Claire Maumo has experience in investment banking, strategic consultancy, and journalism. She has a Bachelor’s degree in Business Management and a Master’s in finance. She has a knack for making complex concepts easy to understand. Her primary focus is on crypto, blockchain, and financial instruments. Follow her for expert insights on trading and investment.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

Pepperstone is a Melbourne-based broker established in 2010. Being among the most trusted global brokers, it continues to attract many traders. We noted that it is licensed by multiple global authorities and supports forex and CFD trading. Plus, Pepperstone hosts quality resources, which we will break down in this comprehensive Pepperstone review. Note that this review is backed up by thorough market research and tests, and all features we share here have been confirmed and approved by our experts.

Our Opinion about Pepperstone

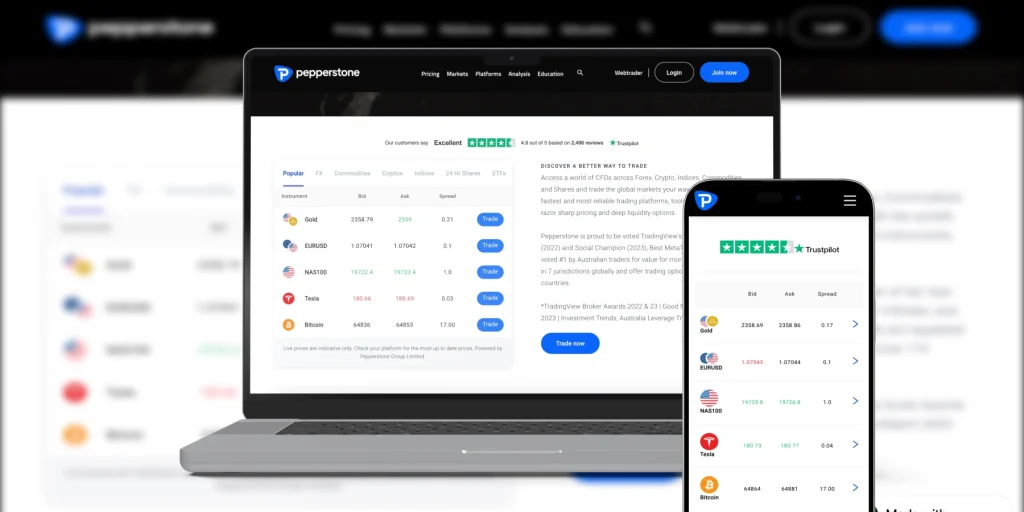

Pepperstone is trusted by millions of traders in 160+ countries, making it a trustworthy brokerage firm. It is a CFD and spread betting broker with low spreads and commissions. We believe it is affordable even to low-budget traders. Its modern design interface also gives you an exciting experience. Moreover, we like Pepperstone’s diverse platform offerings, which accommodate all types of global traders.

While we discovered numerous unique features at Pepperstone, there are also a few pitfalls to note. For instance, we wish the broker will allow buying and taking ownership of underlying assets. Its asset offerings are also limited compared to some of its peers we tested.

Pros

- A 24/7 support service via phone, email, and live chat

- Vast array of trading platforms, including cTrader, TradingView, MT4, and MT5, which host advanced resources

- Low spreads from 0.0 pips on its Razor Account

- A user-friendly and navigable platform

- Excellent trading app with high ratings on Google Play, the App Store, and Trustpilot

- Supports AI and social trading

- Free deposits and withdrawals

Cons

- The number of asset offerings can be improved

- You can only trade the featured securities and CFDs or spread betting

- Its support service response rate can be improved

Fees

We find Pepperstone broker to be one of the brokers with transparent fee structures. There are no hidden charges, so what you see displayed on its platform is what you will incur. This makes it easier for you to budget without worrying about overspending.

Let’s discover below some of the trading and non-trading charges at Pepperstone.

| Trading and Non-Trading Charges | Details |

|---|---|

| Account Opening | $0 |

| Management Fee | $0 |

| Minimum Deposit Requirement | From $0, depending on your jurisdiction |

| Commission | From $0.02 on US-listed shares |

| Spreads | From 0.0 pips on its Razor Account |

| Deposits and Withdrawals | Free |

| Inactivity | None |

| Overnight Funding | Varies based on global market conditions |

| Copy Trading | Free |

Note that Pepperstone charges both spreads and commissions. While spreads are charged on all accounts, commissions are only imposed on the Razor Account.

