with tight daily schedules.

Pros

- There is no minimum deposit requirement for Canadian clients

- Plenty of learning and research materials

- Lists over 80 currency pairs

- Low forex trading fees

Cons

- Its offer for traders to earn annual interest on balances is only available for VIP clients

- Charges a C$25 withdrawal fee for amounts less than C$10,000

3. OANDA – Top Beginner-Friendly Platform With no Minimum Deposit Requirement

If you are looking for the best trading platform for beginners with no minimum deposit requirement, OANDA is a good choice. According to our analysis, users can get started with any amount of capital they can afford. The best part is that there are no transaction costs when making deposits or withdrawals. This makes it easier for newbies to start investing in various instruments without worrying about risking a lot of money. With OANDA, you will trade a range of popular CFD instruments, including forex, indices, commodities, bonds, and more.

Note that this platform has a variety of trading accounts to choose from based on your skill level. Besides the demo account offering risk-free opportunities, there are the standard and Elite Trader program accounts, each with its unique features. Plus, we discovered a variety of trading platforms, including TradingView, MT4, Web, and OANDA Mobile. With these platforms, rest assured of a range of sophisticated analysis tools, automated trading, and APIs. Another unique feature worth noting at OANDA is its welcome bonus for newbies, which currently stands at up to C$13,650 for forex CFD trades.

Pros

- No minimum deposit requirement

- A user-friendly and modern-design platform

- Quality learning and research materials

- Various account types and platforms to choose from

Cons

- Its trading fees are higher compared to most of its peers

- You can only trade the assets as CFDs

OANDA broker has a clear fee structure with no hidden charges. This makes it easier for you to know how much you will be paying once you make a commitment. Some of the fees to incur at OANDA include the following:

| Trading and Non-Trading Charges | Details |

|---|---|

| Account Opening | $0 |

| Management Fee | $0 |

| Minimum Deposit Requirement | From $0, depending on your jurisdiction |

| Commission | From 0% on US-listed shares |

| Spreads | From 0.6 points |

| Deposits and Withdrawals | Free deposits. Withdrawal fees apply based on the payment method used |

| Inactivity | $10 after 12 months |

| Overnight Funding | Varies based on global market conditions |

| Currency Conversion Fee | Calculated by applying a 0.5% mark-up or mark-down |

4. XTB – Cheapest Trading Platform For Beginners in Canada

While there are numerous cheap trading platforms for Canadian newbies, XTB takes the lead in this category. From our analysis, we like that it has no minimum deposit requirement, making it easier for any user to get started. Moreover, this platform imposes no transaction fees for deposits and withdrawals. Trading charges are also low, with commissions from 0% on stocks and ETFs. And while there is a C$10 monthly inactivity fee, it kicks in after 12 months, which, in our opinion, is a long period compared to platforms like AvaTrade that impose this fee after only three months.

Besides being affordable, XTB lists over 6,200 CFD instruments across multiple classes. These include forex, shares, commodities, indices, and more. When it comes to learning tools, expect numerous options, most of which are available free of charge. On top of that, XTB hosts quality trading tools for market analysis. Its award-winning xStation 5 and xStation Mobile platforms ensure you are comfortable enough to face the challenges that await you in the financial space. The best part is that users are given an opportunity to earn up to 5% interest on their uninvested funds and manage their positions with risk management controls like stop-loss and take-profit orders.

Pros

- Hosts diverse asset classes for portfolio diversification

- Low trading fees with commissions from 0%

- Free deposits and withdrawals

- Hosts a virtually funded demo account and plenty of learning materials for newbies

Cons

- No third-party platforms like the MT4/5

- Has an inactivity fee of C$10 monthly after one year of the account’s dormancy

We love XTB because it is one of the most affordable brokers out here. How so? For starters, there are no XTB minimum deposit requirements. Moreover, the broker’s users don’t have to pay additional fees while funding their accounts or cashing out. Most importantly, XTB doesn’t require traders to cover account opening, maintenance, or inactivity fees. In the table below, we’ve highlighted the fees, commissions, and costs you should take note of before committing to XTB.

