Claire Maumo has experience in investment banking, strategic consultancy, and journalism. She has a Bachelor’s degree in Business Management and a Master’s in finance. She has a knack for making complex concepts easy to understand. Her primary focus is on crypto, blockchain, and financial instruments. Follow her for expert insights on trading and investment.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

It’s been nearly two decades since eToro was born, and it continues to surprise millions of global traders with its cutting-edge features and technology. Renowned primarily for its social trading features, this broker stands tall among many. It has earned excellent user testimonials for being user-friendly and hosting quality resources.

eToro is an award-winning trading and investing platform that is licensed by numerous global authorities. We tested it to understand its features. Our goal was to share an honest review that will help you decide whether it fits your trading or investment needs.

Our Opinion about eToro

eToro has a £100,000 virtually-funded demo account. Therefore, we signed up for trading/investing accounts at it to test its performance and understand its offerings. Various features stood out, including a user-friendly platform, commission-free stock trading trades, social and copy trading, a vast array of asset classes, and more.

However, we also discovered a few pitfalls, like high trading fees, withdrawal charges, and more. Here is a summary of our findings.

Pros

- A user-friendly and modern design trading platform

- A highly reputable and efficient trading app

- Hosts an award-winning eToro copy trading platform

- Excellent selection of learning materials

- Commission-free stock trading/investing

- A multi-asset platform listing over 6000 trading instruments

- Offers clients an opportunity to earn interest on their balances

- Has an investment insurance of up to 1 million euros/AUD to eligible clients

Cons

- We discovered a withdrawal fee of £5

- Does not host a third-party platform like MT4/5

- High trading fees compared to its peers

Fees

eToro has a transparent fee structure that is easy to understand and helps you plan accordingly. From our analysis, we discovered the following trading and non-trading eToro fees.

| Trading and Non-Trading Charges | Details |

|---|---|

| Account Opening | $0 |

| Management Fee | $0 |

| From $50, depending on your jurisdiction | 0.6 |

| Commission | From 0% on stocks and ETF trading |

| Spreads | From 1 pip on major currency pairs |

| Deposits and Withdrawals | $5 withdrawal |

| Inactivity | $10 monthly |

| Currency Conversion | 1.5% or 3.0%, depending on the currency or payment method |

| Overnight Funding | Varies based on global market conditions |

| Copy Trading | Free |

Note: {etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Copy Trading does not amount to investment advice. Your investments value may go up or down. Your capital is at risk. Other fees apply.