Available Assets

At Pepperstone, we discovered over 1,200 CFD and spread betting assets. The securities are in different classes, including shares, commodities, forex, indices, ETFs, and cryptocurrencies. Unfortunately, some assets like options are missing.

As we previously mentioned, there are two types of trading accounts, namely Razor and Standard, with which you can explore these securities. We also noticed that Pepperstone supports leverage trading on its featured securities. Retail traders will enjoy limits up to 30:1, while professionals are eligible for limits up to 400:1. This allows you to manage larger trades with a small capital, thus maximizing your chances of earning huge profits.

That being said, let’s break down the number of asset offerings at Pepperstone.

| Asset Class | Number Offered |

|---|---|

| Forex | 97+ currency pairs |

| Shares | 1000+ |

| Indices | 23+ |

| Commodities | 40+ |

| Cryptocurrencies | 30+ |

| ETFs | 48+ |

Disclaimer: Spread betting and CFD trading have the application of leverage attached to them. Therefore, while the activity can magnify your returns, losses are inevitable. To avoid incurring massive losses with CFD trading, understand how it works plus all the risks involved. Plus, only risk funds you are comfortable losing, considering that over 76% of retail traders lose money in this activity.

Security

Pepperstone is a legitimate brokerage firm overseen across over 7 global jurisdictions. We analyzed its security measures and were impressed by its highly encrypted platform. Plus, it supports fee-free secure payment methods, including credit/debit cards, e-wallets, and bank transfers. We also like that it takes additional security measures to safeguard users’ personal details. Whether you trade using a desktop or mobile device, the broker encourages you to secure your account using passcodes, face IDs, and more.

By being licensed and regulated by multiple authorities, Pepperstone guarantees your funds’ safety. Your money will be stored in a segregated tier-one bank, only accessible to you even when the broker becomes bankrupt.

In addition, Pepperstone broker offers favorable trading conditions and investor protection to its clients. However, the amount will depend on the entity you belong to. We noticed that traders in the UK, Australia, and the European Union countries are eligible for protection. Those in the UK will get protection up to £85,000, while traders in other countries get up to €20,000.

That being said, here are the top-tier authorities regulating Pepperstone activities.

| Financial Regulator | Legal Entity |

|---|---|

| Cyprus Securities and Exchange Commission (CySEC) in Other European countries | Pepperston EU Limited |

| Financial Conduct Authority (FCA) in the UK | Pepperstone Limited |

| Australian Securities and Investments Commission (ASIC) in Australia | Pepperstone Group Limited |

| Dubai Financial Services Authority (DFSA) in Middle Eastern Countries | Pepperstone Financial Services Limited |

| The Securities Commission of the Bahamas (SCB) | Pepperstone Markets Limited |

| The Federal Financial Supervisory Authority (BaFin) in Germany | Pepperstone GmbH |

| Capital Markets Authority (CMA) in Kenya | Pepperstone Markets Kenya Limited |

Note: The negative balance protection applies only to UK, Australia, and the European Union retail clients. This means that there is no compensation scheme for professional traders.

Conclusion

We hope that this Pepperstone broker review will help you understand its features and make the best decisions. Trusted by over 300,000 global clients, it is safe for your activities. Plus, Pepperstone’s multiple platforms with excellent features like social and automated trading make it fit for all types of traders. Its support for margin trading also gives traders an opportunity to manage larger positions with small capital.

However, understand that margin trading is risky, and you must approach it strategically. Applying risk management controls can help mitigate massive losses in case a trade fails to work out in your favor. For beginners, start by exploring Pepperstone’s features using its demo account. The account is risk-free and funded by virtual funds, so you do not have to spend your hard-earned money.

Would you recommend this provider?

Fees

Account opening

Customer service

Deposits & Withdrawals

Would you recommend this provider?

Fees

Account opening

Customer service

Deposits & Withdrawals

Thanks for the detailed review! Pepperstone sounds like a solid option, especially with its low fees and diverse platforms. I like that they offer social and AI trading too. I’ll probably start with a demo account to test things out first.

Would you recommend this provider?

Fees

Account opening

Customer service

Deposits & Withdrawals