| Fees and Charges | Amount |

|---|---|

| Account opening and maintenance | $0 |

| Minimum deposit | $0 |

| Deposit fee | $0 |

| Withdrawal fee | $0 for withdrawals above $50; $30 for withdrawals below $50 |

| Investing commission | From 0% |

| Spreads | From 0.3 pips |

| Currency conversion fee | 0.5% |

| Inactivity fee | $0 |

5. Saxo – Top-Beginner-Friendly Platform With Numerous Trading Tools

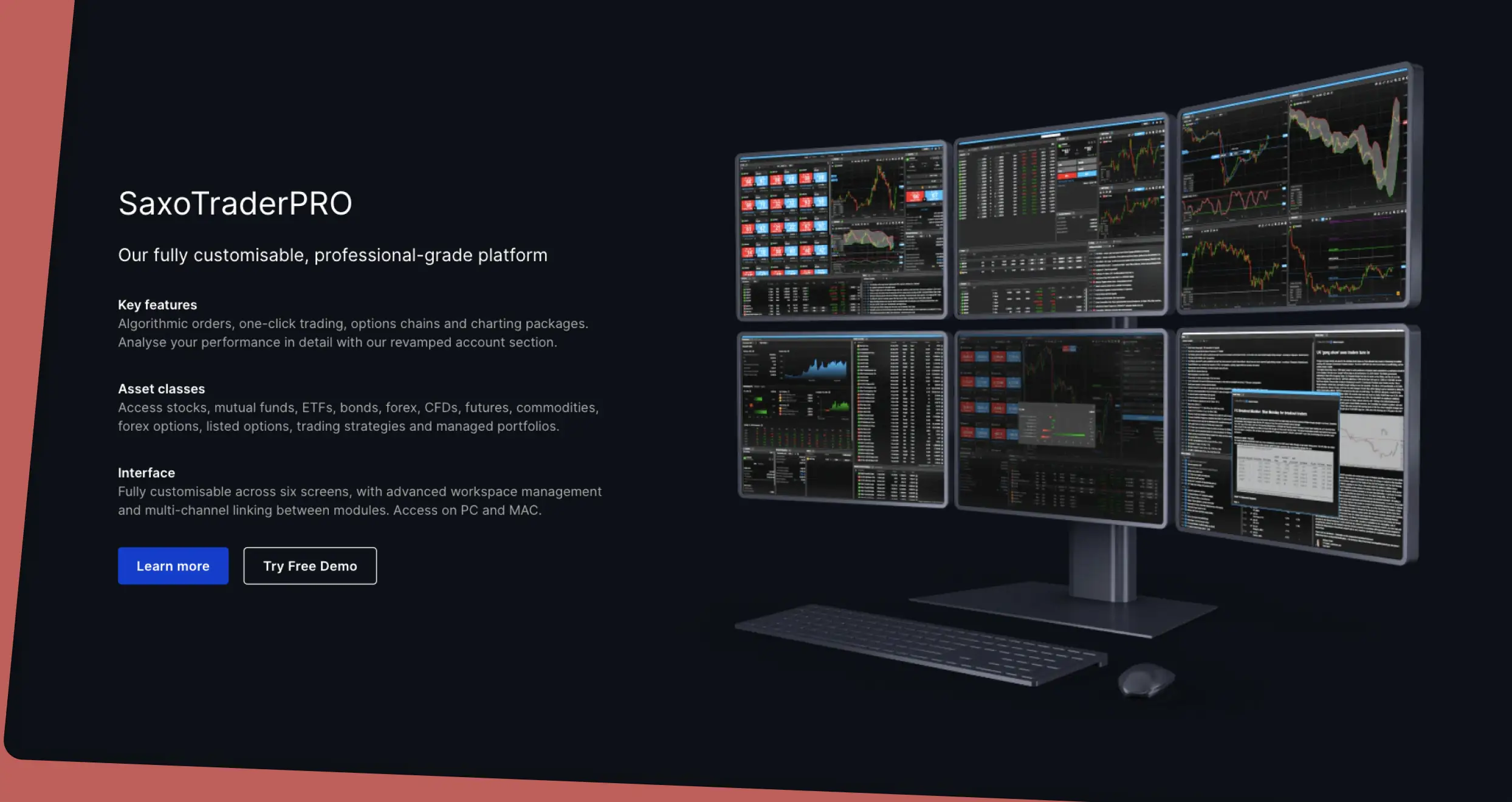

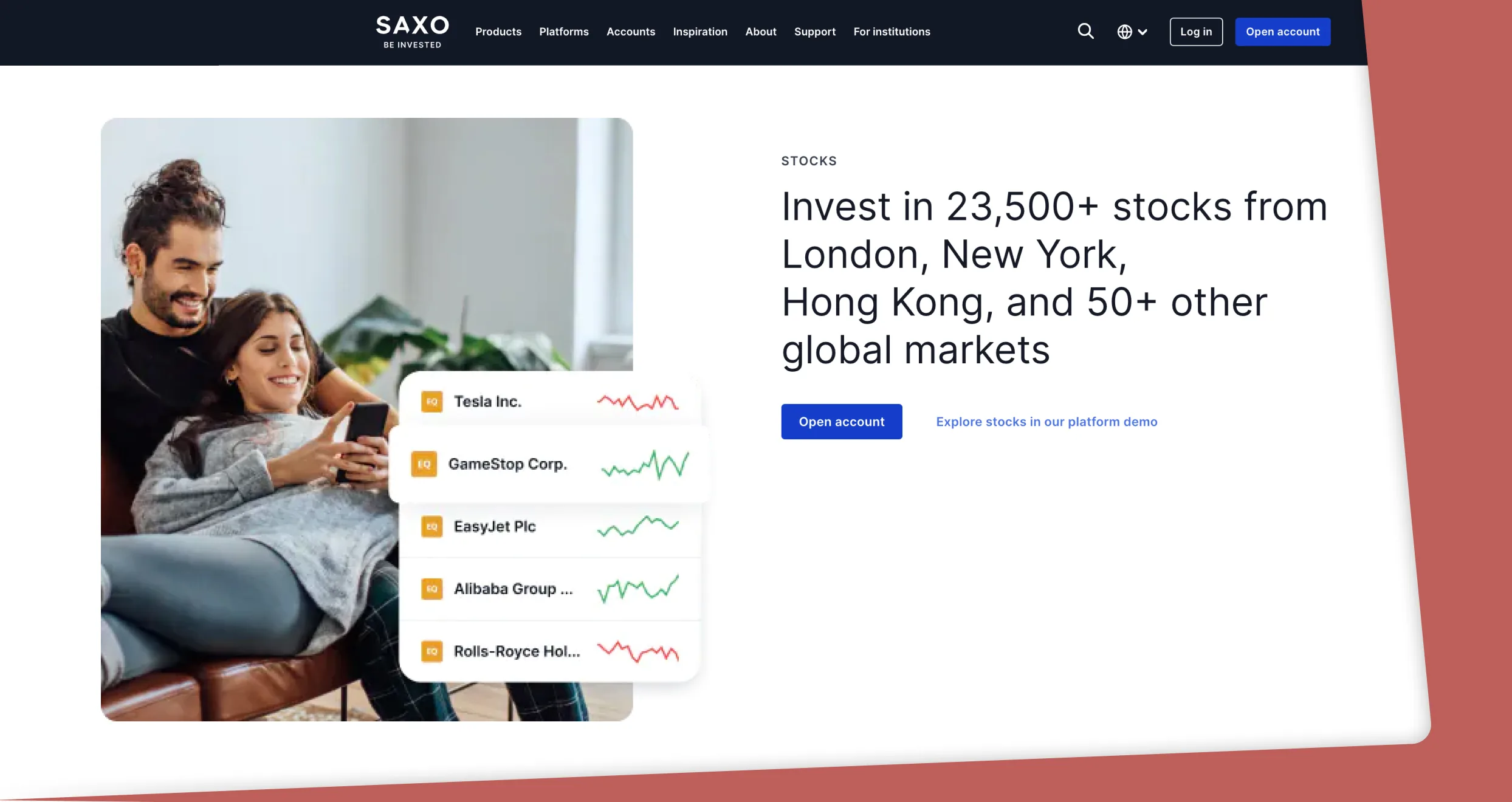

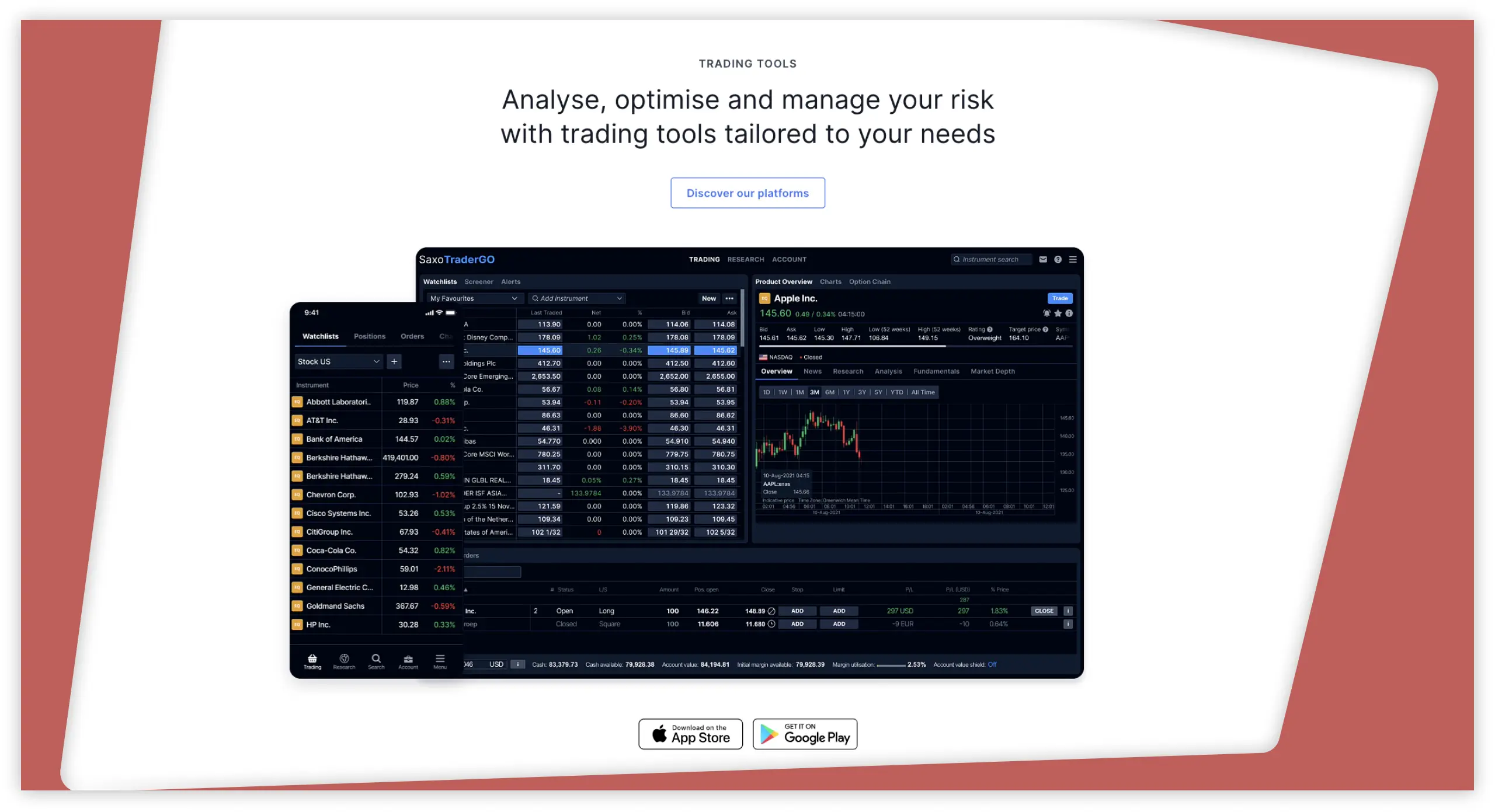

If you are looking for a platform with diverse resources, consider Saxo. This platform is user-friendly, has a modern design, and is customisable. This means that you can trade with Saxo for a longer period while advancing your skills. We also like that this platform has a fast trade execution speed, whether you are using a desktop or mobile device. You can get started with any amount you can afford since it has no minimum deposit requirement. A C$100,000 virtually funded demo account is also offered to test the platform’s performance and gauge your skill level before starting to risk real funds.

Saxo hosts numerous trading tools on its SaxoTraderPro, SaxoInvestor, and SaxoTraderGO platforms. From technical indicators to margin trading, this platform has everything for every user. We discovered over 71,000 assets to explore not only as CFDs but also buying and taking full ownership. These include stocks, forex, ETFs, bonds, and more. With Saxo, expect no inactivity fee and low trading charges.