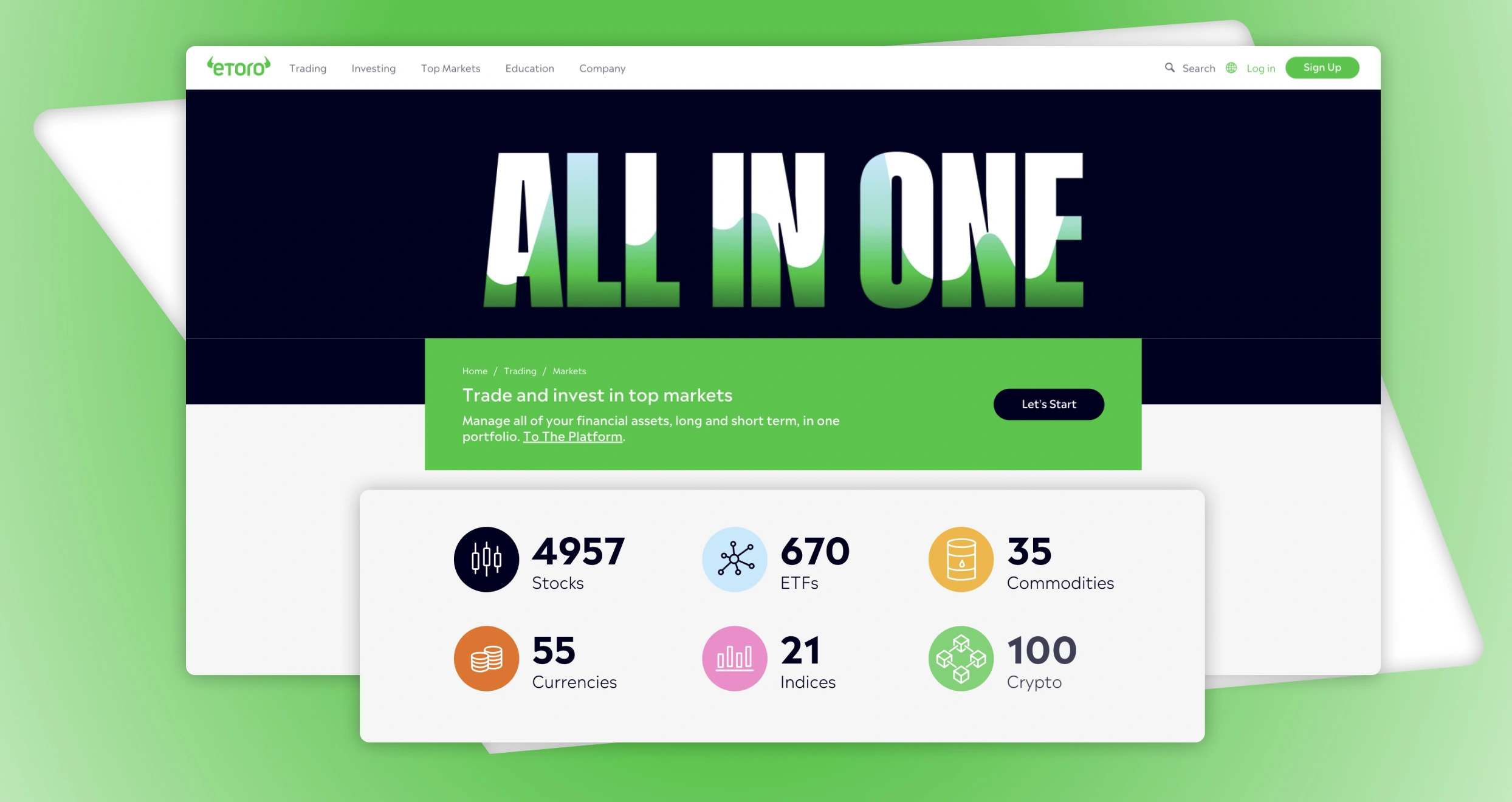

Available Assets

We discovered that eToro allows users to trade and invest in global markets. You can go long or short in a single portfolio. Overall, there are more than 6,000 instruments, which are spread across multiple classes. Investment options are stocks, which allow you to buy and take ownership of global stocks across various sectors. Fractional share purchases are also supported at eToro. This will enable you to fill your portfolio with leading stocks from global exchanges. ETFs are also other investment assets at eToro.

When it comes to CFD trading, this broker offers it with flexible leverage limits for both new and professional traders. From our experience, retail traders get up to 1:30 leverage limit and professionals up to 1:400. With CFD assets, you can go long or short and speculate on both rising and falling asset prices.

That being said, here is the number of tradable assets available at eToro.

| Asset Class | Number Offered |

|---|---|

| Forex | 55+ currency pairs |

| Shares | 5558+ |

| Indices | 21+ |

| Commodities | 35+ |

| Cryptocurrencies | 100+ |

| ETFs | 680+ |

Note that eToro also supports options trading but is limited to US clients only. You can also explore diverse non-fungible tokens (NFTs) via its Delta platform.

Disclaimer: CFD trading is risky and complex, thus not suitable for all types of traders. This is primarily due to the application of leverage attached, which can give you good profits as well as leave you with massive losses. So far, over 76% lose their money in CFD trading. That is why it is important to conduct extensive research and understand CFD trading risks before you invest your money in it.

Security

From our exploration of this broker, it is evident that it takes the security of its users very seriously. The broker web and app are not only highly encrypted but also have additional security measures like passcodes, face IDs, and more to prevent unauthorized access. Unfortunately, eToro’s shares are not listed on any stock exchange, and it has no banking license.

Besides being highly encrypted, eToro is licensed and regulated by tier-one global authorities. It operates several legal entities, meaning it serves clients based on their jurisdiction. It also offers investor protection, but the amount will depend on the entity you belong to. For instance, should eToro UK go bust, its UK clients are eligible for compensation of up to £85,000. This is under the Financial Services Compensation Scheme (FSCS). You can confirm your region’s protection amount at its official website.

That being said, here are the top authorities overseeing eToro’s activities to global traders and investors.

| Financial Regulator | Legal Entity |

|---|---|

| Cyprus Securities and Exchange Commission (CySEC) | eToro (Europe) Ltd |

| Financial Conduct Authority (FCA) | eToro UK Ltd |

| Australian Securities and Investments Commission (ASIC) | eToro AUS Capital Limited |

| Securities and Exchange Commission (SEC) | eToro USA Securities Inc |

| Malta Financial Services Authority (MFSA) | eToro Money Malta Ltd |

| Financial Services Authority Seychelles (FSAS) | eToro (Seychelles) Ltd |

| Abu Dhabi Global Market (ADGM)’s Financial Services Regulatory Authority (FSRA) | eToro (ME) Limited |

Conclusion

eToro is a highly reputable and regulated broker that provides streamlined trading and investing services on both desktop and mobile devices. It is perfect for all types of traders as we have discovered numerous features for all. However, it is crucial to confirm whether it suits your trading/investing requirements before committing. This can only be possible by testing it via its demo account. You should also review previous and current user testimonials on Google Play, the App Store, and Trustpilot. This will ensure you clear all doubts and kickstart your ventures on a broker that supports users with the best trading tools.

Fees

Account opening

Customer service

Deposits & Withdrawals

Would you recommend this provider?

Fees

Account opening

Customer service

Deposits & Withdrawals

Would you recommend this provider?

Fees

Account opening

Customer service

Deposits & Withdrawals

Would you recommend this provider?