Pros

- Charges low trading fees with commissions from C$1 on US-listed stocks

- No minimum deposit requirement

- No inactivity fee

- Plenty of learning and research materials

- Allows you to invest in global stocks and take full ownership

Cons

- Its demo account is only available for 20 days after activation

- There are no third-party platforms like the MT4/5

Trading for Beginners in Canada

Trading for beginners in Canada may seem challenging, but the activity is easy with proper knowledge and skills. For this reason, we always advise newbies to take time and learn how the financial market works before kickstarting this venture. Plus, gauge your skill level using brokers’ demo accounts and decide whether you are comfortable risking real money.

In Canada, trading is legal, and any individual over 18 or 19 can start engaging in the activity. The age limit depends on the province you reside in since rules differ between provinces. Trading in the region is overseen by the Canadian Investment Regulatory Organization (CIRO). This authority strives to maintain the integrity of Canada’s financial marketplace while safeguarding traders’ interests.

For instance, CIRO ensures all brokerage firms adhere to the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) regulations against money laundering activities. Plus, all brokerage firms it regulates must secure users’ funds in segregated bank accounts that are only accessible to the users. On top of that, they must give risk warnings on trading so that traders can approach the financial market investments cautiously.

Overall, beginners should trade with CIRO-regulated brokers for maximum safety and experience. Above, we recommend some of the top options with quality resources for skills and strategy development. Whether you are into forex, shares, cryptos, commodities, ETFs, or more, these brokers have got you covered. Besides learning the market, only trade with funds you are comfortable losing since success in online trading is not guaranteed. You can also apply risk management controls like stop-loss and take-profit orders to control the amount of potential gains or losses.

What Should Know Before Start Trading

Before you start trading in Canada, it is crucial to learn everything related to the activity and the risks involved. As a newbie, never start trading with real money before understanding the markets and selecting an asset you are familiar with. Note that trading is all about taking risks, and approaching the activity blindly will only increase your chances of incurring losses. You can choose to trade forex, shares, commodities, cryptos, ETFs, and many more.

Once you are confident in your skills, select a suitable broker with features aligning with your needs. Most importantly, the broker must be licensed and regulated by CIRO for safety reasons. Canada’s financial market hosts both legit and fraudulent brokers. Therefore, you do not want to risk falling victim to scammers by overlooking this element.

Traders must also be aware that online trading in this region is considered a business venture and not a gambling activity. This means that any profits you incur trading must be subject to capital gains tax. Consider calculating your potential gains after tax deductions before opening a position to avoid confusion.

As mentioned earlier, trading is risky, and losses are inevitable. To mitigate these risks further, apply risk management controls like stop-loss and take-profit orders to your trade. These orders will ensure your position closes at a certain level to control the amount of profits or losses you will incur.

Lastly, avoid making decisions based on emotions like excitement, fear or greed. Depend solely on your strategy and the arising opportunities to avoid making the wrong decisions. And to avoid repeating the same mistakes, track your strategy development tricks by writing them down in a journal. Most importantly, remain patient, as success does not come overnight.

How to Choose the Best Trading Platform for Beginners

Choosing the best trading platform for beginners in Canada might seem challenging, considering the lengthy procedures involved. To streamline your quest and make informed choices, here are what to consider.

Your safety and that of your trading funds should be of utmost importance when choosing a trading platform in Canada. With fraudsters in the market, ensure the platform you select is licenced and regulated by the Canadian Investment Regulatory Organization (CIRO). Plus, the platform must be highly encrypted to ensure no unauthorised persons have access to your trading account. You will notice that some platforms, like the ones we recommend, have multiple top-tier authorities regulating them. This proves their credibility further.

Since losses are inevitable while trading, choose a platform you can afford. Have a budget and ensure the platform you settle with fits it. Consider trading and non-trading fees like minimum deposit requirements, inactivity fees, commissions/spreads, overnight charges, and more.

The best trading platforms for beginners in Canada should host your preferred trading instruments. These include forex, shares, commodities, cryptos, and more. Choose one with assets you are familiar with so it will be easier for you to strategise and diversify your portfolio. Not all platforms will host your preferred security, so do not overlook this element.

The platform you select must be user-friendly and customisable to maximise your experience and keep you hooked long-term. Also, confirm whether the platform has a fast trade execution speed and is compatible with desktop and mobile devices. It is important to manage your activities even while on the move using mobile devices to maximise on arising potentially profitable opportunities.

As a beginner, you need all the support you can get to remain comfortable and explore the financial landscape with confidence. Having a platform with a reliable and responsive support service will help you settle into your activities. Such support services ensure your concerns and questions are promptly taken care of without affecting your open positions. You can confirm a team’s reliability by contacting them and gauging their response rate. Plus, check the supported communication channels to ensure there is a convenient option for you. The support service team’s availability must also align with your trading schedule.

Before making a decision or choice, analyse what other previous and current traders have to say regarding their experiences with a trading platform. Numerous positive reviews mean that the platform you consider is safe and reliable. You can get honest user comments and ratings from Google Play, the App Store, and Trustpilot.

Choose a treasure trove of tradable assets and instruments to help you diversify your portfolio. Be sure you can access your preferred or familiar investment vehicle before venturing into the unknown.

Risks to Consider Before Trading

The financial market offers numerous opportunities to traders while also carrying risks. Understanding these risks will help you diligently approach online trading and make the best decisions. These include:

- Volatility Risk

The financial market is volatile, meaning that asset prices can frequently fluctuate due to specific market conditions. Frequent price fluctuations can make it challenging for traders to make accurate predictions and identify the best entry and exit points. Ultimately, they will incur losses.

- Liquidity Risk

Investing in illiquid assets may make it challenging for you to make sales, especially during periods of market stress. You may end up making sales at a loss. However, understand that such assets can also bring you good profits should the markets favour you.

- Cash Management Risk

It is crucial to learn how to manage your hard-earned cash to avoid putting yourself at risk. Many traders base their decisions on emotions like fear, excitement, or greed. This leads them to spend more money even without a solid strategy, which only increases the chances of incurring losses.

- Leverage Risk

When applying leverage in a trade, you are literally managing a larger position with a small capital. While this strategy can magnify returns, losses will be massive. Therefore, understand what leverage means before applying it. Plus, do not manage very large positions that can leave you with huge debts. Only trade with funds you are comfortable losing.

Conclusion

Trading in Canada has proven lucrative, with many individuals making good profits from the activity. As a beginner, do not start by putting up a lot of money in this venture. Instead, ensure you are familiar with an asset and can conduct extensive research for solid strategies. Also, have the best broker, like the ones we recommend above, in your corner. Such brokers host the best tools that will maximize your experience and potential. And remember, there is a potential for loss. To limit this risk, remain disciplined, be patient, apply risk management controls, and practise continuous learning.

Solid breakdown of platforms! I’ve tried a few of these, and AvaTrade’s demo account was super helpful for getting started. XTB’s low fees also stood out. For anyone starting, testing with demo accounts is a must